Bitcoin’s price is more than 60% up since the start of the year. Still, it’s down nearly 30% from the April peak. With just a few months left until the end of the year, predictions are flying left and right about the asset’s price tag at that point.

One of the most popular models – Stock-to-Flow – sees BTC exploit six-figure territory by the end of December. If bitcoin is to go into such unseen and unimaginable (until recently, at least) heights, it would have to more than double its value in a few months.

Thus, the creator of the model recently describe some of the potential reasons that could propel such an impressive increase.

Bitcoin ETF Approval in The US

Perhaps one of the most discussed topics in the cryptocurrency space in the past year or so is whether the US Securities and Exchange Commission will (soon) approve an exchange-traded fund tracking the performance of bitcoin. It became even more popular after Canada and Brazil gave the green light to these products earlier in 2021.

The SEC has received countless applications since 2016. It rejected almost all of them until last year, but in 2021 it has a new approach – delaying the decisions. This, Gary Gensler’s hints, and the fact that many analysts claim that a BTC Futures ETF may be imminent, has led to speculation that such a product may indeed be approved by the end of this year.

If indeed happens, it would legitimize the primary cryptocurrency among many traditional financial investors and institutions as they will have exposure to the asset through a well-regulated Bitcoin ETF. As such, the implications of such a move could indeed lead to a substantial appreciation in the price of the underlying asset.

Massive Adoption

Adoption is another crucial word this (and last) year. PlanB discussed the legalization of bitcoin in El Salvador, as the country made history in September when it became the first country to do so.

So far, the BTC usage is rapidly growing, at least according to El Salvador’s president Nayib Bukele. As such, the creator of S2F pointed out that if another country were to follow suit, it could increase the price of the cryptocurrency.

Even if it’s not a country, a prominent name could do the same. We have seen in the past how the price of BTC can fluctuate when names like Elon Musk are talking about it. So, in case the crypto community gets a new Michael Saylor, bitcoin could indeed head higher rapidly.

The adoption could also come from a giant company like Apple, Amazon, Google or Microsoft. A recent fake report claiming that Walmart will enable Litecoin payments sent BTC up by a few thousand dollars in minutes.

Although it turns out to be a fake (which caused the price of bitcoin to plummet just as quickly), one can only imagine what would happen if one of the biggest organizations in the world joined the crypto train.

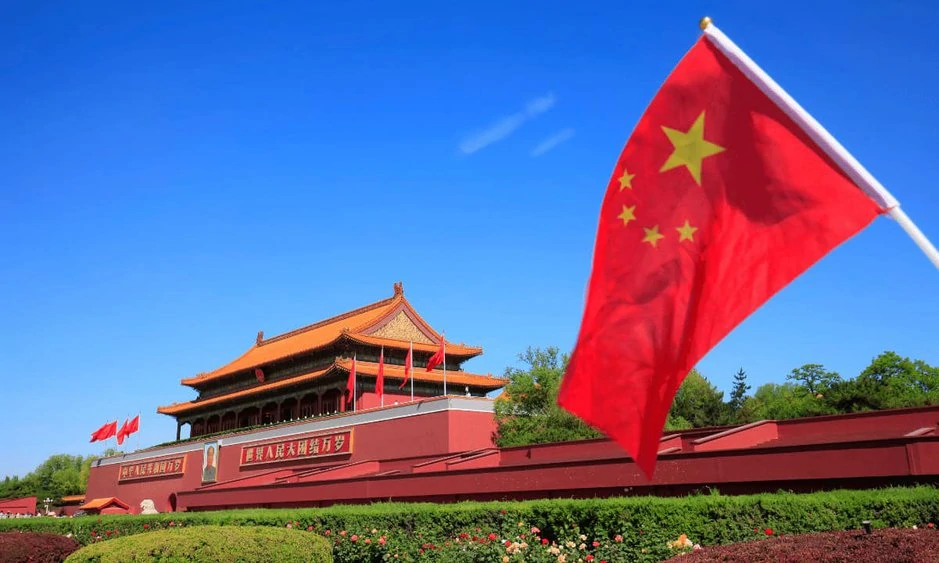

U-Turn From China

This seems like the most unimaginable scenario at the moment. China has been against the cryptocurrency space for almost as long as it has been around. This year, though, the country took it to a whole another level by going after digital asset miners, trading, and everything in between.

The miners had to search for other homes, which had temporary negative effects on the BTC network. Numerous centralized cryptocurrency exchanges had to halt services for Chinese users.

The world’s most populous nation, known for its aversion to decentralized products or widely accepted internet entities, is developing its own central bank digital currency. It will work entirely differently than bitcoin, meaning that it will allow the government to retain control over all transactions.

Therefore, the chances of a Chinese turnaround seem low, if not zero. However, it might not be needed. The US – the world’s largest country by nominal GDP – has already said it won’t go down the same road, which had a positive impact on the markets.

What Does History Say

Bitcoin currently sits below $ 50,000. If it is to reach $ 100,000 by the end of December, that would mean it must increase in value by more than 100%. It does sound like a tall task, given the fact that there’re less than three months left.

Yet history has shown that the main cryptocurrency is capable of such impressive increases. Exactly a year ago, it traded at $10,500. However, it saw massive growth at the end of 2020 and ended the year at $ 29,000. From a percentage point of view, this is a 175% surge in the same timeframe.