September was not a good month for Ethereum. It took more losses than Bitcoin and a few other altcoins. However, October proved to be pretty supportive. Ether’s month-long rise is creating records with each passing day but the question remains- for how long will this continue?

Ethereum’s trajectory

Ether was the only coin to see a steady increase throughout October, including over the past week when most altcoins, in addition to Bitcoin, consolidated. As a result, on 29 October it finally breached the $4200 resistance and marked a new all-time high.

What’s more, on November 2, it rose 6.28% again and marked a new all-time high of $ 4,595. Registering two all-time highs in a single week is not common for Ethereum or any other top coin. So, the pertinent question is – what will happen from here on?

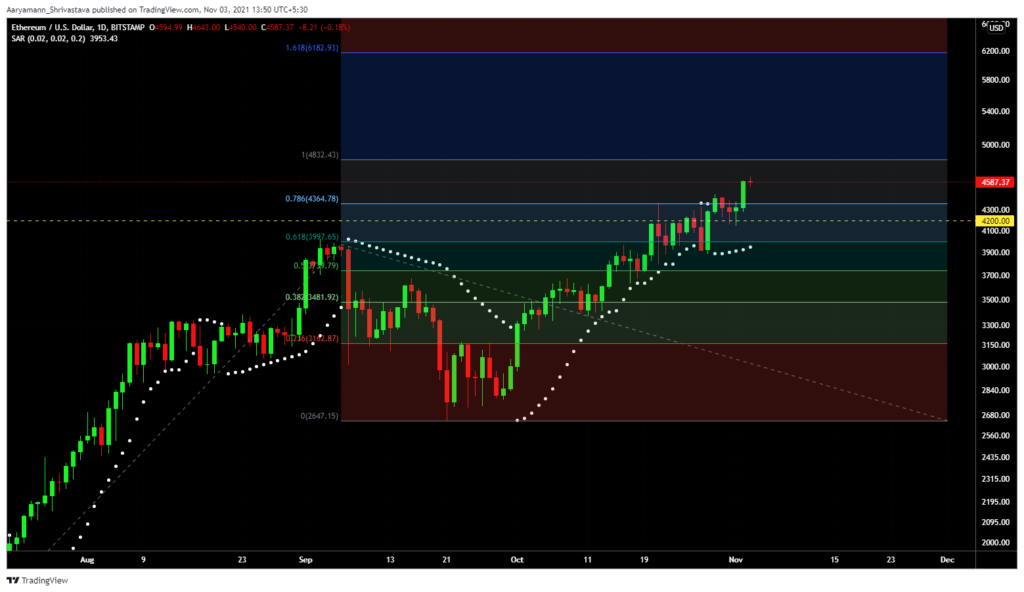

Well, according to the Fibonacci retracement indicator, yesterday’s new all-time high was recorded above the 61.8% level. Since, the market is still in an uptrend, as observed by the Parabolic SAR’s white dots under the candlesticks, a bounce off of this 0.618 line would only push ETH higher.

