Here are three reasons why traders may soon run into Ethereum liquidity issues

While Ethereum updates its all-time high day after day, there are numerous things happening in the background that might cause so-called supply shock. Some analysts agree that it is already there and that it affects asset prices.

How supply shock affects the market

A supply shock is an unexpected, rapid decrease in the supply of a product that directly impacts its price. There are two types of supply shock: negative and positive. In Ethereum’s case, the market is faced with a negative supply, resulting in a rapid rise in asset prices. In case of a positive supply shock, the price of a product decreases.

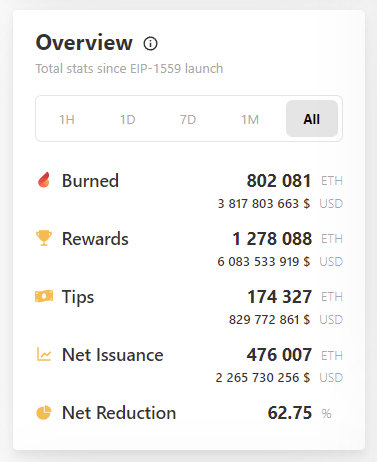

The main reason for the Ethereum supply shock is the implementation of the fee-burning mechanism that has already led to the combustion of over 800,000 ETH coins. With the demand for the coin continuously rising and issuance progressively slowing down, the market faces a supply shock.

Other reasons for the supply shock

While the burning of fees has a direct impact on the available supply, indirect factors are also changing Ethereum’s position in the market. Additional factors include the number of coins in staking contracts, coins locked in DeFi and exchange supply flow.

Currently, over 8.2 million Ethereum is stuck in the DeFi contract, which can be seen as an illiquid supply that cannot be urgently used by the market. At the same time, more than eight million coins are also locked in staking contracts.

Trade flows are not in favor of supply either, with more than 800,000 Ethereum coins that have been moved away from trading since the start of the month.

All factors combined put Ethereum in a tough spot in terms of available liquid supply. There are still a lot of coins available in the market, even for large retail traders. But at the current rate of supply change, markets might face problems with liquidity relatively soon.