Bitcoin broke back above the $60,000 levels and records moderate revenues in the previous day. The benchmark crypto trades at $61,483, at the time of writing, with 4% profits in the daily chart and a 7% loss in the weekly.

Bitcoin has actually decreased from its rally after it was declined at the high of its existing levels. As NewsBTC has been recording since BTC’s price started turning to the upside, the rally has been driven by institutions increasing their bet on the cryptocurrency as its ETF was rollout in the U.S.

The upward pattern brought a great deal of utilize to the Bitcoin-based derivatives as speculators and short-term financiers attempted to ride the brand-new bullish momentum. However, more leverage implies more volatility, and it can turn an upward trend fragile and susceptible to sudden moves.

In that pick up, as Bitcoin scored a brand-new all-time high above $67,000, long-lasting holders began taking revenues. This brought BTC’s price back to the high at $50,000 and a display of low volatility with mostly sideways movement in recent days.

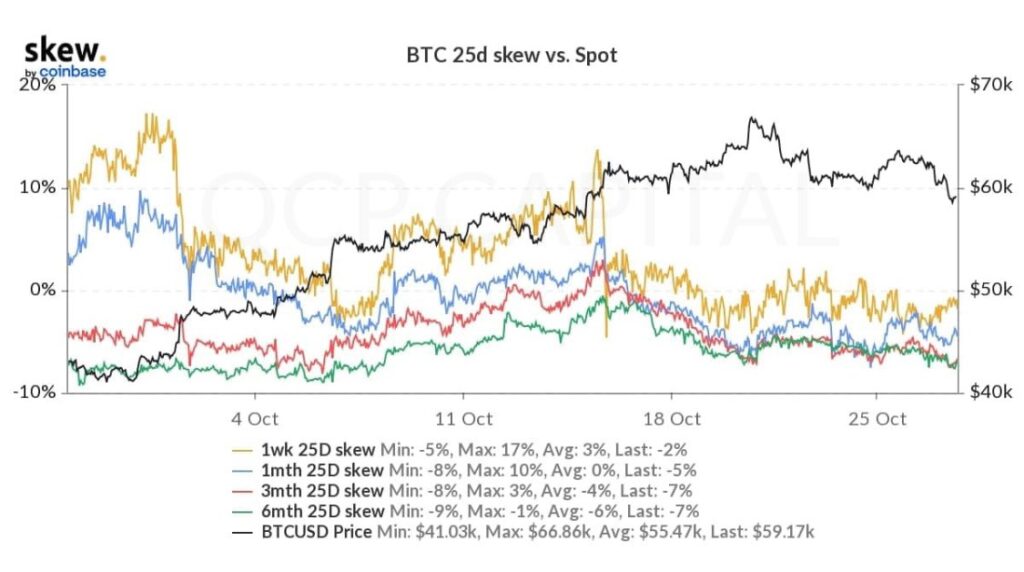

Bitcoin’s transfer to the disadvantage has actually left market belief undamaged, as QCP Capital Capital declared in a current analysis. The firm believes BTC’s price is “taking a breather” after a run towards uncharted territory.

The basic belief in the market stays bullish in spite of the current dip and retest of vital assistance at $58,000. QCP Capital claimed:

Despite this quick dip from the highs, the market feels relatively calm and perhaps even slightly optimistic that this is just a dip before a larger rally into year-end.

This can be much better pictured on the Bitcoin Options market, often utilized by financiers to front-run or hedge versus the prospective future disadvantage. As seen in the chart below, and as explained by QCP Capital, the market remains optimistic with “risk reversals still skewed to the call side”.

Bitcoin Could Rise As Altcoin Bleed

QCP Capital anticipated Bitcoin to respond with short-term bearish rate action and sideways motion, now they are minimizing their BTC shorts with the prospective to turn neutral on the property.

The firm added that funding in perpetual futures contracts is flat. The cool-off has actually infected other sectors in the market, the company stated:

October forwards were trading at over 30% annualized and are about to settle. November futures were trading around 25% and have actually boiled down listed below 15%.

However, this could be bad news for altcoins as Bitcoin could resume its rise in market dominance. Thus, numerous might underperform while BTC’s rate returns to rate discovery.