Call it the Huobi discount rate.

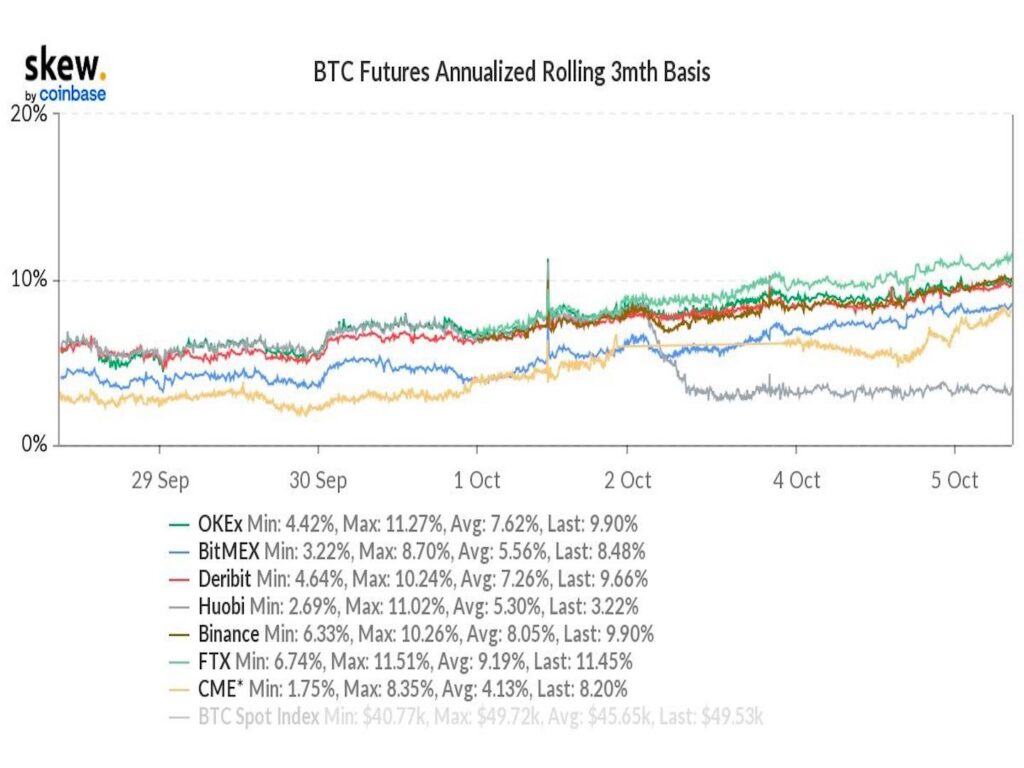

Bitcoin’s transfer to $50,000 has actually restored bullish belief, raising futures premiums on many significant cryptocurrency exchanges. These premiums represent the difference between the price of bitcoin futures contracts traded on a given exchange and the broader spot-market price – often seen as a gauge of speculative interest.

But on the Huobi exchange, traditionally manipulated towards Chinese clients, the premium hasn’t budged. Analysts say the relatively low premium on Huobi might be the result of the exchange’s decision to suspend services to China-based clients.

While the annualized three-month futures premium, or basis, has actually just recently balanced around 5% on Huobi, the premium on Binance, OKEx, Deribit and other significant exchanges has actually reached near 10%.

“Traders have been actively moving to other exchanges to trade perps and futures,” said Matthew Dibb, chief operating officer at Stack Funds. “Perps” describes continuous swaps, a kind of derivative in cryptocurrency markets that acts as an option to normal futures agreements.

Huobi announced late last week that Oct. 29 will be the last day for derivative trading for users on the Chinese mainland. The exchange pointed out a “commitment to local compliance policies” and stated it would “retire user accounts over the next few months.”

“Huobi’s trading volume amongst leveraged products has shown signs of weakening given the regulatory overhang from China,” Dibb said. “This is having a large impact on futures volume and basis.”

Patrick Heusser, head of trading at Crypto Finance AG, stated that some traders on Huobi require to close their positions.

“This might be due to offboarding pressure by Huobi,” he said.

Arcane Research, a Norwegian cryptocurrency-analysis company, composed Tuesday in a weekly report that the Huobi futures contract had actually formerly been among the most essential for bitcoin’s rate discovery. “So these developments will present some interesting structural changes in the market onwards,” according to the report.

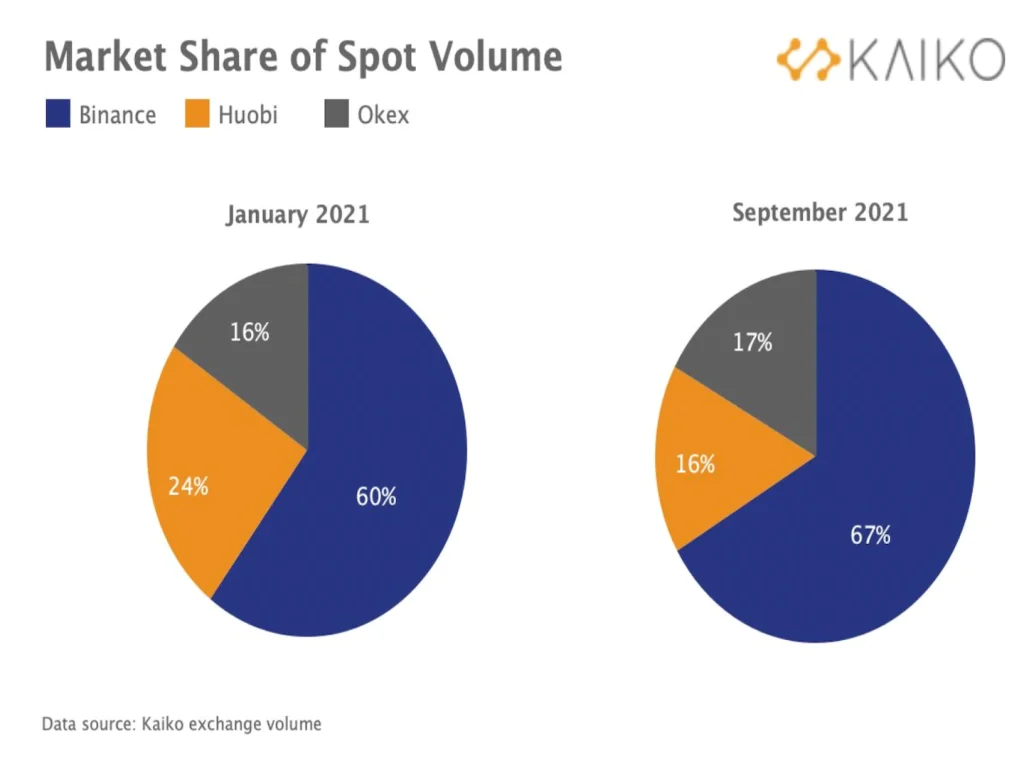

Huobi has actually lost substantial market share to rivals Binance and OKEx considering that the start of the year. Huobi’s share of spot-market trading volumes has dropped to 16% from 24%, according to data from Kaiko.

The exchange’s phasing out of Chinese accounts over the coming months might affect its share of volume a lot more, Kaiko composed in an Oct. 4 research study newsletter.