Bitcoin has actually been declined in the high location around its existing levels and patterns to the drawback in the everyday chart. At press time, BTC’s price has slide back into early week levels trading at $62,668 with a 5.1% loss in the daily chart.

The bullish belief stays as Bitcoin has actually had the ability to keep its profits in greater timeframes. The benchmark crypto smashed its previous all-time high at $65,000 and roared its way up to the $68,000.

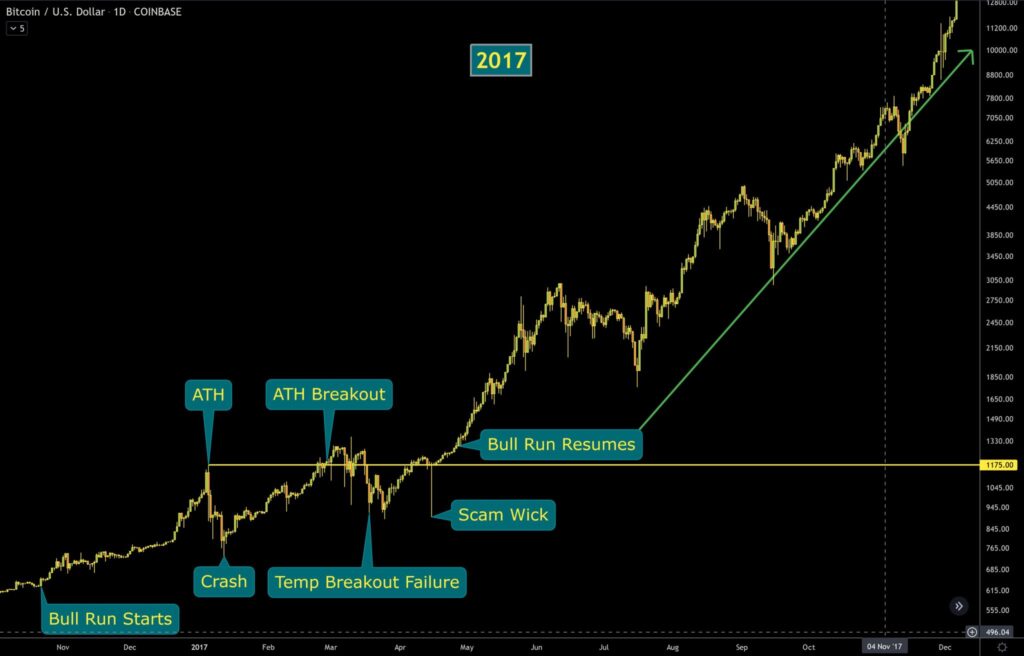

Analyst John Wick believes Bitcoin might follow a comparable trajectory as in 2017. As seen below, BTC performance has been imitating the price action at that time with a similar ATH breakout and continuation of the bullish trend.

On this rally, Bitcoin has actually handled to break a number of all-time highs in its indications. The upwards trend has been propelled by the launch of a BTC-link ETF in the United States.

This financial investment item tracks the cost of Chicago Mercantile Exchange (CME) futures agreements. Thus, many traders are looking into Bitcoin’s Open Interest has it made its way up with the price of the underlying asset.

The BTC Futures Open Interest OI stands at $5.75 billion in the CME, according to information from Skew. The exchange now traders more contracts that Binance, FTX, Bybit, and other major exchanges most likely due to the impact of the Bitcoin ETF.

Bitcoin At Risk Of Further Downside Or Heating Up For New ATH

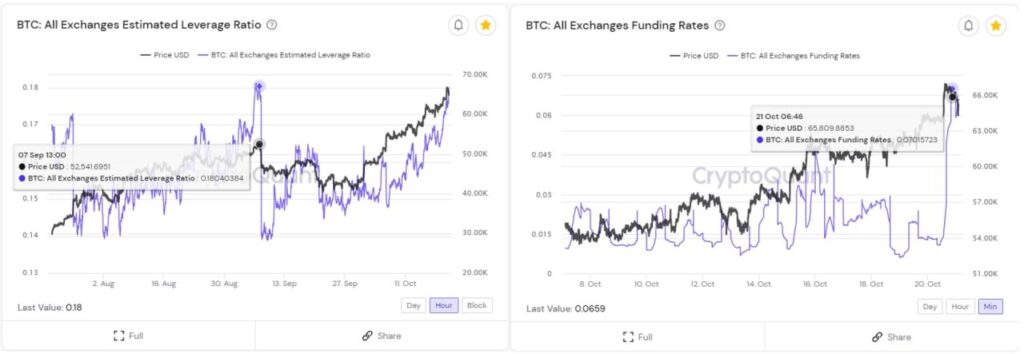

Further information provided by CryptoQuant indicate a heating up in the futures market with the take advantage of ratio increasing to September levels. Funding rates are going positive, as traders expect more gains and short-term investors take leverage Bitcoin positions.

The Bitcoin Option Open Interest follows a comparable pattern that the futures market, Delphi Digital kept in mind. The OI in this sector also reached an all-time high, the firm said the following on the increase interest on this market:

This was anticipated provided BTC’s brand-new all-time high and futures markets striking record open interest levels too. Most activity is centered around short to mid-term call purchases.

In the short-term, Bitcoin might continue its rally as historic information recommend. Some analyst claims BTC’s price tends to return to discovery mode a few days after a successful push into new highs.

However, as the futures market runs hot, the bulls might deal with difficulties. In the past, whenever too much leverage enters the market, Bitcoin tends to correct to shake out short-term investors. Only time will tell if history repeats.