According to on-chain data, Bitcoin miners appear to be holding back on selling BTC despite the current rally where the coin has actually crossed $57k.

Bitcoin Miner Reserves Continue To Move Sideways

As pointed out by a CryptoQuant post, BTC miner reserves continue to trend sideways amid the coin’s strong move up.

The “miner reserve” is a indicator that shows the overall quantity of Bitcoin that miners are presently keeping in their wallets.

An increase in the metric’s value suggests miners think the coin’s value will go up in the near future, hence they are stocking up on it.

While a decline would indicate they are taking their revenues as they anticipate a correction or bearish market in the future.

Here is a chart showing the trend in the value of this indicator versus the BTC price over the last year:

As the above graph shows, the indicator’s value has been moving rather sideways recently, despite the sharp move up in Bitcoin’s price.

Generally, such a relocation indicates miners are either neutral or bullish about the crypto. Many of them are still taking out some coins, while others are adding back in similar amounts. This is why the reserve is looking really well balanced at the minute.

On a closer look at the chart, it becomes apparent that the metric also showed a bit of sideways movement during the rally that took BTC to the current all time high (ATH).

Perhaps something comparable will occur here so it can be worth watching on these miner reserves for any motions in either instructions.

BTC Price

At the time of writing, Bitcoin’s price floats around $57.5k, up 22% in the last seven days. Over the last month, the crypto has actually collected 26% in gains.

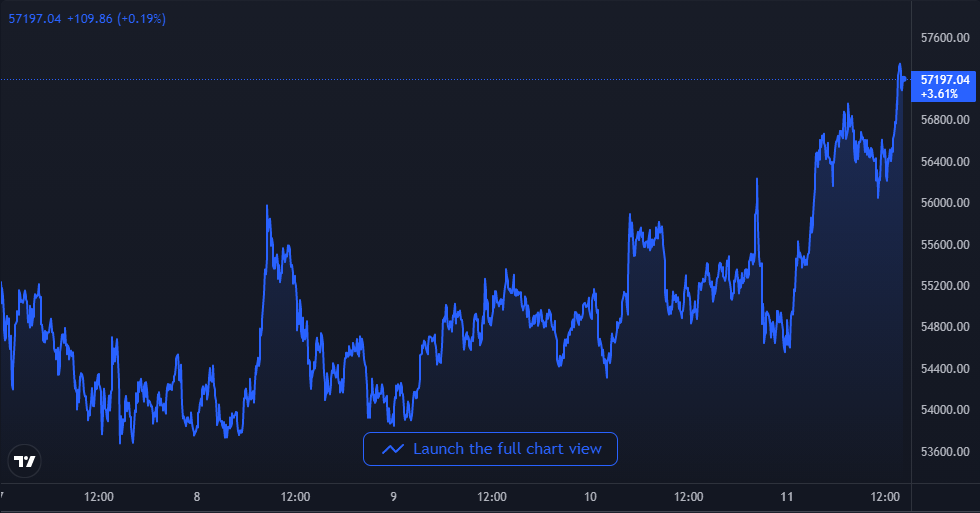

The below chart shows the trend in the price of the coin over the last five days:

Bitcoin has actually revealed a great deal of volatility just recently, however the rate has actually still been revealing a general upwards pattern as the coin now crosses $57k for the very first time given that May of this year.

It remains to be seen if the crypto can keep up this momentum and make a new ATH soon. Signs appear to be leaning favorable as a supply shock now appears to be developing in the market as revealed by the exchange reserves of the coin that have actually dropped to lows not seen given that October 2017.