Bitcoin continued to climb higher in the past 24 hours and tapped a new multi-week high just shy of $50,000. Most alternative coins, however, have lost value against their leader in recent times, and BTC’s dominance has increased slightly.

Bitcoin Nears $50K

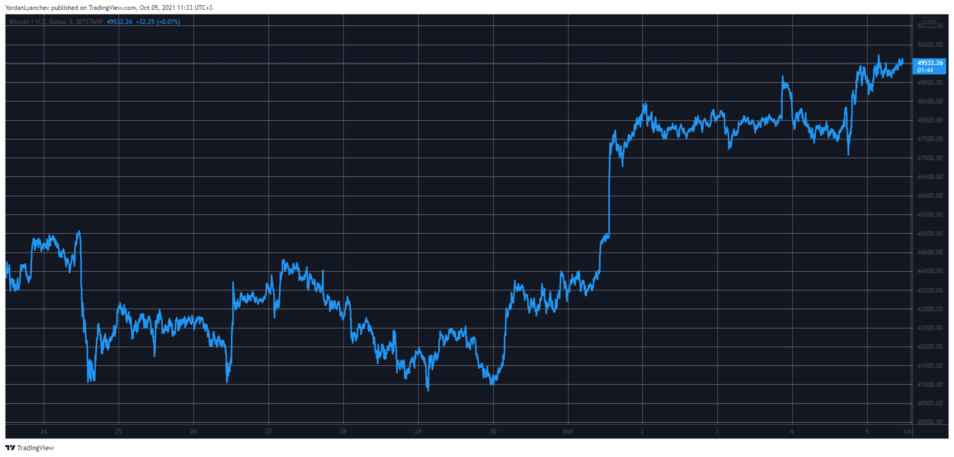

It was less than a week ago – on September 30th – when the price of bitcoin had fallen below $41,000 for the third time in five days. Yet a lot has changed since then, perhaps initially fueled by promising news from US Fed Chairman Jerome Powell, who claimed the country has no plans to ban digital assets.

BTC started to rapidly recover by reclaiming $43,000 and $45,000 in just two days. It continued to rise in value and hit $ 48,000 over the weekend. It was rejected here at first, which drove it back down to $47,000, but the bulls initiated another leg up in the following hours.

This time bitcoin even broke above $ 49,000 and hit an intraday high of $ 49,800. After charting this four-week high, BTC has retraced slightly, but it’s still above $49,500.

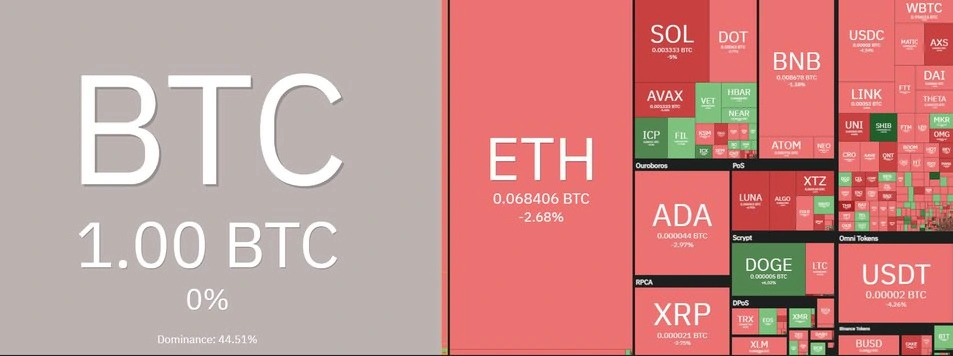

As a result, bitcoin’s market cap has risen to well above $ 900 billion. The dominance over the alts is also up to 43%, as most have failed to follow BTC upwards.

Altcoins blocks against Bitcoin

Most altcoins have recently mimicked BTC’s performance, but the situation has changed in the last 24 hours as mentioned above. ETH, for example, is around 1% up against the dollar, and it stands at $3,400. However, it has dropped by more than 2.5% against BTC in the same time frame.

Cardano, Ripple, Solana, Polkadot, Binance Coin, Litecoin, Terra, and Algorand have also lost valuable chunks against the larger cryptocurrency.

A few exceptions are evident from Dogecoin, and the self-proclaimed DOGE-killer – Shiba Inu, which are in the green compared to the dollar and bitcoin.

Being up against the USD means that the cryptocurrency market capitalization has also increased in the past 24 hours. The measure is up $ 80 billion from yesterday’s low and currently stands at $ 2.170 billion.