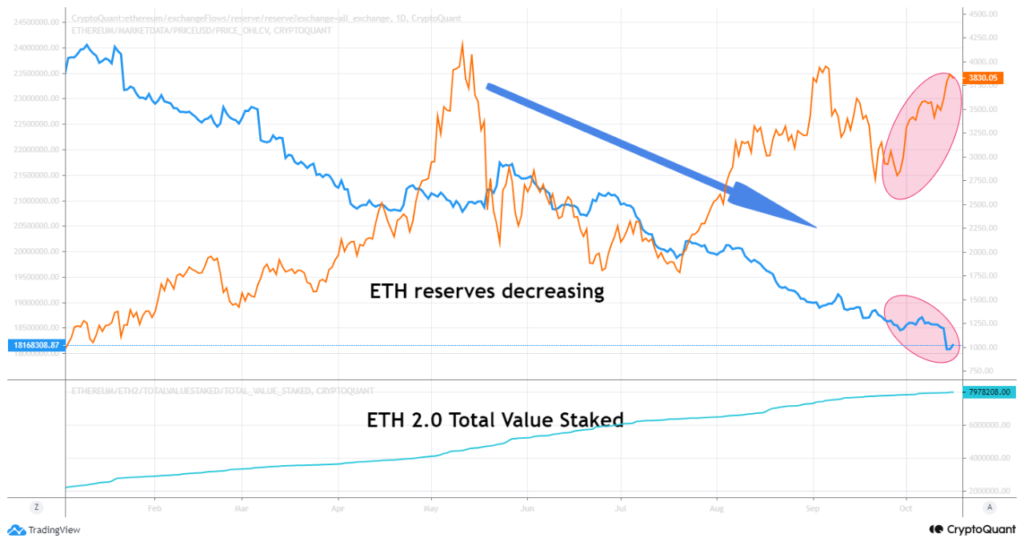

The Ethereum supply shock has actually been growing as exchange reserves continue to decrease and worth staked in ETH 2.0 contract increases.

Ethereum Supply Shock: Exchange Reserves Go On Decreasing While ETH 2.0 Staking Contract Grows In Value

As pointed out by a CryptoQuant post, ETH exchange reserves have been decreasing while the coins locked in the staking contract have been rising.

The “all exchanges reserve” is an Ethereum indication that highlights the overall variety of coins saved in wallets of all exchanges.

When the value of this metric goes up, it means there is an increase in the supply of ETH on exchanges. Such a pattern might reveal that there is a selling pressure in the market as financiers are sending out these coins to exchanges for withdrawing to fiat or altcoin getting.

A decrease, on the other hand, would imply the supply of ETH is going down as investors take their crypto off exchanges for hodling or selling through OTC deals. This habits might reveal that purchasers feel bullish on the coin’s future.

Now, here is a chart that shows the trend in the all exchanges reserve for ETH:

As the above chart programs, the Ethereum exchange reserves have actually been progressively heading downwards given that rather a long time now.

This is despite ETH’s recent sharp increase in price. It appears financiers want to hang on as they think the cost will value even further.

This is creating a supply shock in the market. An boost in need from huge whales like institutional and retail financiers now can blow the cost up.

In fact, on-chain data suggests institutional investors have already started getting involved in the crypto as 400k ETH exited the crypto exchange Coinbase a few days back.

By the method, the chart from prior to likewise consists of the worth presently staked in ETH 2.0. As this contract is seeing a steady increase in the number of coins being locked, it looks likely that some of the supply going off exchanges is going into this contract. This even more backs the concept that financiers remain in Ethereum for the long term.

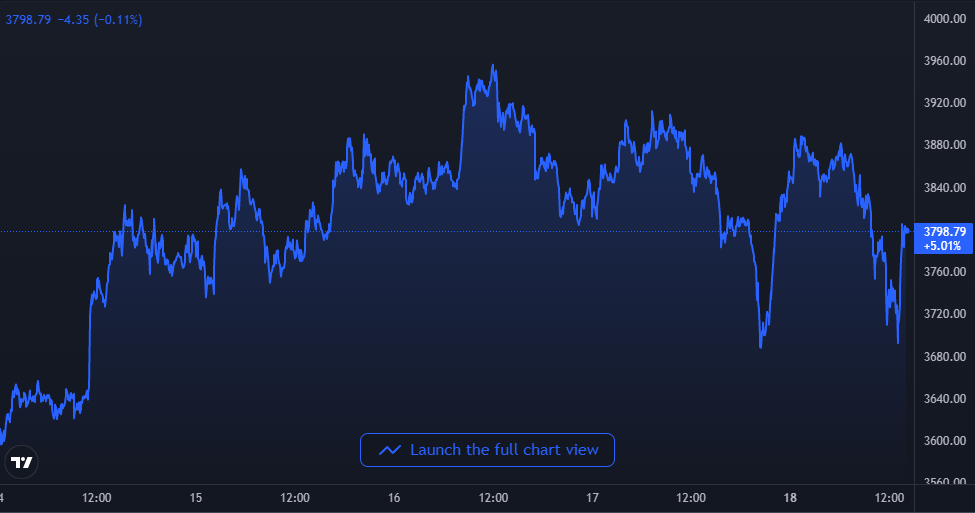

ETH Price

At the time of writing, Ethereum’s price floats around $3.8k, up 5% in the last seven days. Over the previous month, the crypto has actually acquired 9% in worth.

The below chart shows the trend in the value of the coin over the last five days.