Ethereum followed Bitcoin’s lead with the broader crypto market as it recovered this month. Trading at $3914.85, the altcoin is in a good spot and the same can be observed from investors’ perspective as well. But this development could put an end to the good mood that reigns in the market.

Ethereum on a roll

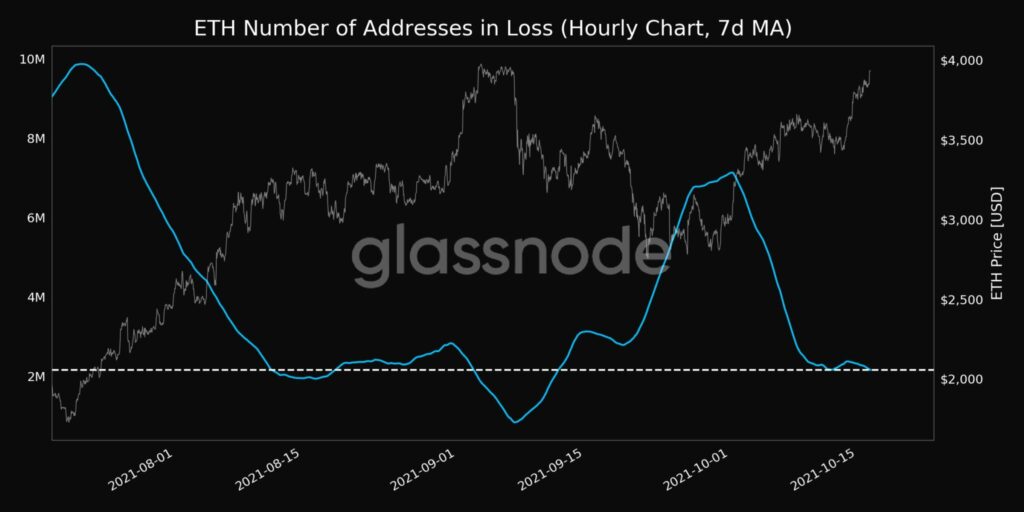

After a 30.40% rally this month, ETH managed to make things easier for its investors. At the time of writing, the number of losing addresses has fallen to its lowest level in a month, at just 2.17 million, which is just 1% of all Ethereum investors.

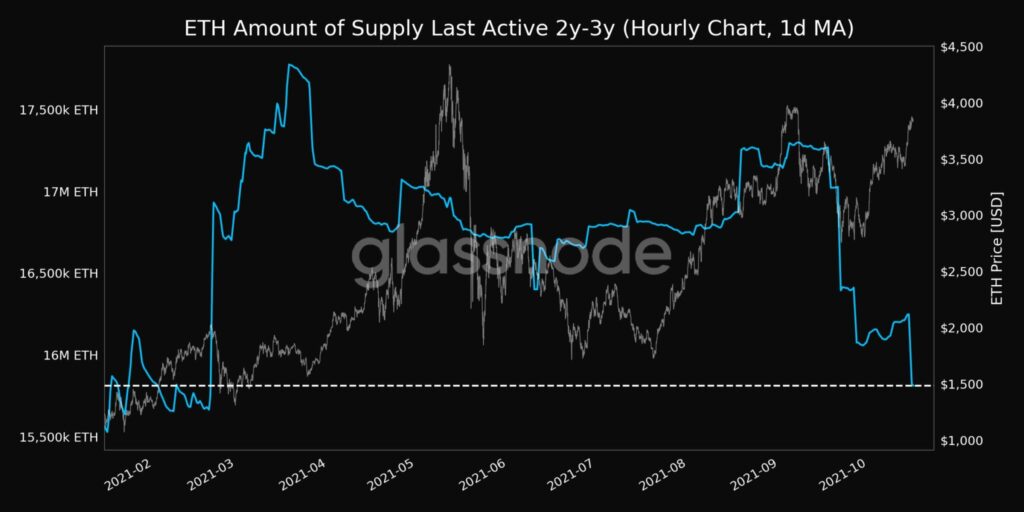

In fact, investors probably even took advantage of Ethereum’s rally towards $4k and maybe sold their holdings. And these sellers were not regular traders either. Medium-term holders, who held ETH for 3-6 months, and long-term holders who held their balance for at least 2-3 years, sold the majority of their holdings this month.

Mid-term holders’ supply reached a 6 month low and long-term holders’ supply fell to a 7-month low.

