shot of bull silhouette

After closing its finest greatest week considering that its beginning, the bulls stay in control of the cost of Bitcoin. At press time, BTC’s price trade at $61,386 with a 3.8% profit in the daily and a 12.3% profit in the weekly chart.

In the crypto leading 10, just Dogecoin (DOGE) and Binance Coin (BNB) have actually exceeded Bitcoin as this property’s supremacy over the crypto market continues to increase.

The general sentiment amongst traders and operators seems bullish with potential FOMO coming in the coming weeks if Bitcoin can score a new all time high beyond $64,500.

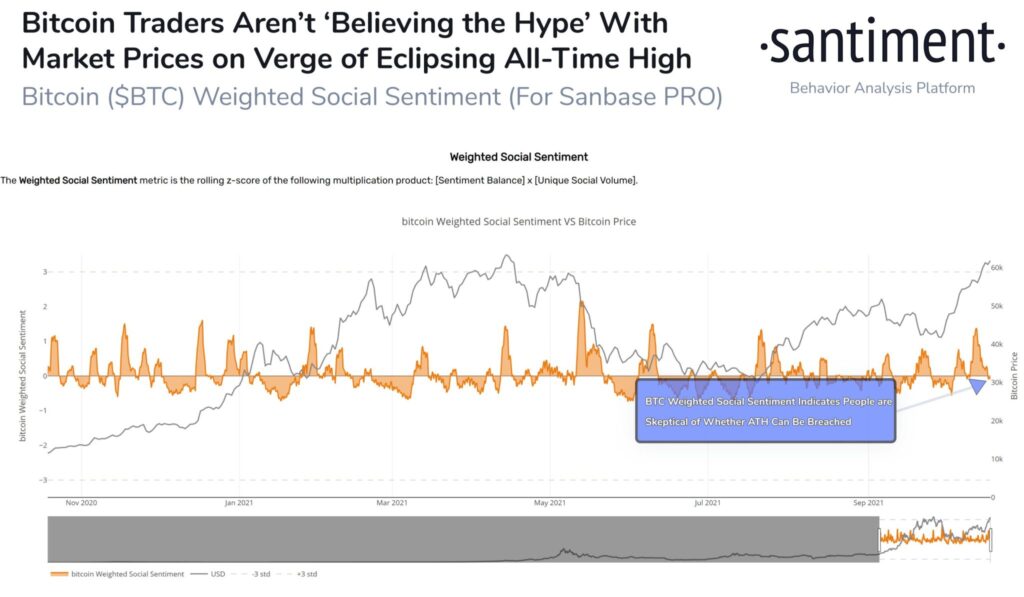

In that sense, research study company Santiment records no spike in BTC’s Weighted Social Sentiment, a metric utilized to track social networks and determine market belief. As seen below, this metric stands almost flat as Bitcoin reclaims previous highs.

As the chart recommend, there appears to be a connection in between Bitcoin and its social networks belief. When the metric experiences sudden spikes, BTC’s price trends to the downside most likely driven by short-term investors that enter the crypto market to make a quick profit.

Lately, the connection has inverted as Bitcoin moves greater, its Weighted Social Sentiment pattern lower. Santiment kept in mind the following:

(…) traders are showing a surprisingly low level of excitement. With blissful commentary being tempered, it’s a great indication that rates can exceed in the future without #FOMO stopping momentum.

Bitcoin Loaded With Rocket Fuel

On the possibility of BTC’s price returning into uncharted territory, Charles Edwards, founder at Capriole Investments, reiterated his bullish stance.

As NewsBTC reported, 2 months back when Bitcoin was trading at $45,000, Edwards reported that his Hash Ribbons sign went bullish. Used to track BTC miner activity, this indicator flashes a buy signal when a capitulation event has concluded leading into a rally.

On this event, Edwards showed the Market Value to Realized Value (MVRV) sign, a metric utilized to determine if BTC’s cost is at under or over worth, has actually reached 3.0.

As seen below, when Bitcoin’s MVRV stands at these levels, it has usually followed with a rally. In 2013 and 2017, the chart shows, BTC’s cost reached its all-time high rates in the coming months after the metric entered its present levels.

In the short term, bulls could face some headwind as the derivatives sector start to heat up. Analyst Ali Martinez records a 5-month high in BTC Futures Open Interest standing at $22 billion.

In addition, on-chain activity declining in combination with a 98.34% of BTC’s total supply at unrealized profit suggest potential downside risk, as Martinez added.