Anyone paying attention to Bitcoin in the past months will notice a subtle, but importance change in its fundamentals. As BTC’s cost made its method back to May’s high, prior to the very first capitulation occasion, there was an uptick in on-chain activity.

Unlike the sell-off period that occurred from May to end of July 2021, there was an increase in Bitcoin transactions. This increase caused an increment in network charges, as revealed by explorer Mempool.area.

At the time of writing, a high priority Bitcoin transaction needs to pay a 20 sat/vB to be included in the blockchain, one of the highest fees in the past month. Conversely, BTC trades at $57,632 with a 19.3% earnings in the day-to-day chart.

Although the Bitcoin network is still far from the levels of activity experienced during its price peaked, the uptick is significant and could point towards a sustain rally by end of 2021.

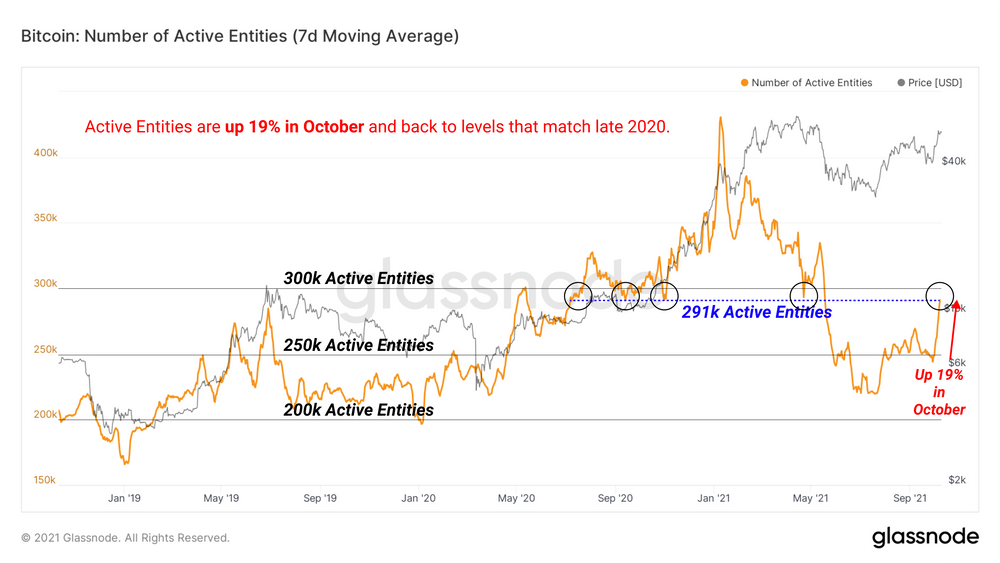

According to a current report by Glassnode, the increase in network activity recommend fresh need for Bitcoin might show up to the marketplace in Q4. The research firm records a 19% grown in individual participants on-chain during the past 7-days.

This metric stands at 291,000 active entities daily. Glassnode kept in mind the following on what this might imply for BTC:

This value is on par with counts from late 2020 at the beginning of the last bull run. More active market individuals has actually traditionally associated with growing interest in the property throughout early phase booming market.

In addition, there has been an increase in the median transaction size during September. This metric stands at over 1.3 BTC, the research firm claimed.

A rise in the typical deal size doesn’t always indicates an extension of the present rally, however recommend more organizations are entering the marketplace, Glassnode included:

Generally speaking, periods near the end of bear markets are when smart money start to accumulate in size. These durations are frequently characterised by lower (however increasing) on-chain activity and progressively big deal sizes.

Bitcoin To Enter Bullish Phase?

Additional data provided by Glassnode notes an increase in some important metrics. For example, the Bitcoin Percent Supply in earnings for the previous week reached a 4-month high.

The transaction volume in the BTC Perpetual Futures Contract reached a 3-month high of $281,278,010 on crypto exchange Bitfinex. This recommend that the derivatives market is likewise beginning to warm up and might when again end up being a challenge for the BTC bulls.

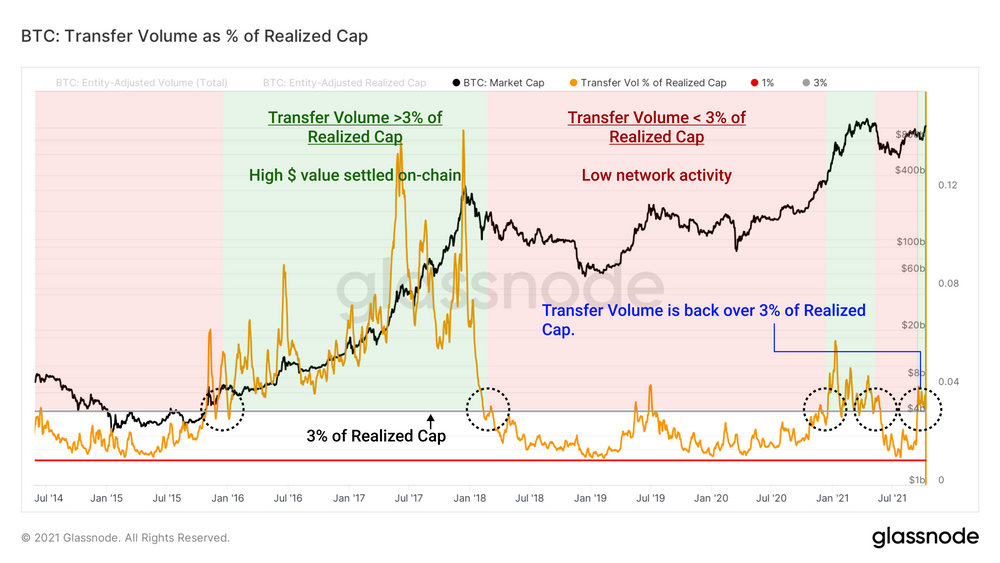

However, the Transfer Volume as a percentage of the Realized Cap, a metric used to compare on-chain activity with the “value stored” in Bitcoin, recently rose above 3%. As Glassnode suggested, this recommend BTC might be ready to enterer a bullish market stage.

Transfer Volume has once again broken above the 3% threshold suggesting growing demand for on-chain settlement of value. This is a bullish an advancement worth enjoying in the coming weeks based upon its high historic signal.