While random altcoins can outperform Bitcoin and Ethereum momentarily in the market, the two major digital assets are miles ahead when it comes to market valuation. Sitting at a market cap of $1.14 trillion and $460 billion respectively, BTC and ETH influence high market liquidity, and certain assets are influenced by their movement.

During 2021, Bitcoin and Ethereum dominated the bullish proceedings during their rallies, and at the time of publication, a similar situation was unfolding.

With one of the assets asserting supremacy in the chart again, we analyzed which digital token exhibited higher investment potential in the short-term rally.

Bitcoin vs Ethereum; the Q4 battle royale?

At the time of going to press, Bitcoin topped the October charts with 38.50% growth compared to Ethereum’s 29.88% rise. While both the assets have managed to maintain a position above their MAs, the momentum might be rightfully on Bitcoin’s side.

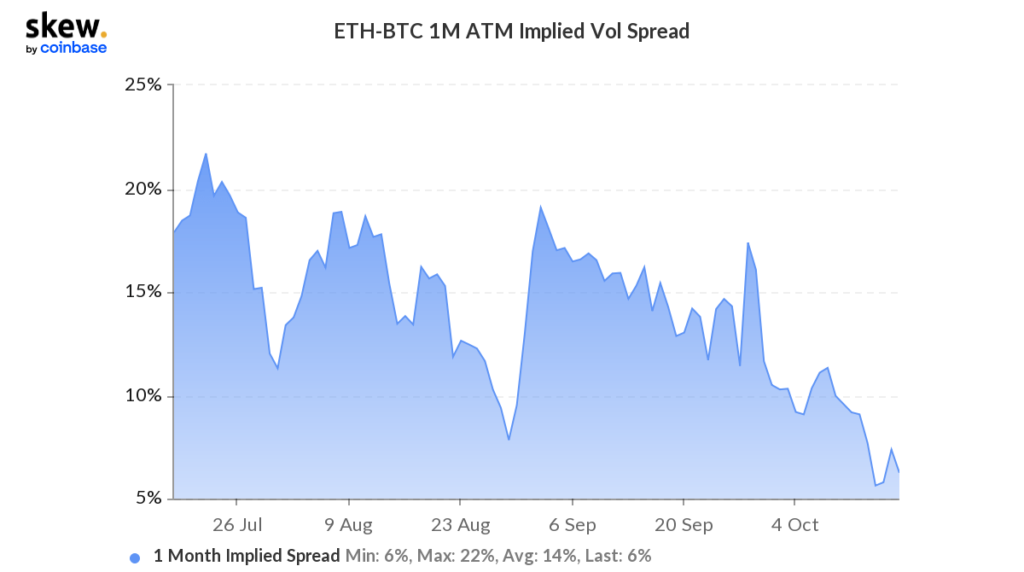

According to the Skew chart, the 1-month and 3-month realized volatility gap of Ethereum-Bitcoin has fallen to year-round lows, indicating that Bitcoin is more likely to advance faster in the charts.

When the Implied Volatility is compared, a similar picture unfolds. The Ethereum-Bitcoin 1M ATM Implied Volatility Spread indicates that traders expect BTC to show higher volatility over the next few days, as IV drops to annual lows.

Now, historically, a lower RV and IV value for Ethereum with respect to Bitcoin has led to a strong performance for the king coin. The current market structure is also heading towards the point where Ethereum is still facing resistance from a high set in September 2021, but BTC is close to its ATH range from May.

Therefore, in the short term, investing in Bitcoin might be more lucrative than Ethereum.

Still, Ethereum has a “quarter edge?”

During 2021, Ethereum outperformed Bitcoin on a quarterly basis. Even during the second quarter’s bearish rally, Bitcoin lost its value by 40% while, surprisingly, Ethereum ended its quarter up 18%. So while the short-term momentum supports BTC to hike in the charts, in the long-term Ether has had a better ROI in 2021.