Yes, Bitcoin (BTC) really hates September, but orange bulls are ready to show their power

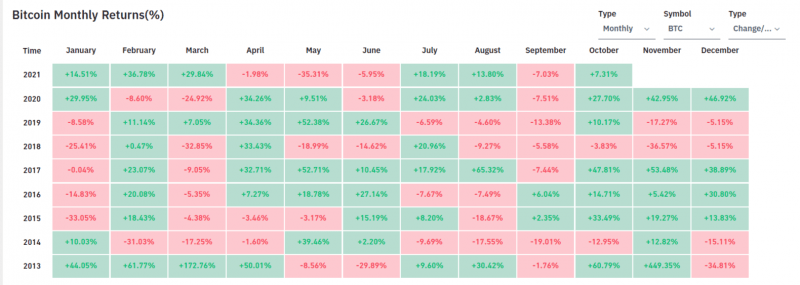

Bitcoin, the flagship cryptocurrency, closed September with 7.03% price losses. Is that a lot?

Fifth in a row

According to data from the Bybt chain dashboard, for the fifth time in a row, Bitcoin bulls (BTC) fail to close September in the green zone. However, September 2021, brought less pain than in 2019-2020.

The price of Bitcoin (BTC) fell 7.03%. Over the past two years, the first month of fall ended with losses of 13.38% and 7.53%. It also should be noted that Bitcoin (BTC) registered its most painful day ever this September: on Sept. 7, it lost more than $10,000 in one day.

At the same time, in terms of quarterly performance, Bitcoin (BTC) broke the trend in 2021. While Q1 and Q3 are historically bearish for Bitcoin (BTC), in 2021, it managed to close them with 103% and 25% gains, respectively.

Now Bitcoin (BTC) is entering its most profitable quarter for bulls: in the past eight years, it has closed at least two of the three months in the green on five occasions.

September ended, Bitcoin wakes up

Shortly after exiting September, Bitcoin (BTC) started rallying like it was on steroids. Today, October 1, 2021, he added $ 3,500 in about three hours.

A similar upsurge has not been registered by Bitcoin (BTC) since April 2021, the most bullish month ever.

In the futures markets, the bears were shot today: of 400 million liquidations recorded in the past 12 hours, more than 66% were shorts. On BitMEX, bears were responsible for 99% of the liquidations.

Strong hands continue accumulating BTC aggressively

Such a spike cannot happen overnight. According to on-chain data from leading analytics provider Glassnode, large-scale Bitcoin (BTC) holders continue to pile up.

In late September, 2021, the number of Bitcoins (BTC) accumulated by long-term holders touched a historical high at 80.5% of the circulating BTC supply.

Glassnode and CTO co-founder Rafael Schultze-Kraft noticed that accumulation processes were recorded across all categories of Bitcoin owner (BTC):

Yes, increased accumulation across cohorts. Very bullish if we see this trend continuing.