The Decentralized Finance (DeFi) space, which is dominated by Ethereum, had a rather rough month as the market fluctuated immensely. For a while, bearish sentiment was seen across the board. However, that is now changing for good as it seems like losses have been repaired owing to these 2 reasons.

Ethereum to the rescue?

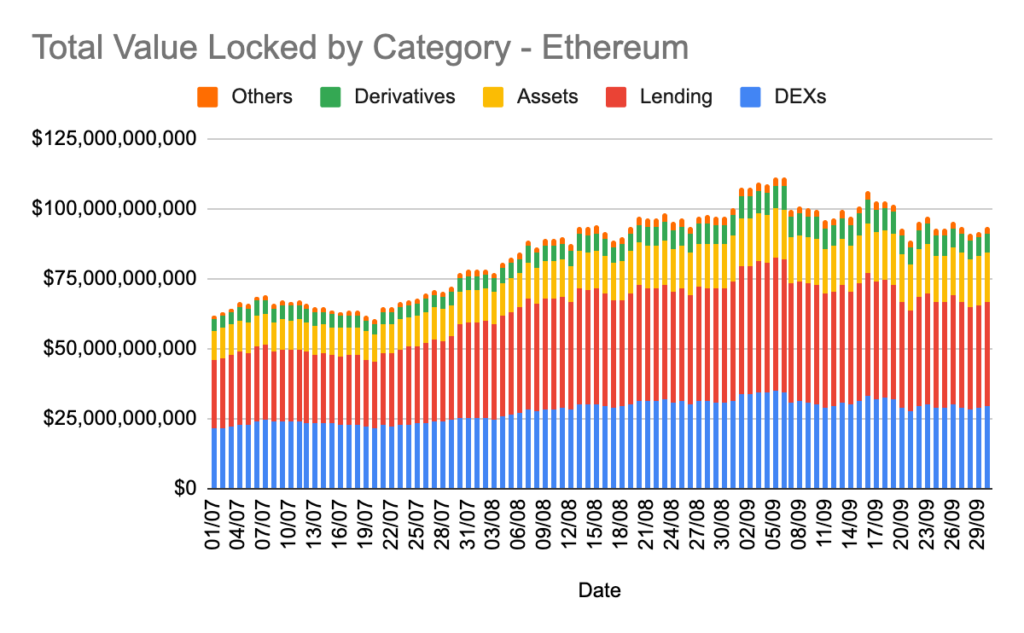

During the week, the Total Locked-In Value (TVL) in DeFi increased by $ 20 billion after falling steadily over the past month. TVL is again closer to around the $200-billion mark. Such high levels were last seen on September 6.

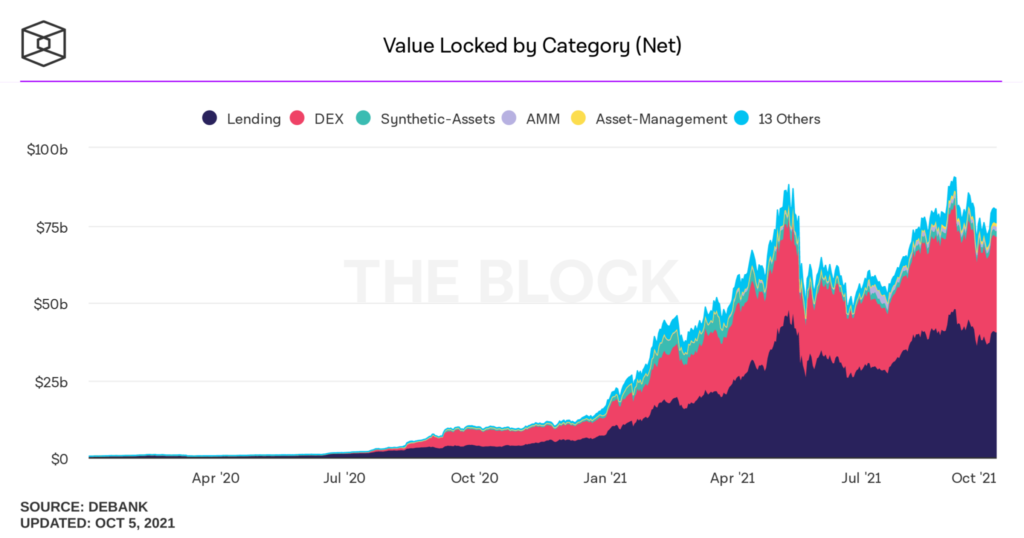

The biggest contribution to this, however, continues to come from Lending and Decentralized Exchanges (DEXs). Being DeFi’s biggest use case, they hold the most dominance across all channels. At the moment though, it’s actually the DEXs that are seeing more participation than Lending.

On Ethereum, DEX TVL has risen 11% over the past week. While Lending is still dominating the chain, this hike is proof that DEXs are attracting more inflows into the network.

