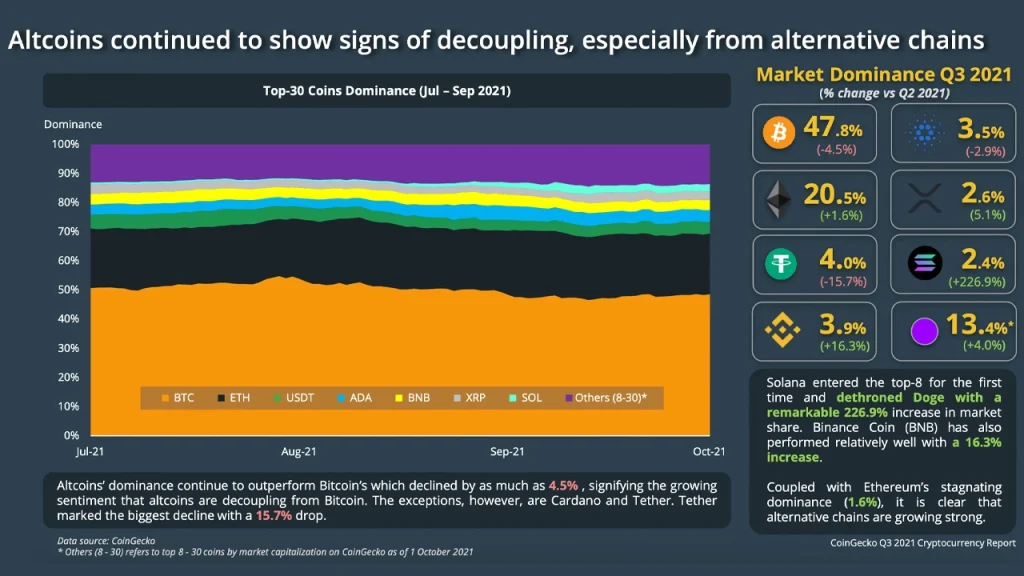

On Thursday, crypto asset aggregation portal Coingecko released the company’s third quarter 2021 report which shows a number of different findings. According to the study, for the most part, the crypto economy recovered from the market downturn in May as the top 30 market caps grew by 31% in Q3. The report shows that altcoins continue to decouple (especially those from alternative chains) and that the main stablecoin link has lost its share “as the preferred stablecoin”.

2021 Q3 Cryptocurrency Report Observes the Crypto Landscape and Bitcoin’s Third-Quarter Market Performance

This week Coingecko’s analysts and founders’ Bobby Ong and TM Lee published the firm’s 2021 Q3 Cryptocurrency Report which observes the crypto economy’s third quarter. The study looks at a myriad of topics, including decentralized finance (challenge), non-fungible token (NFT) assets, and crypto market performance in the third quarter. In the founder’s note section of the report, Ong and Lee explain that “NFTs are redefining value and culture.”

“NFTs are here to stay and have proven to be the gateway drug for mainstream adoption. We have been big fans of NFTs since learning about them in 2016,” the Coingecko founders detail.

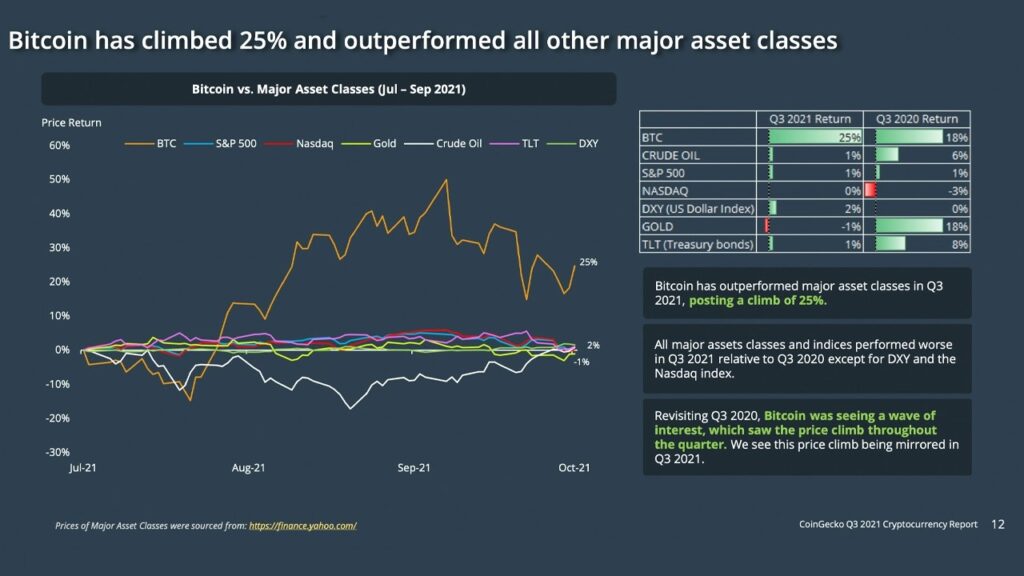

Additionally, the report deals at length with bitcoin (BTC) and notes that the main crypto asset saw a price return increase in the third quarter of around 25%.“Bitcoin ended Q3 2021 at $43,859, a 25% increase quarter-on-quarter and had consolidated since its retracement from Q3’s peak,” the report details. However, at the same time, Coingecko’s research reveals that there has been an increase in the dominance of altcoins.

“Altcoins’ dominance [continued] to outperform Bitcoin’s which declined by as much as 4.5%, signifying the growing sentiment that altcoins are decoupling from Bitcoin. The exceptions, however, are Cardano and Tether. Tether marked the biggest decline with a 15.7% drop,” the researchers add. Stablecoins that increased in dominance include USDC, BUSD, DAI, and UST.

Strong hashrate recovery, Bitcoin outperforms traditional assets and indices

The 40-page report explains that the BTC hashrate rose 54% in the third quarter, and the research highlights the crackdown on bitcoin mining that has taken place in China. “The strong hashrate recovery may be linked to the great miner migration from China to the rest of the world,” Coingecko’s report details.

The report coincides with new data from the University of Cambridge’s Bitcoin Electricity Consumption Index (CBECI) project, which shows that a large number of mining operations now reside in the United States. and outperformed all other major asset classes. “All major asset classes and indices performed worse in Q3 2021 relative to Q3 2020 except for DXY and the Nasdaq index,” the study’s researchers noted.

The research is also looking at other metrics, and in Q3 2021, state-owned companies controlled around 1.11% of the total BTC supply. Additionally, the report notes that BTC’s market valuation is 13.5X away from surpassing gold’s overall market capitalization.

Since the release of Coingecko’s Q3 2021 report, bitcoin (BTC) has risen significantly in value. For instance, the day before the report was published BTC was swapping for $54,887 per unit and today the crypto asset is exchanging hands for above $61.2K per BTC. That’s an increase of 11.59% during the last two days.