As Bitcoin rallies previous $57k, Quant explains utilizing on-chain analysis why the cryptocurrency might see a pullback here.

Bitcoin Funding Rate And Futures Open Interest Show Rising Values

As explained by an analyst in a CryptoQuant post, some BTC indicators are showing values that have historically signaled that a correction could be coming soon.

The initially metric of significance is the Bitcoin financing rate, which is specified as the regular payment that futures contract traders need to pay. Positive values imply most traders are bullish and long traders are paying this fee to short traders.

While unfavorable worths suggest simply the reverse; traders are bearish on Bitcoin and brief traders need to pay long traders.

The other indicator is the futures open interest. This metric programs the overall variety of futures agreements that are open at the end of the trading day.

Here is a chart showing the trend in both these indictors for Bitcoin:

As the above graph shows, both the indicators have been observing a rise in their values recently. The quant has actually marked circumstances where comparable worths were seen on the chart previously.

Looks like when such a trend in these metrics has been seen before, a correction has followed soon after.

Also, it looks like both the long-lasting holders and short-term holders remain in earnings today, as the listed below chart highlights:

Both long-term and short-term Investors being in such profit means they are becoming more likely to take some profits at this level.

This truth integrated with the increasing financing rates and futures open interest makes the Quant think that BTC could see a pullback in the short-term quickly.

BTC Price

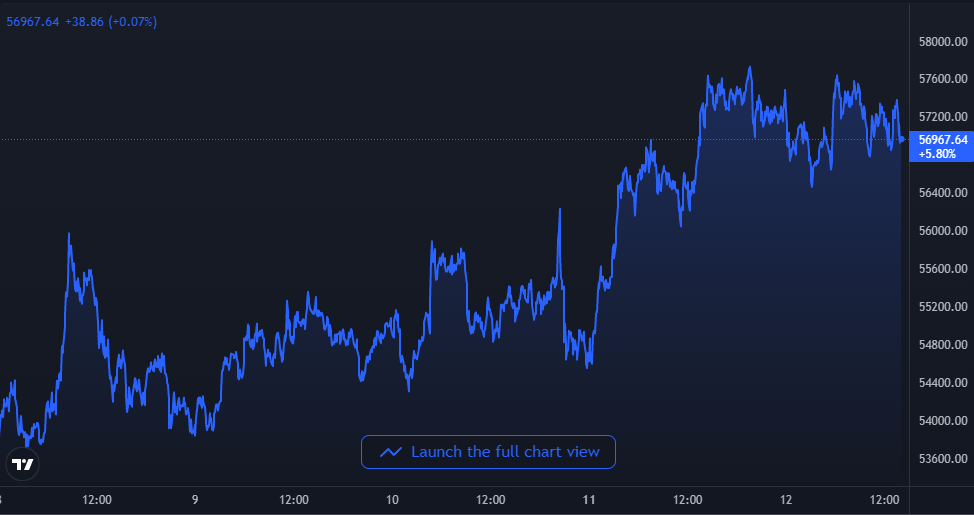

At the time of writing, Bitcoin’s price floats around $56.9k, up 14% in the last seven days. Over the previous thirty days, the crypto has actually acquired 24% worth.

Here is a chart showing the trend in the price of BTC over the last five days:

BTC has actually continued its go up in the last couple of days as the coin now rallies above $57k. It’s unclear at the moment if the crypto can keep this momentum up, but if the funding rates and futures open interest is anything to go by, the market may be leading to a correction soon. Long term indicators, however, still remain bullish.