Bitcoin rallies as the very first Exchange Traded Fund (ETF) released by ProShares debuted in the NYSE. The first cryptocurrency by market cap trades at $62,908 with 2% and 9.5% profits in the daily and weekly charts, respectively.

The basic belief in the market turned bullish as October made its entry, traditionally a green month for Bitcoin. Traders and operators seem to expect a fresh all-time high in the near term driven by fresh capital coming into the market via the BTC ETF.

At press time, ProShares’ item has actually seen a $280 million in trading volume. Senior ETF analyst for Bloomberg Intelligence Eric Balchunas claims this makes the Bitcoin ETF part of the top 15 at opening day in terms of trading volume with the potential to become number one if it surpasses $1 billion during the day.

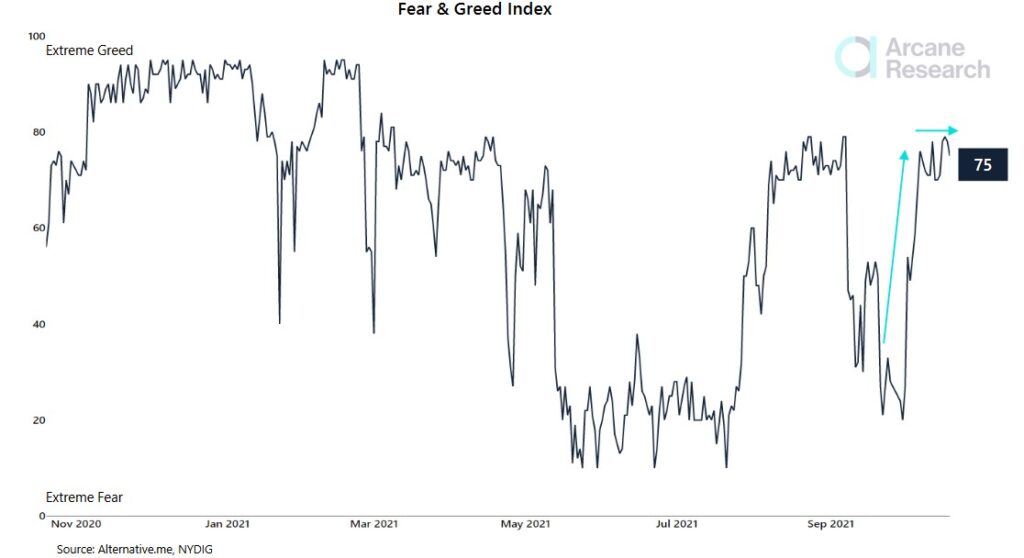

The Fear and Greed signs have actually transferred to the advantage as a repercussion of current occasions and Bitcoin’s efficiency. Per an Arcane Research report, The Fear and Greed Index signaled “extreme greed” for the past two weeks.

This indication generally changes at high levels when the crypto market hypes over an occasion, such as the launching of exchange Coinbase on the general public market. In addition, Arcane Research claims Bitcoin experienced a similar phenomenon in 2020 when the bull-run to $64,500 began.

As a possible favorable signal for the bulls, on-chain activity appears to be increasing as revealed by the minor boost in deal charges on the BTC network. As NewsBTC reported, experts believe this suggests institutional demand for the digital asset is returning.

Bitcoin Sees Increase In Demand, More Upside Imminent?

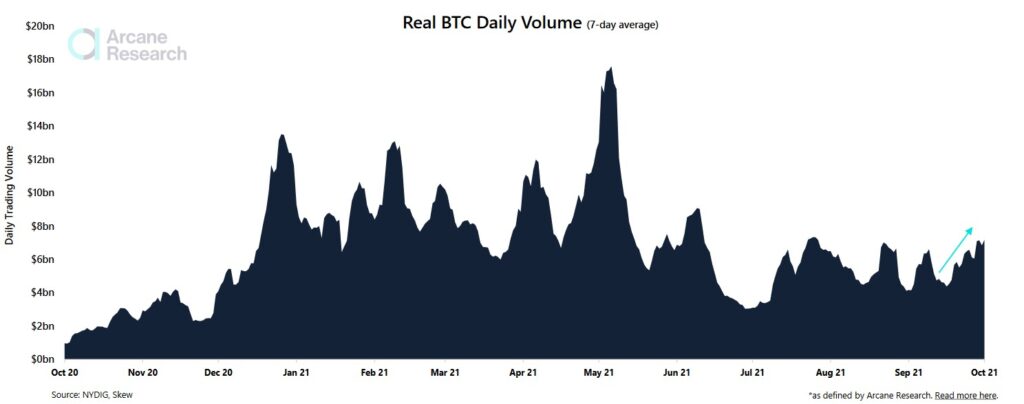

In assistance of this theory, Arcane Research records a climb in BTC area volume. As seen below, this metric saw a sharp decline in May and July, as BTC’s price kept on falling. It began to recuperate by August and has actually continued to trend upwards.

BTC’s trading volume stood at $7.2 billion during October’s second week with the 15th of this month recording a $12 billion intraday volume, Arcane said, the biggest in the past 6 months. The firm said:

The exact same day, the bitcoin rate increased by 7.6%, demonstrating how the most significant day-to-day volumes accompanied the most considerable boosts in the rate. These developments signal a renewed interest in bitcoin after a sleepy summer.

In the short-term, traders might see an increase in volatility due to the BTC ETF impact on the marketplace. The derivatives sector seems to be getting overheated with the Open Interest (OI) points to an uptick in leverage positions.

As with the Coinbase launching, excessive take advantage of might cause a liquidation-driven brief capture. Whether it will favor the bulls or bears, that remains to be seen.