The bull and chart for business or bull market trader concept

Bitcoin is moving with conviction to the $60,000 location. At the time of writing, BTC’s price trades at $57,681 with a 4% profit in the weekly and daily charts.

The basic belief in the market stays bullish as Bitcoin has actually had the ability to get rid of the bears over the previous days. Traders and savvy investors have called BTC’s recent price action the beginning of the “Bitcoin Season”.

During this duration, BTC takes control of the spotlight and rallies soaking up capital from other cryptocurrencies. As a consequence, the Bitcoin Dominance trends to the upside as it has since mid-September standing at a 44.65% of the entire crypto market.

This metric stands far from its pre-crash levels but could continue to increase in the coming days suggesting more appreciation for Bitcoin.

In a report QCP Capital highlighted the value of a possible BTC-based Exchange Traded Fund (ETF) in the United States. This event is most likely driven the current bullish price action impacting the crypto market.

The U.S. Securities and Exchange Commission (SEC) has actually held off the choice to authorize or turn down, their typical choice in the past, a Bitcoin ETF till next week.

The market seems to be positioning towards an approval on the back of certain statements made by the SEC Chair Gary Gensler. The regulator declared that it’ll be more likely to authorize a Bitcoin ETF based upon Chicago Mercantile Exchange (CME) futures.

QCP Capital explained the effect of these claims in the market:

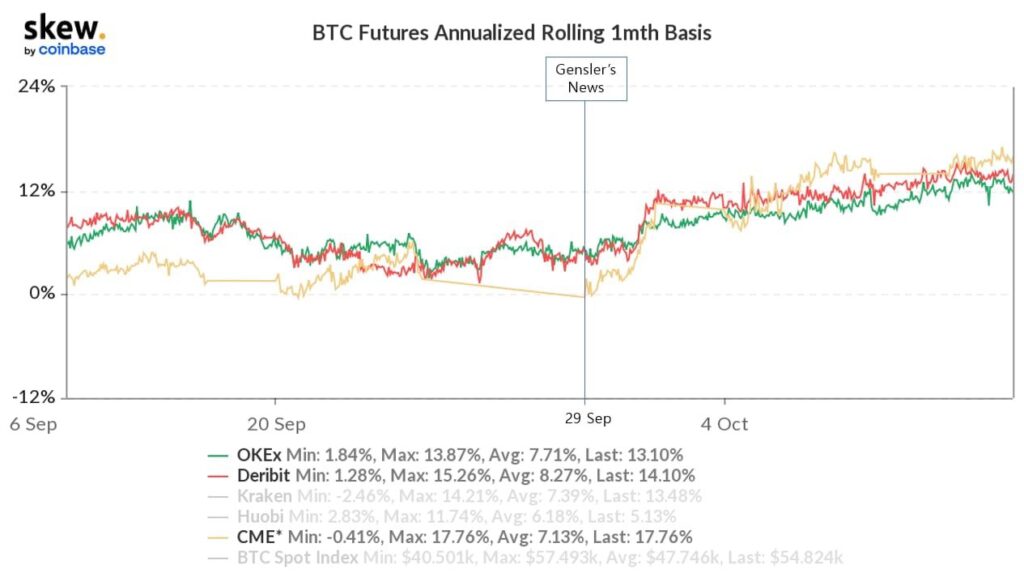

Funding and forwards have also been heating up over the last two weeks since SEC chair Gensler made favourable comments about a futures-based BTC ETF. Perpetual swap financing went from somewhat unfavorable in the end of September to around 20% now.

Bitcoin At A Crossroads, Fresh Capital Price In ETF Decision

Further data provided by QCP Capital showed that institutional investors have entered the market after pricing in a potential Bitcoin ETF approval. As seen listed below, the CME futures premium as pattern upwards particularly after Gensler made its optimist remarks.

In that sense, the SEC’s decision could trigger two of the following scenarios for Bitcoin. In the bullish situation, the ETF approval will drive a new age of institutional need for BTC, QCP Capital anticipates.

In a second scenario, Bitcoin will face another “buy the rumor, sells the news” event with potential for more downside and a retest of its support levels.

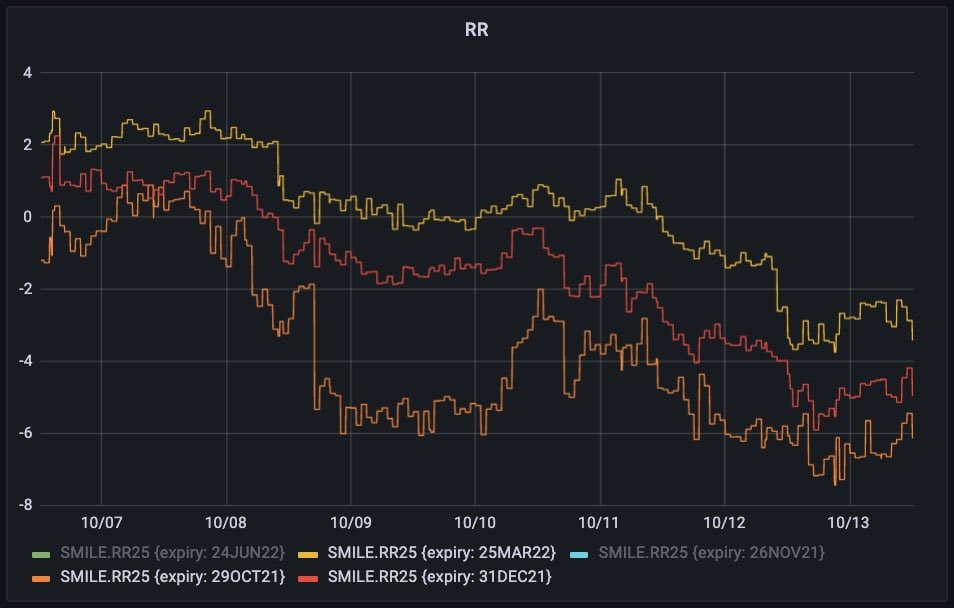

As seen listed below, QCP Capital highlighted the vibrant in the BTC Options markets with the “front-end risk reversals” tending drawback. This suggests a lot of uncertainty amongst investors and a “prevailing downside nervousness”. The firm said:

Direction-smart for BTC, we discover ourselves with a bullish predisposition however not able to form a strong bullish conviction in spite of the clear optimism in the market.

The firm has set its target on Monday, next week. If the occasion is to prefer the bears, it is possible that the weekend cost action may expose what’s to come in the list below days. QCP Capital stated:

A lot hinges on the Pro-shares ETF decision on Monday, with their application being the first and widely expected to get approval. As the ETF choices are underway, we anticipate BTC to stay the focus of the crypto market.