After the Proshares Bitcoin Strategy exchange-traded fund (ETF) listed and smashed records in the first two days of trading, Vaneck’s bitcoin futures ETF was given the green light to start trading next week. Additionally, sources indicate that the Valkyrie Bitcoin Strategy ETF is expected to launch this week with a possible listing on Friday.

Proshares Bitcoin ETF Smashes Records

October is the month of bitcoin exchange-traded funds as the United States approved the first ETF last week. Proshares’ Bitcoin Strategy ETF (NYSE: BITO) was listed on Tuesday and registered nearly $ 1 billion in volume on its first day of trading.

The following day, BITO continued to perform remarkably and bitcoin (BTC) spot markets tapped a new lifetime price high at $67,017 per unit.

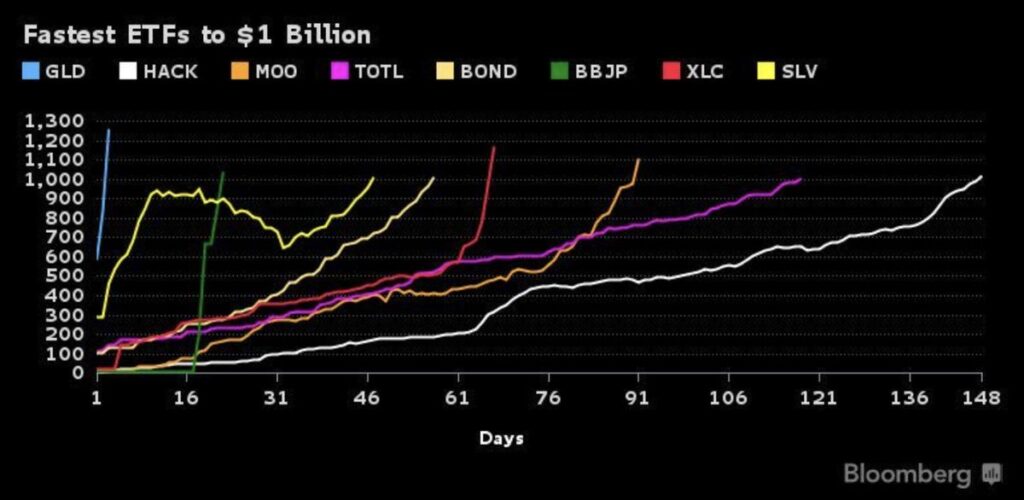

In fact, the senior ETF analyst for Bloomberg Intelligence, Eric Balchunas, explained how the bitcoin ETF was one of the fastest in history to capture $ 1 billion in assets. Balchunas noted:

RECORD BREAKER: BITO assets up to $1.1b after today, making it the fastest ETF to get to $1b (2 days) breaking [gold’s] 18 [year] old record (3 days), which is poetically apropos.

Two sources say Bitcoin Valkyrie strategy ETF is expected to launch on Friday

Balchunas is a source who said the Bitcoin Valkyrie Strategy ETF is expected to launch this week. In addition to statements from Balchunas, crypto reporter Danny Nelson confirmed with a Valkyrie spokesperson that the fund will begin trading on Friday after it “cleared the final regulatory hurdles.” Bloomberg’s senior ETF analyst also explained the news on Twitter.

“I just heard that Valkyrie is changing the ticker to BTF 🙁 SEC prob was not a fan of BTFD. Also odds [are] growing they will launch tomorrow. Not final yet [though],” Balchunas said.

Then he corrected his tweet and noted that the Valkyrie ETF would be listed on Friday. “I had said this was launching [tomorrow] it’s actually going to be on Friday. Sorry about that,” the analyst further detailed.

The Valkyrie fund will benefit from the ticker symbol “BTF”, but there have been discussions that the company will adopt the ticker symbol “BTFD”. Unlike Proshares and Vaneck, the Valkyrie ETF will list on Nasdaq rather than the New York Stock Exchange (NYSE).

Valkyrie’s ETF was initially filed in August and operating expenses per year are 0.95%, according to the pre-effective amendment filed Wednesday morning.