The last couple of months have seen the market fall to the lowest and then race up to a local top. In the midst of this eventful race, some coins have made headlines with their new ATH and independent trajectories while others have tempted the market with high gains.

Cardano, Solana, Terra, Avalanche, and Tezos were among the few that garnered attractive gains during the time. In fact, at the time of going to press, as Tezos made new ATH prices, anticipation and skepticism about the coin’s trajectory has increased.

Tezos has been fetching its holders hefty returns of late. XTZ’s one-day ROI against the USD, at the time of writing, was around 15%, while its weekly ROI was 22% and its monthly ROI was about 50%. In effect, its price has appreciated by close to 40% since the beginning of October.

Looking back, the gains have been rather impressive as Tezos and Elrond were the worst performing midcap alts in the third week of September. However, XTZ’s price recovery alongside high trade volumes after its price fell to $3.9 in the last month fueled its journey to a new ATH.

XTZ ATH was supported by …

While Tezos’ realized market cap hit an all-time high of $ 4.25 billion, many attributed its rally to network growth after Granada’s upgrade in early August. The upgrade enhanced several existing network features like cutting block times in half and reducing smart contract gas consumption.

In addition, the NFT mania also played a role in the price increase of alt, as several institutions announced the use of the network for their NFT experiment.

Notably, Redbull racing, McLarenF1, and DojaCat announced to use Tezos for their NFT experience, and more recently Premiere League soccer club Toulouse FC also announced the use Tezos for the same.

Indicators supporting the uptrend

Tezos’ adjusted NVT was trending at lower levels compared to last month. The network-value-to-transaction ratio highlighted that value being transferred on the network was at par with the network value or market cap which was a good sign of growth.

In addition, data from Tezos official site presented that 76.4% of the total supply was staked on the network. Staking has essentially limited the number of tokens available in the market thereby inducing a kind of supply shortage and a price-uptrend pressure.

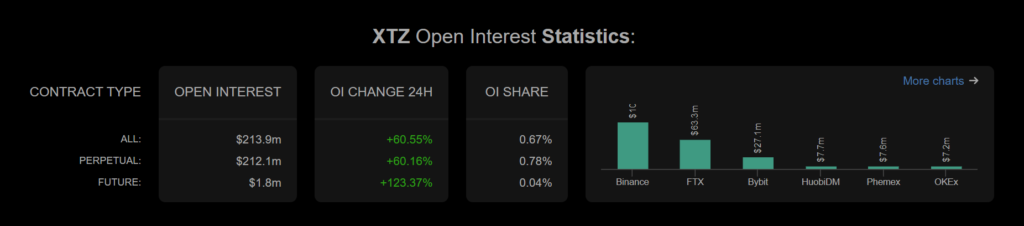

With XTZ seeing an ATH price in the spot market, the futures market also looked bullish on the coin. In fact, Open Interest change over the last 24 hours in the futures market was a staggering +123.37%.

Now, with the price side appearing secure, Tezos appeared to be catching up with Ethereum’s dominance in the Defi space. Tezos had more than 130 projects and dApps in development on its network. However, with Tezos’ market cap dominance still below 2020 levels, speculation was looming on the market as to whether altcoin’s gains would hold up or if it would just be a one-time wonder. .