BTC continues to consolidate with multiple retests of the critical $40.7k higher low. The recent reduction in global risk has added selling pressure to BTC, but so far it looks like $ 40.7,000 is maintaining support with a solid push to the upside, reaching $ 42.3,000 at the time of the release. writing.

BTC continues to hold a larger technical structure as $40k has been established as significant support. Even with negative news, macro risk and a rising dollar, Bitcoin has shown resilience by holding $ 40.7,000 on multiple occasions over the past week.

$40.7k is a very important level to hold, as it is the deepest higher low BTC can make to complete the Wave 2 corrective wave. Falling below $ 40.7,000 will increase the likelihood of retesting $ 40,000 or potentially increasing to $ 37.3,000 to $ 39.3,000 due to sell-offs or additional risk in global equities.

Open Interest Remains Flat

Near term, open interest has remained flat, holding around $8B even with the drawdown from $45.2k to $40.7k in the past week. Previous withdrawals of $ 52.9,000 resulted in massive multi-billion dollar selloffs, triggering stunts of hard sells, pushing down spot prices as weak-hand panic sold out.

For the past two weeks, the size of liquidations has been trending lower, which is a positive signal, suggesting less weak hands are positioned and remaining in the market looking to sell at current prices.

This could explain why BTC continues to hold $ 40.7,000 despite the rising dollar and falling global stocks. For the short term, it is critical for BTC to hold $40.7k as support. If $ 40.7,000 is retested for the fourth time, the probability of breaking support will increase, potentially pushing BTC down to $ 37.3,000 to $ 40,000.

On-chain metrics continue to show strong accumulation

As we reported for weeks, the long-term holders have not sold the recent drawdowns and have continued to accumulate. Most of the selling pressure came from liquidation events and weak-handed panic sales.

Although the near-term price action has been weak, on-chain metrics are showing no major warnings of a bear market.

Bear markets occur after parabolic highs, with deep price corrections, where long term holders and miners continue to distribute aggressively.

The 55% crash in May 2021 did not lead to further distribution from long-term holders and miners. Instead, they started to pile up, strongly suggesting that this is not a bear market.

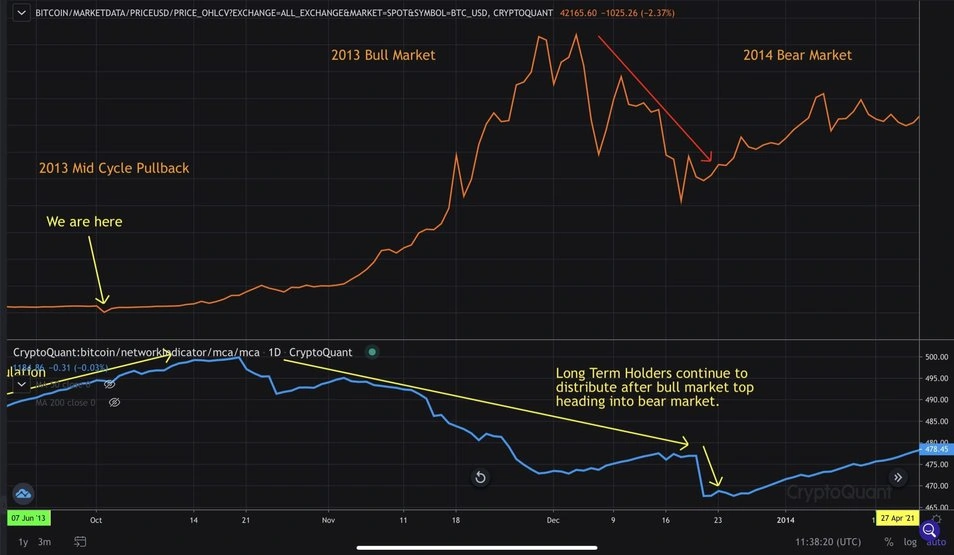

The charts below highlight the Mean Coin Age movement during BTC’s post bull market runs in 2013 and 2017, heading into the bear market. The average age of coins continued to decline after the BTC spike, confirming a new distribution of long-term holders.

The next chart shows the 2021 mid-cycle pullback where BTC fell 55% from the highs at $64.8k to $30k. The average age of coins began to increase, confirming that long-term holders were accumulating instead of selling.

This is exactly what occurred in the 2013 mid-cycle pullback. After BTC spent around six months consolidating with an increasing trend in the average age of coins, BTC hit new ones. historic highs and began the parabolic blast phase to end the bull market of 2013.

What to Watch

Near term, it is critical for BTC to continue holding $40.7k as the higher low for Wave 2 completion. The more $ 40.7,000 is tested, the more likely it is to be broken. It is important for BTC to continue pushing higher to make a high above $45.1k this week.

The 4 hour chart is showing signs of consolidation with the flattening of the 21 and 50 hour moving averages. This indicates a potential attempt for BTC to push towards the key $45.1k level, completing the near-term consolidation. If the breakthrough attempt fails and $ 40.7,000 struggles to maintain support, BTC could see a downside risk of $ 37.3,000 to $ 40,000.

Despite the near-term uncertainty and risk-off, the overall trend in fundamental and on-chain remains firmly bullish as long-term holders and miners are not distributing aggressively. The high accumulation and HODL behavior of these entities is a positive sign. This pullback could be a near-term shake-out, in the middle of a bull market, with significant upside ahead later this year.