The two dominant digital assets, Bitcoin and Ethereum, have reached remarkable levels since their inception. As per CoinMarketCap, both of these assets were trading in the green zone. The first was above the $ 62,000 mark with a further increase of 1.5% at the time of going to press. Whereas the latter rose above the $4.5k mark with a 1% increase in the past 24 hours.

That said, what is worth considering is how much room there is for BTC and ETH price shares to develop further.

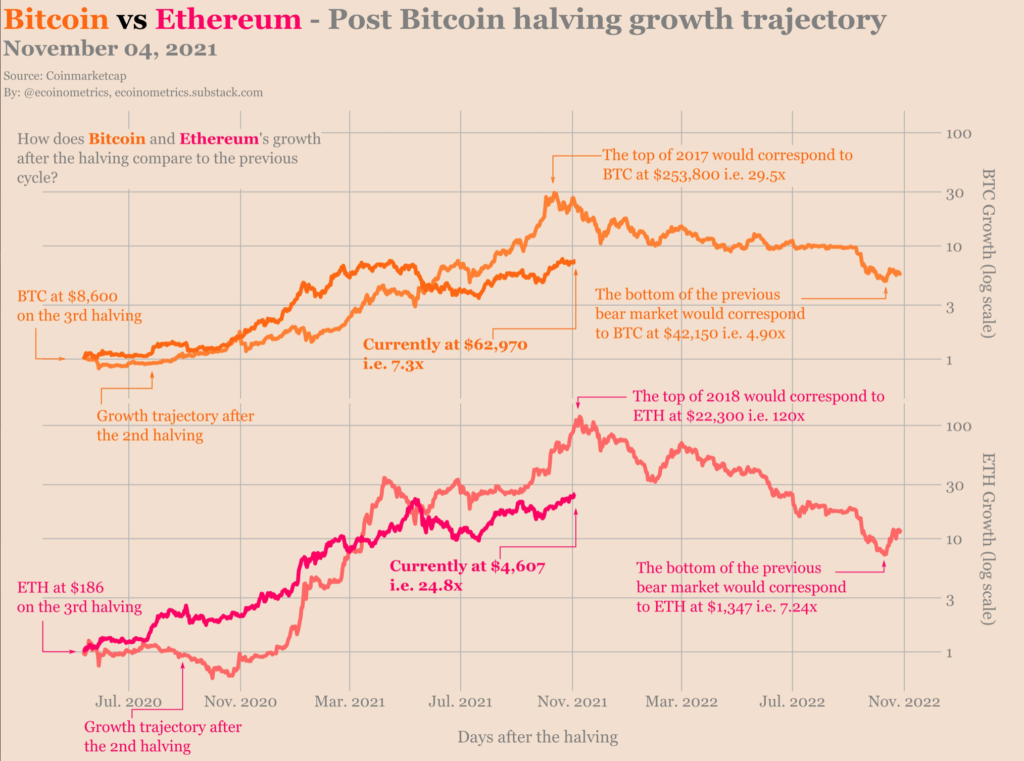

On-chain data source Ecoinometrics tweeted some insights to highlight the aforementioned scenario. According to the story, BTC / USD has the potential to eclipse the estimates simply by following a historical precedent. Consider this table.

Firstly, shedding light on the BTC “historical precedent” aspect, on 11 May, 2020, the Bitcoin blockchain experienced its third block reward halving. Since then, Bitcoin has traded 7.3 times its price share last year. A significant change between the two events, from $ 8,600 then to $ 62,970 respectively, at press time. However, price action will not stop until it is 30 times higher.

As the chart above shows, the current cycle, despite some weak hands, remains closely tied to the previous two (cycles). For better context, aligning with the 2017 cycle, the next BTC price peak could be as much as $253,800, (i.e 29.5x). Since the 3rd halving:

“BTC is up to (up to) 7.3x (capped at 29.5x last cycle)”

Moving on to the largest altcoin. Ethereum witnessed a much larger comparative gain relative to Bitcoin. Following the same point of view, as described above, it could reach 120 times its halved price in 2018.

“ETH is up (to) 24.8x (topped at 120x last cycle).”

This would mean an ETH / USD trade at $ 22,300. However, some price correction is inevitable. Ergo. following its tradition. Bitcoin would need to bottom out at around $42,000 whereas ETH would drop to $1,347.

Nonetheless, even though numbers this high may seem difficult to hit, crypto supporters remain positive regardless of the circumstances. For example, one analyst tweeted,

Moreover, well-known data analyst Willy Woo believes that this Bitcoin halving cycle would be unique in a specific way.

Overall, BTC and ETH still have huge leeway to expand and create more ATHs in the near future.