With increasing volatility in the cryptocurrency market, more traders are choosing to hedge their open positions

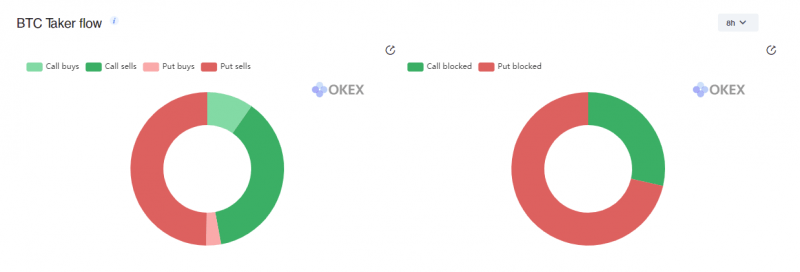

With the volatility on the cryptocurrency market, more traders chose to hedge their positions via options contracts. But with the current call / put ratio, some inexperienced investors might receive a bad signal on the current state of the market.

How traders utilize options

Options contracts are a high volatility asset that might give traders a major return if bought for the right price, but professional traders and investors do not ever use them to trade. The main purpose of options is to hedge your primary market position.

By using put (sell) options, traders can hedge their long positions on the market. Every time an asset’s price returns quickly and a correction begins, the price of their options contract will increase exponentially and cover any losses from the long position.

If an asset moves in the planned direction, traders can simply leave the option and just lose their contract fee, which is usually significantly lower than the size of the covered position.

Why this might be a good signal

As open interest increases on put options, this could be a signal of increasing hedging volumes in the market. Usually, a large number of hedged positions is a sign of a healthy market.

Bitcoin showed an increase in overall volatility after hitting a new ATH, then quickly fell back below $ 60,000. Due to the volatility increase, some traders chose to safeguard their unrealized positions by using options contracts, taking profits if a flash crash happens and then reopening their positions for a lower price, which will give the market an initial boost for a new rally.