As Bitcoin slid up the charts, it took all the cavalry with it. From a technical standpoint, we can expect BTC to consolidate over the next two weeks, with altcoins supposedly taking over. However, the narrative flips fast in the crypto-industry.

In accordance with these fixes, we can take a look at Ethereum and Cardano to determine if the crashes were actually surprising or possibly expected.

Ethereum and Cardano – How was the curry spilled?

The market turnaround was definitely a surprise for Ethereum. Before the 9.4% drop on the charts, ETH recovered earlier in the day to record a position above the resistance of $4,238. However, the crypto asset was unable to consolidate for long as a cascade of possible liquidations resulted in a huge drop of less than $ 4,000.

With Cardano, it might have been less surprising. Since the 3rd week of September, ADA has been consolidating between the price range of $2.30 and $2. Since October 10, the price has hovered below the moving average of 20 on the 1-day chart. Many in the market expected the same to be violated soon.

However, ADA breached the bearish side of the horizon, hitting a floor price of $1.81 and dropping by 15.62%.

Excitement, what else?

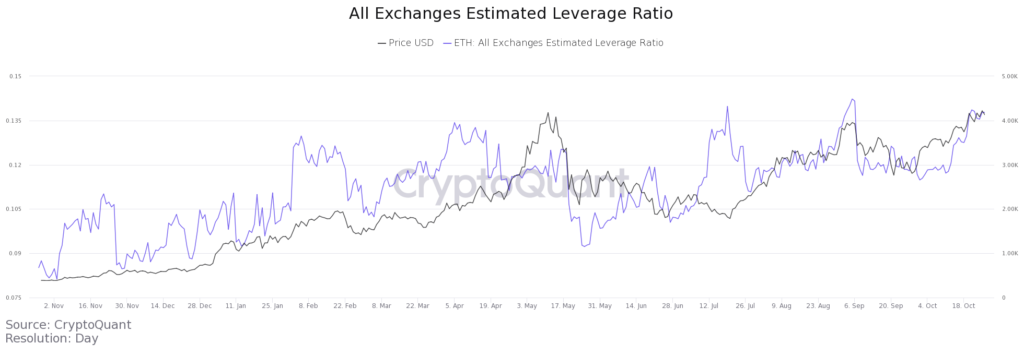

24 hours before the decline, it was observed on CryptoQuant that all estimated leverage ratios of trading for Ethereum had reached an overheating point. The same was identified in previous fixes.

The aforementioned leveraged ratio was last recorded on 3 September when Ethereum dropped by 25%, from $4000 to $3000.

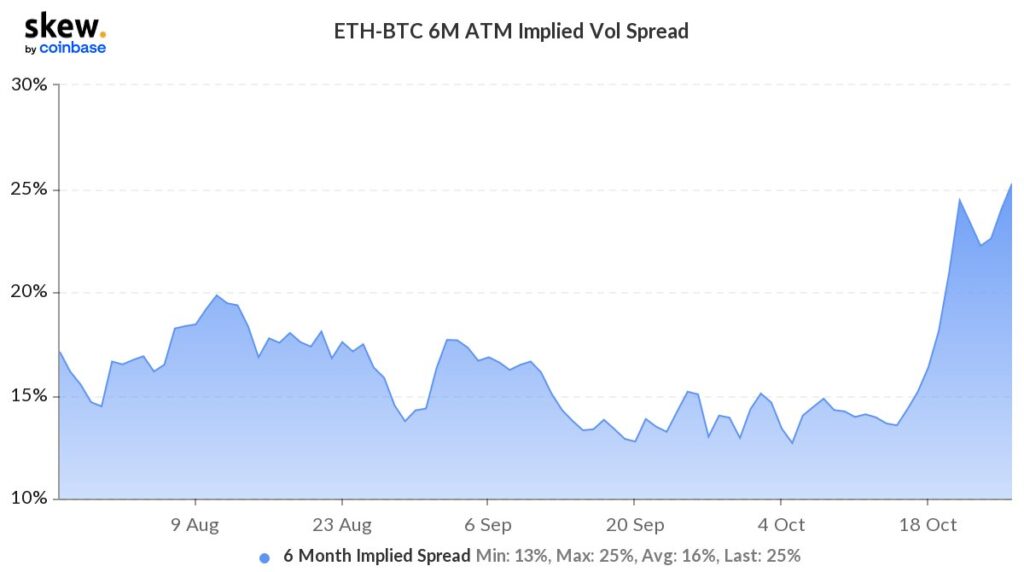

Apart from that, ETH / BTC Implied volatility at 6 months also hit a 3-month high, indicating that traders are more excited about altcoin. More volatility was expected in a bullish direction, but the narrative flipped in the short term.

For Cardano, it was more or less the same with $ 20 million liquidations, the largest since the September 7 crash of $ 55 million.

Recovery could be immediate

While Cardano might see some strain as a lack of momentum has transpired over the month, Ethereum may bounce back immediately and soon recover its position above $4200.

However, it will be essential to analyze the buying pressure over the next 48 hours. So, until then, it is safer to stay put and avoid FOMO investments.