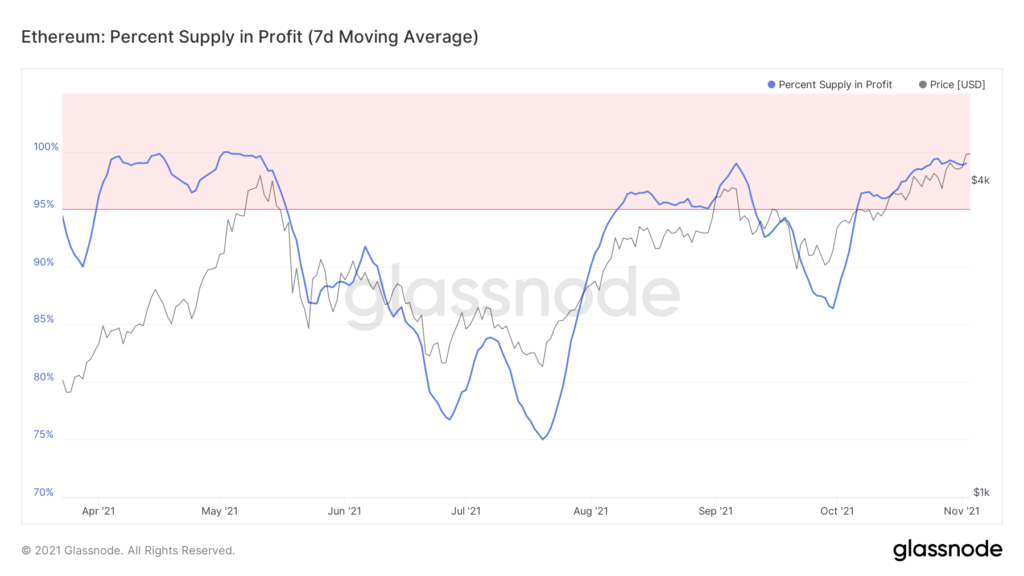

However, a fall below this level would indicate that the rally failed and we would see possible consolidation or lower prices. Secondly, the percent of supply in profit is sitting at the same level of 99.992% which it was in May. Therefore, for the very first time since May, all investors are either in profit or in the money, but no investor is in loss.

However, investors must remain cautious since the market top has already been created thanks to the 99% supply being in profit. Historically, a market top has been a trigger for corrections, which is why there’s a good chance we could see a reversal anytime.

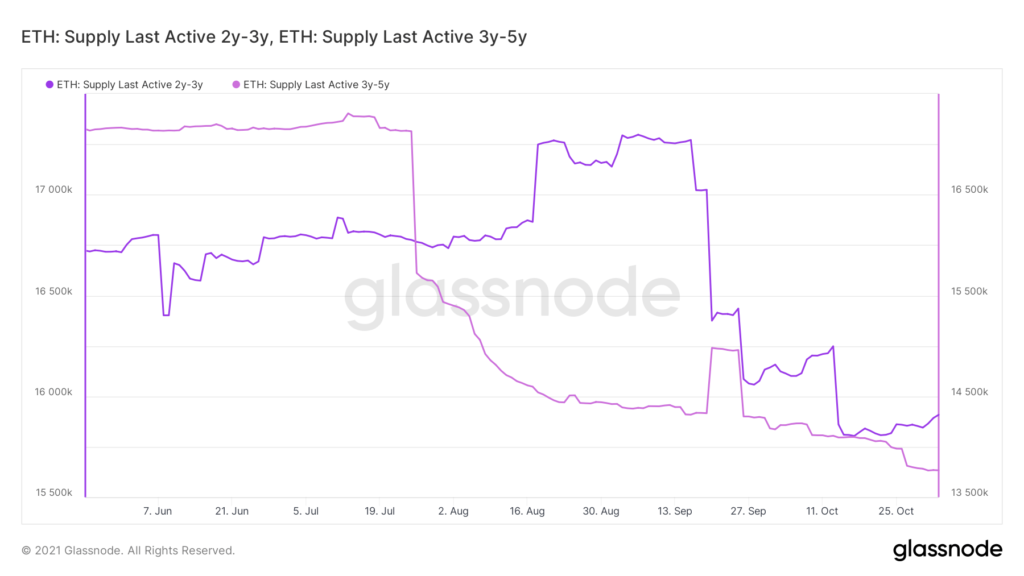

Even though ETH has been sitting in the zone for more than a month now, it has still been rising. However, this cements the possibility of further correction. Additionally, we can already see mid-term holders numbers rising and some younger cohorts of long-term holders are also increasing.

But coins between two and five years have shrunk, indicating that LTHs are moving their holdings either to make profits or to avoid losses.

In any case, LTHs are important in stabilizing price falls. They must maintain their positions for now. Other than that, a fix is in progress, it’s just a matter of “when” at this point.