The Federal Reserve will begin to reverse its unprecedented economic support

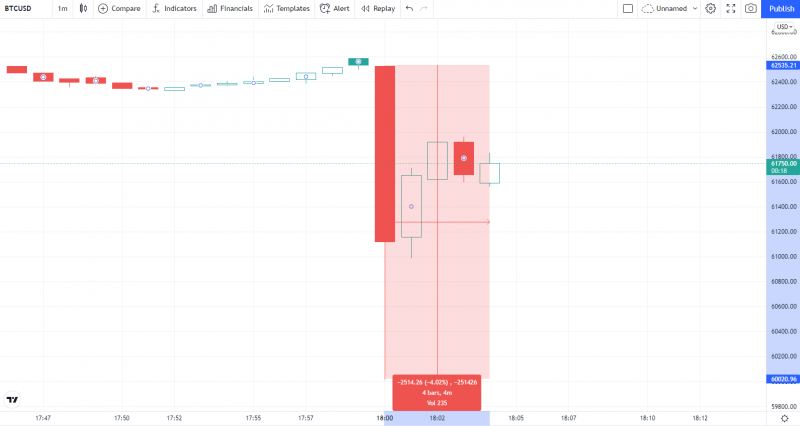

Bitcoin, the flagship cryptocurrency, dropped roughly 4% to an intraday low of $60,018 on the Bitstamp exchange after it was revealed that the U.S. Federal Reserve would start “tapering” in November.

In its most recent post-meeting statement, the Federal Open Market Committee announced that bond purchases will be reduced by $ 15 billion each month.

Interests rates, however, remain unchanged for now, according to a decision made by Fed officials.

The central bank still sees inflation as “transitory” contrary to the expectations of many financial analysts.

As reported by U.Today, billionaire PayPal co-founder Peter Thiel recently opined that high Bitcoin prices were a sign of “real” inflation.

Twitter CEO Jack Dorsey sparked heated debate last month with his controversial “hyperinflation” tweet.

The largest cryptocurrency is yet to fully recover from the plunge. At the time of publication, it is changing hands at around $ 61,800 on major spot exchanges.

Bitcoin has been struggling to regain bullish momentum after hitting its current lifetime peak of $67,276 on Oct. 20.