The come-up of the FTX cryptocurrency exchange has actually been among the most motivating stories out of the crypto area. Its success put its CEO Sam Bankman-Friend on the path to become one of the richest crypto billionaires. The 29-year-old was included on the Forbes 2021 List of 400 Richest People In America, which saw the CEO called as the wealthiest crypto billionaire.

Although FTX has had an impressive track record, the road to the present was not always an easy one. CEO Sam Bankman-Fried opened on a few of the obstacles the exchange come across when it had actually opened its doors for company. In a piece on Bloomberg Businessweek, the CEO revealed that the crypto exchange had faced significant challenges in getting the banks onboard.

Turning To Tether

CEO Bankman-Fried informed Bloomberg that the business had significant issues with getting the banks to deal with them. This was because banks are very skeptical about working with crypto-related institutions due to regulatory problems and had refused to work with his exchange. “If you’re a crypto company, banks are nervous to work with you,” Bankman-Fried stated.

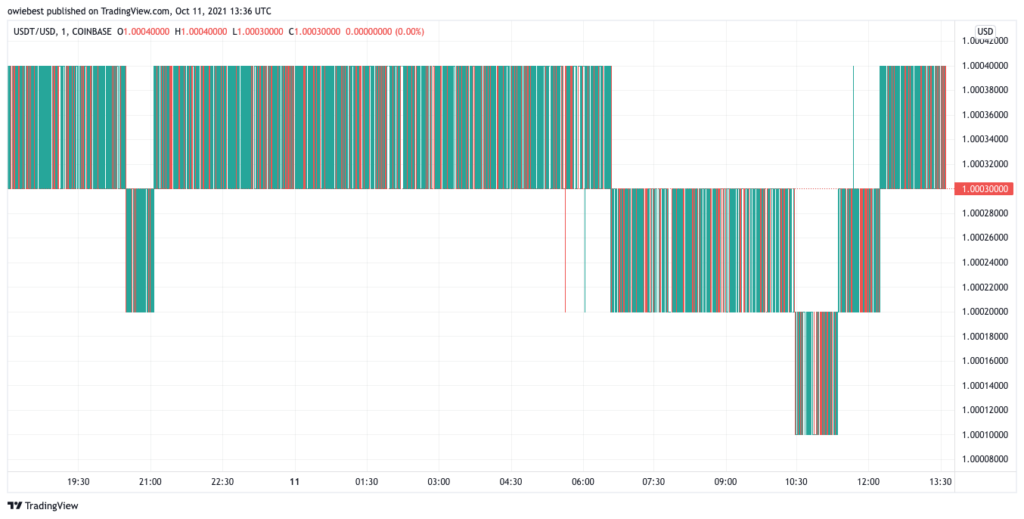

Taking this in stride, the CEO had turned his attention to something else; Tether. Its ease of usage made it the apparent option for the cryptocurrency exchange because of its bank concerns. Hence, investing in the stablecoin had been the solution to this problem. Tether enabled FTX consumers to negotiate and trade on its platform, and the business might hold Tether rather of going through the trouble of transforming crypto to U.S. dollars.

Bankman-Fried revealed that the company had purchased billions of dollars of USDT in order to help users trade on their platform. But has actually clarified that the crypto exchange does not in fact deal with the stablecoin like it does the dollar.

Battling It Out With The Law

Tether has been in various long-running legal battles. The business has actually been implicated of preventing laws and bank scams, which led to a probe from the U.S. Department of Justice. Another class-action lawsuit had been filed against the stablecoin issuer, but Tether had emerged victorious in what it called “a clumsy attempt at a money grab.”

Most of Tether’s issues have actually been connected to just how much of its provided coins are backed by genuine currency. The stablecoin issuers claim that the coins are 100% by cash and cash equivalents but investors are wary of this as data shows that only about 2.9% of all issued coins are backed by cash reserves. The biggest of its support remains in business documents, which represent about 65.4% of Tether’s reserves.

Despite these, Tether still remains a top 5 cryptocurrency by market cap. It boasts the greatest variety of trading sets in the crypto market and has a market cap of $68 billion.