On-chain data shows a current increase in the variety of stablecoin addresses sending out to exchanges, recommending a boost in dry powder supply pumping into Bitcoin.

Stablecoins Exchange Inflow Addresses Count Recently Surges

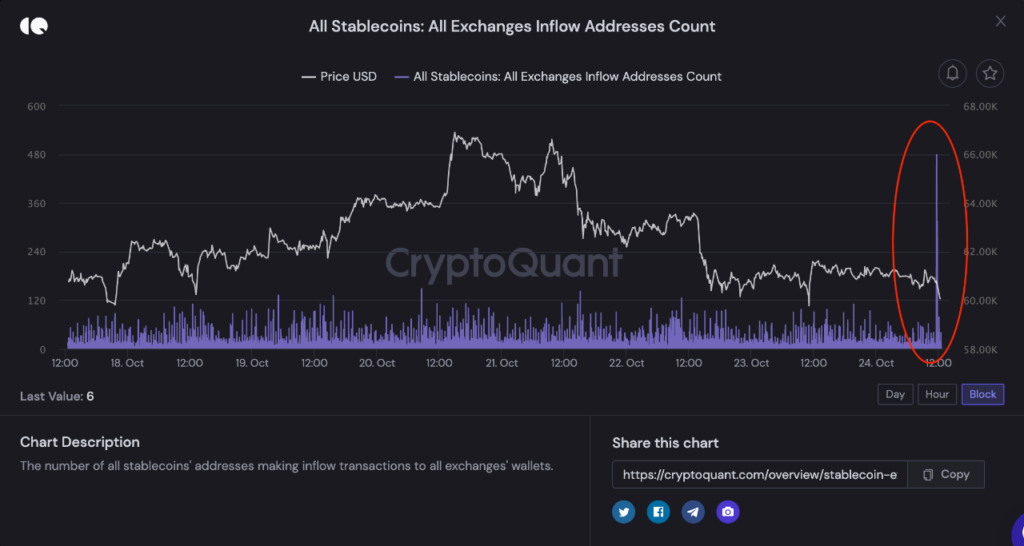

As pointed out by a CryptoQuant post, the number of stablecoin addresses making inflow transactions to exchanges saw a sharp rise yesterday.

Stablecoins are tokens that have their worths connected to a fiat currency. Since they are relatively stable (as their name suggests), investors like to use them for temporarily pulling out of volatile markets like Bitcoin.

The “all stablecoins: all exchanges inflow addresses count” is an indication that shows the overall variety of these fiat token addresses that are sending their coins to exchange wallets.

A spike in the metric’s worth implies there is a boost in the supply of stablecoins for moving to other cryptos. This could suggest investors believe now may be a lucrative entrance into volatile markets, and so they are converting their fiat-tied coins to BTC and other cryptocurrencies. They might likewise be aiming to withdraw the coins into fiat.

They might likewise be aiming to withdraw the coins into fiat.

As the above chart shows, the indication revealed a large worth the other day, indicating that a great deal of financiers sent their coins to exchanges at that time.

The reason behind the trend could be the recent correction that Bitcoin suffered after making its new ATH. Investors might be bullish on the future cost of the coin and discover that this dip is a great purchasing chance.

One that thing should be noted is that not the entire stablecoins supply moving into exchanges will be pouring into Bitcoin. A portion of them will enter into altcoins and another will be withdrawn into fiat or kept exchanges.

Nonetheless, a surge in the total supply is still a good sign for BTC and may help the coin bounce back from the correction. Sustained such inflows can show to be bullish and take the crypto to greater all-time highs (ATHs).

Bitcoin Price

At the time of writing, BTC’s price floats around $63k, up 4% in the last seven days. Over the past month, the crypto has gained 48% in value.

The listed below chart shows the pattern in the cost of the coin over the last 5 days: