A look at on-chain indicators for Bitcoin (BTC), more specifically those related to exchanges and institutional investors.

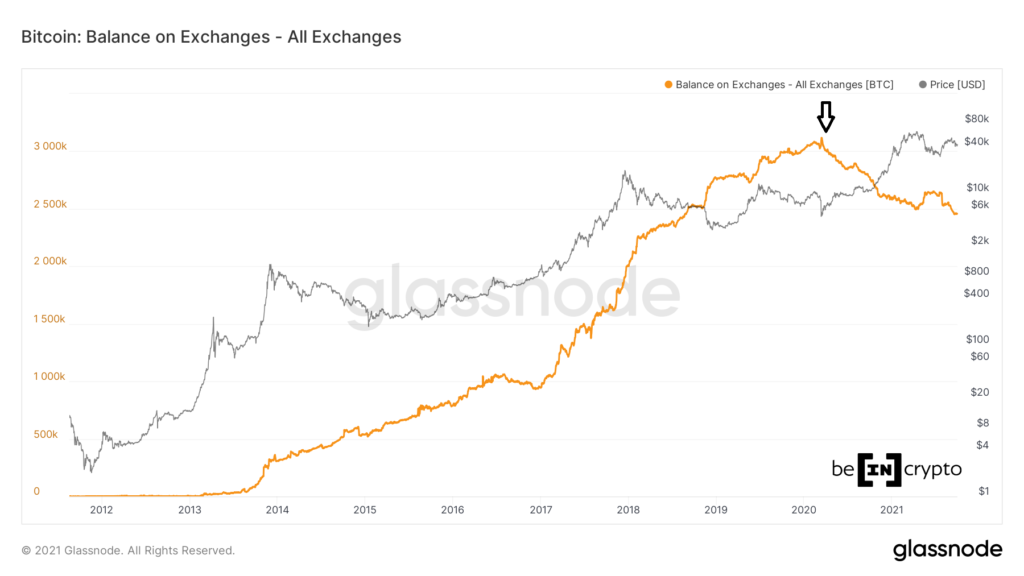

After a brief period in May when currency balances rose, they started to dry up again and hit an annual low on September 26.

BTC Exchange balance

The total amount of BTC that is held on exchange wallets has been steadily moving downwards since March 2020, when an all-time high of 3,118,057 BTC (black arrow) was held in such addresses.

The decline led to a low of 2,494,840 on April 11. This meant that during this time, investors had been steadily buying BTC from exchanges.

After the May price drop, the number of coins held on exchange addresses began to increase, potentially due to investors moving their coins for sale, it fell again, hitting a low from 2,452,843 on September 29.

This is better visualized with a closer look at the movement since May. This shows that the indicator rises in May, when the price of BTC has fallen to $ 30,000.

However, after the ongoing upward movement that began in July (black circle), the balance on exchange addresses has been drying up once more.

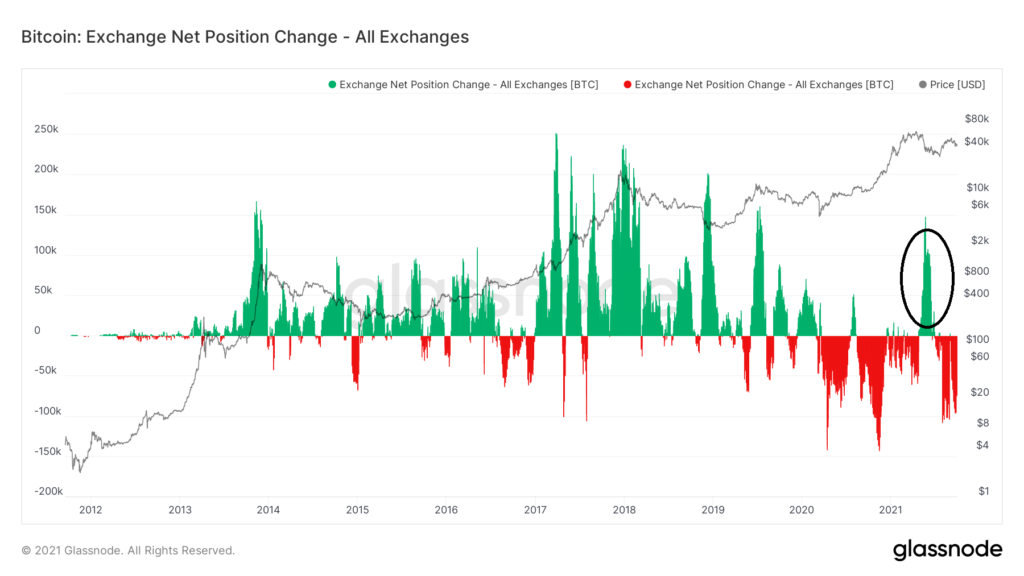

Trend signals

An examination of the development of the net foreign exchange position shows that after the period described above during which the net inflows were positive (black circle), they became negative again.

As is visible from the 2017-2020 readings, positive net position changes are a staple of a bear market. This happens because investors are rushing to take profits and sell their coins. Furthermore, they occur during the beginning of bull markets, when investors are realizing profits.

However, a negative net position change is usually a sign of accumulation, which occurs during an uptrend.

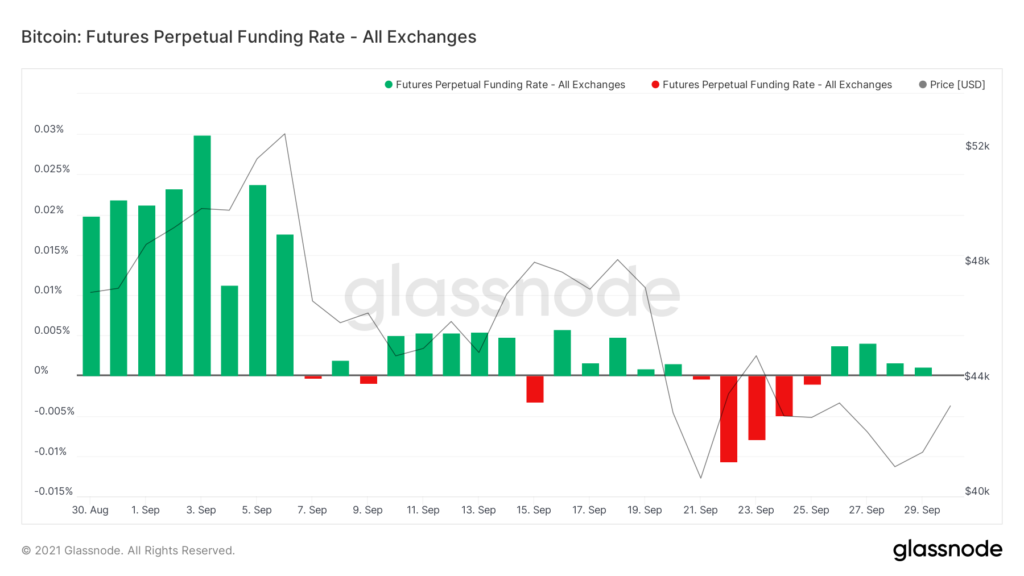

In addition, financing rates are close to negative. It doesn’t give a clear feeling for the trend. Funding rates increase/fall significantly during times of euphoria or panic, when the BTC price rises/drops quickly for a short-period of time.