It lasted a week for the collective crypto market, with Bitcoin hitting a new all-time high. However, some altcoins seemed to be in a rather dormant position, and one of them was Binance Coin.

Over the past two days BNB has more or less consolidated and failed to make any further moves on the charts. Nonetheless, the asset was up by 1% over the last week and somehow managed to retain its third spot in the market.

Now, with BSC’s announcement of the new Binance Evolution (BEP-95) protocol that will accelerate the burn rate of BNB tokens and make Binance Smart Chain more decentralized, can this trigger a BNB rally?

Following Ethereum’s lead

The BEP-95 recommended burning 10% of the transaction fees in an ongoing manner. The implementation of BEP-95 could reduce the cumulative amount of BNB tokens that delegators and validators earn through staking, while simultaneously increasing the fiat-denominated value of the rewards.

The proposal will be validated once it receives a minimum deposit of 2000 BNB. According to the announcement, the combustion mechanism would further reduce the supply of BNB, as increasing demand would increase the value of BNB, thus creating a kind of supply shock.

Interestingly, the protocol would introduce a burning fee mechanism that looks quite similar to Ethereum’s burning policy. In fact, many in the market have high hopes for the price of BNB and expect gains like Ethereum saw after EIP-1559.

Notably, Ethereum soared close to 30% in the two weeks after EIP-1559. The difference between ETH and BNB, however, is that unlike Ethereum, Binance Smart Chain already has an etching mechanism in place. BNB’s 17th Quarterly burn was supposed to take place during the end of Q3 2021, but due to unknown reasons, it hasn’t taken place yet.

To date, Binance has burned a total of 1,335,888 tokens and intends to burn 50% of the total BNB supply over time.

Are things looking good for BNB?

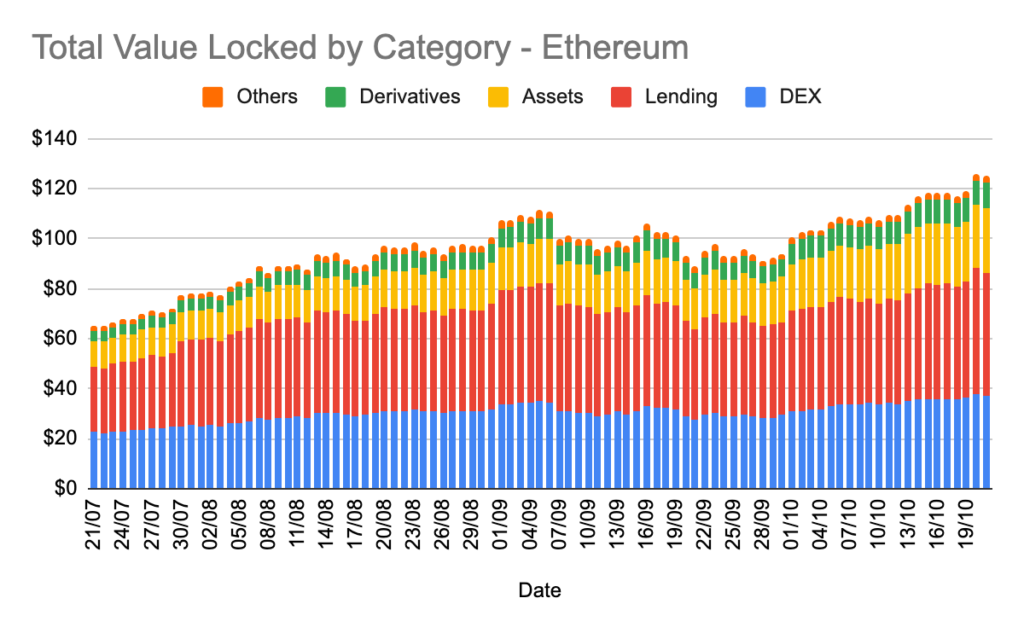

As BNB’s price consolidated, the alt was trading around $ 475.6 at the time of writing, but Binance Smart Chain (BSC) growth appeared to be intact. This week, BSC hit 100,000,000 addresses on the network. The daily transactions of BSC were still in a growing trend, with the daily active address currently, at 8.8 million transactions/day. In fact, the channel’s total locked-in value has grown to around $ 830 million (3.55%).

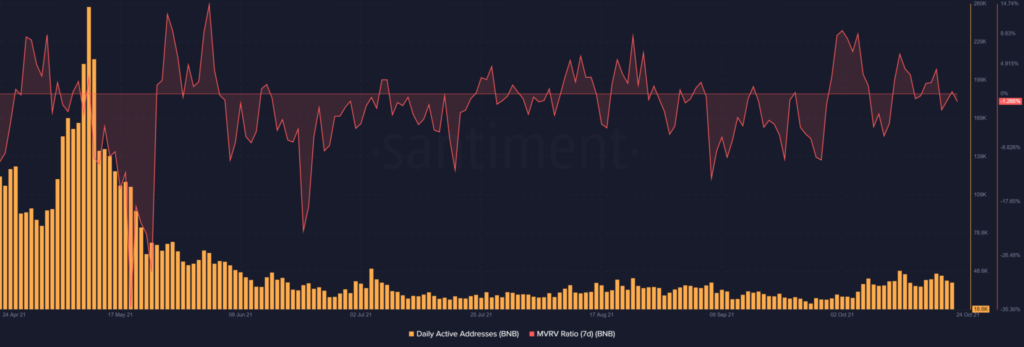

However, despite the recent BEP announcement, BNB’s price showed no signs of gains. In fact, his 7-day MVRV has fallen into the negative zone at the time of writing. Further, its active addresses also saw no major jumps. An MVRV reversal would signal a price rise in the short term.

Nonetheless, with BEP’s approval, if BNB breaks through the resistance of $ 500, the same can change the alt game.