The same is the case for Binance Smart Chain where DEXs hold over 60% market share in TVL. This is true for Solana too where DEXs account for more than 70% of all the value. In fact, over 50% of the total locked-in value of Polygon is DEX as well. So the DEX will only increase.

This is in part due to the very favorable system of decentralization which makes transactions here more reliable. On top of that, the latest episode in China moved more people to decentralized options. This has resulted in the growth that we are seeing now.

What about participation?

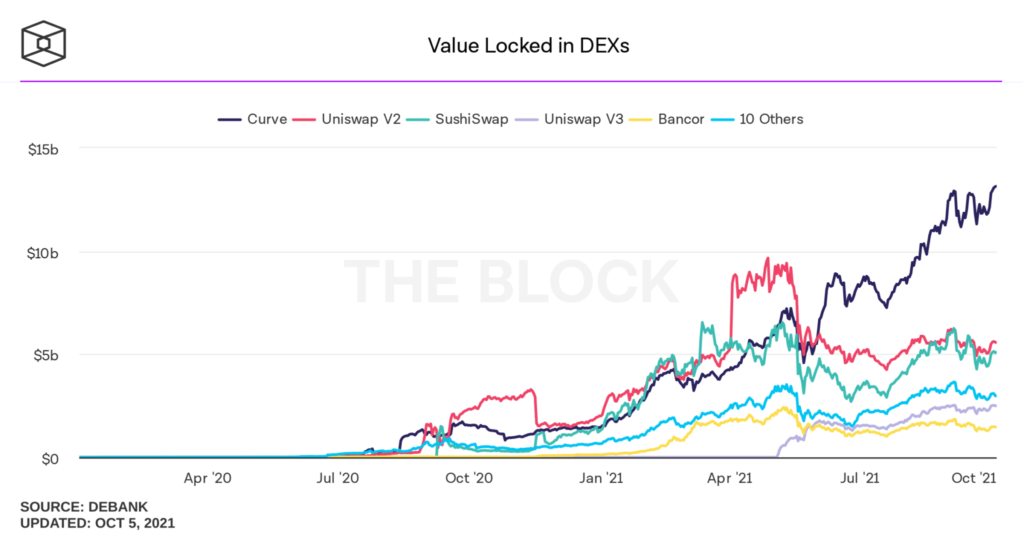

This is where things are rather interesting because the most liquid protocol still is Curve. It has over $ 13.5 billion in TVL, making it the largest DEX protocol on any channel.

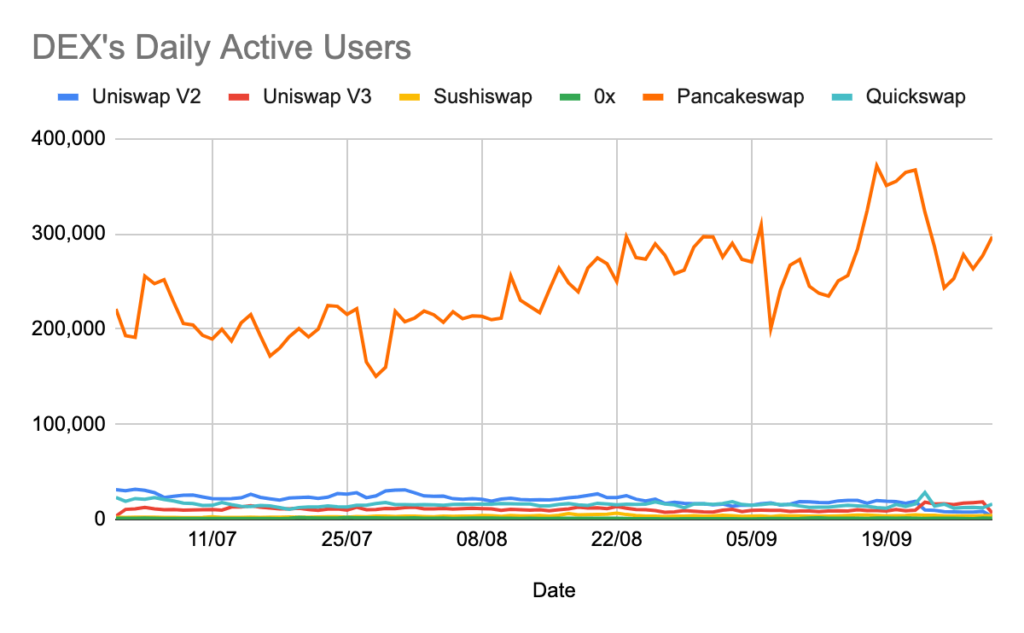

However, the most active userbase sits on PancakeSwap as it continues to draw in more people, over 322k people actually.

Without PancakeSwap and Curve, the combined daily active users of all other major protocols don’t even add up to 30,000.

Ergo, the boom witnessed by the aforementioned DEXs is proof that trust and interest both are rising and this could see higher inflows going forward.