Strategists at financial institution JPMorgan Chase & Co. argued that the reason for the record BTC price is not the launch of the ETF ProShares Bitcoin Strategy. Instead, concerns about the rising inflation made the digital asset an attractive investment option, and that led to its recent rally.

Gold failed, BTC prevailed

The moment, which many in the cryptocurrency community had been waiting for, finally came on October 19 when the Bitcoin-backed ETF ProShares, named BITO, began trading on the New York Stock Exchange. It became the first such product approved in the United States.

In the first day of its launch, it generated massive trading volumes and even became the second highest fund ever to trade. Shortly after, BTC’s USD value headed straight north towards a new all-time high at roughly $67,000.

Yet, according to JPMorgan strategists, including chief executive Nikolaos Panigirtzoglou, another factor has driven bitcoin to this milestone. The specialists indicated that the cryptocurrency had replaced gold as a hedge against inflation in recent months, which had propelled the price north:

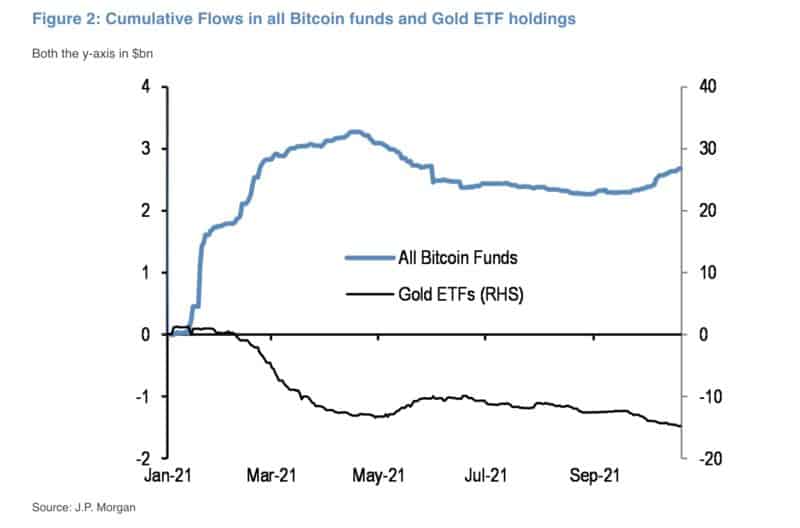

“On its own, the launch of BITO is unlikely to trigger a new phase of entry of much fresher capital into bitcoin. Instead, we believe the perception of bitcoin as a better inflation hedge than gold is the main reason for the current upswing, triggering a shift away from gold ETFs into Bitcoin funds since September.”

The JPMorgan team noted that the past two weeks had not been so successful for the precious metal. Taking a look at a broader period, bitcoin ETF’s have significantly outpaced gold ones, as the strategists revealed:

“This change in flow remains intact, supporting a bullish outlook for Bitcoin through the end of the year.”

Can BTC Now Change The Stance of The Big Boss?

Jamie Dimon – Chief Executive Officer of JPMorgan – is among the most prominent critics of the leading digital asset. Still, it seems he’s started to loosen the hold on her.

It all started in 2017 when the top executive called bitcoin a “fraud.” Dimon did not stop there and warned that “it’s worse than tulip bulbs. It will not end well. Someone is going to be killed. Soon after, however, he regretted making the comment and his financial institution became much more tolerant of BTC.

Last year, Dimon weighed in on the matter once again. This time he was softer in his comments saying that bitcoin is not his “cup of tea” and that he has no personal interest in it.

A few days ago, the CEO returned to its negative phase, calling BTC “worthless”. Nevertheless, he acknowledged that most of JPMorgan’s clients do not share his opinion and show an increasing demand for digital asset services.

With BTC setting a new all-time high, the crypto community has yet to find out whether Dimon will maintain its hostile stance on the matter or rather soften it up a bit and allow more offers to its bitcoin hungry customers.