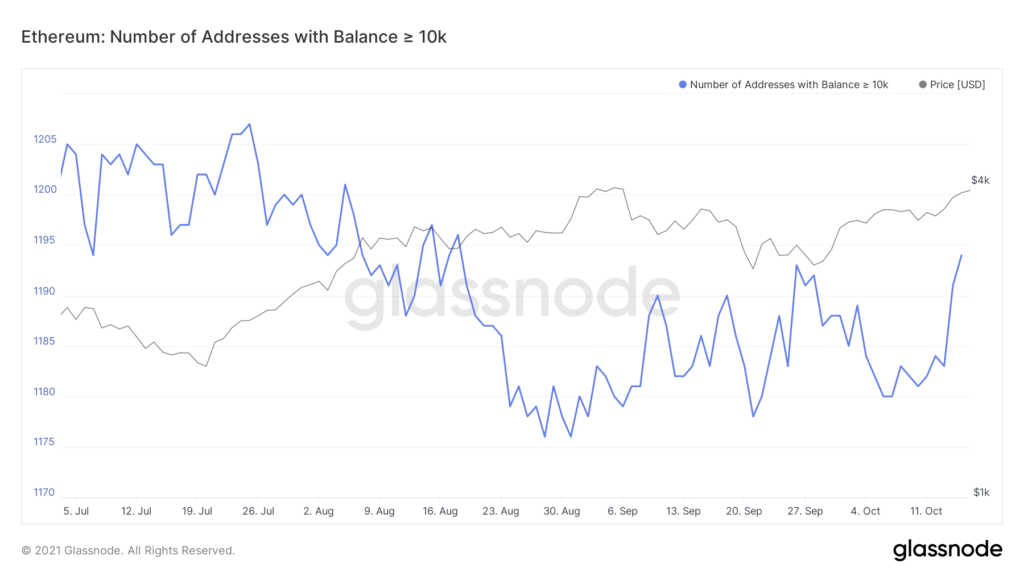

Surprisingly, some of the ETH was actually taken by whales or wealthy cohorts during exchanges, as addresses with more than 10,000 ETH increased in 48 hours. Even at just 10,000 ETH in every address, at least $4.2 billion worth of ETH was bought.

But the sale by MTH and LTH was not a random for-profit sales incident. There is a strong possibility that these investors are preparing for soon to arrive price fall.

Lower prices?

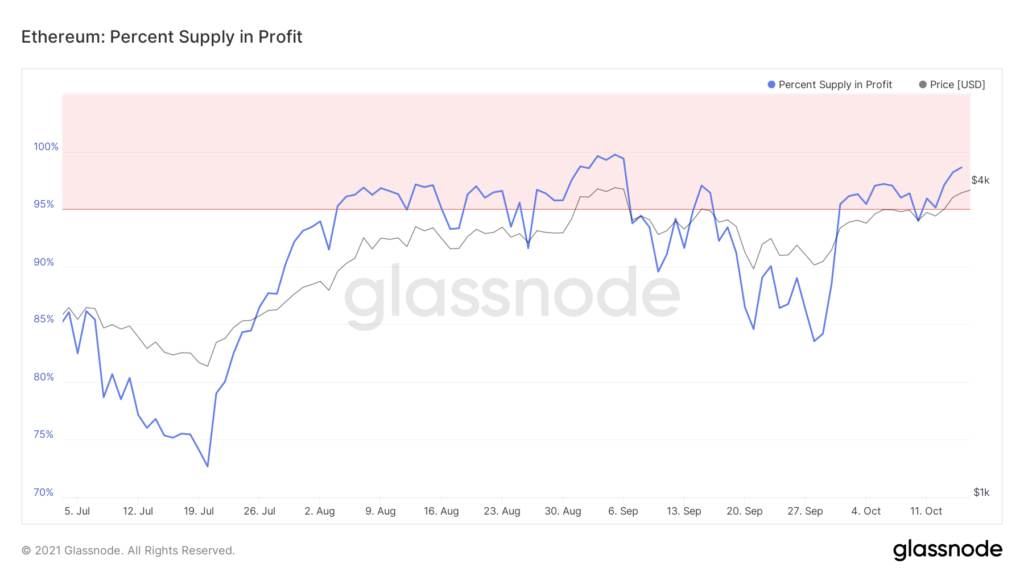

Indeed. The very first indication of the same comes from the top of the market created today when the profit supply reached 98.62%. A market top usually is followed by some price fall. In the past too (September 15), when a market top was formed, price fall followed and the same was hinted back then.

So it wouldn’t be a surprise if the same thing happened again. And on top of that Relative Strength Index’s current position supports the same argument. We can see that the RSI is on the verge of breaking through the overbought zone for the first time this month.

But we must observe whether the RSI cooldown is accompanied by a price dip or simple consolidation.

In any case, it is always better to take precautions than to regret.