Feds rank crypto stability threat between U.S.-China tensions and climate change

In his last Financial Stability Report Released on Monday, the U.S. Federal Reserve ranked cryptocurrencies and stablecoins among its top risks to U.S. financial stability over the next 12-18 months.

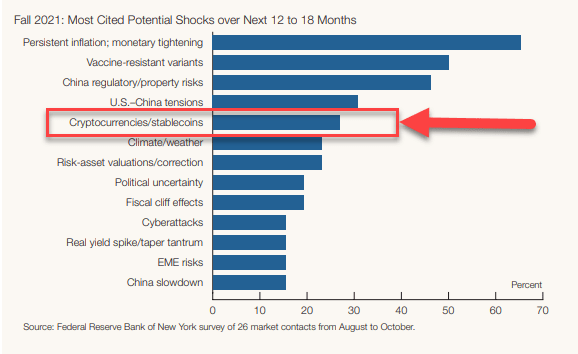

Fed risk matrix ranks cryptos and stablecoins just behind U.S.-China tensions

The Fed report is printed twice a year, once in the spring and again in the fall, and its current edition includes this chart below from Page 67, that rates crypto/stablecoins as the fifth most serious risk to financial stability – tucked between U.S.-China tensions and climate issues.

Why are stablecoins such a threat?

The section of the report regarding stablecoins describes them as digital assets issued and traded on blockchains, which are ‘supposed’ to be pegged to a stable off-chain asset such as gold, fiat currencies or bonds. State. The report also noted that the value of stablecoins has exponentially grown fivefold during the past 12 months to $130 billion as of October 2021.

Here are the main concerns cited in the Fed’s publication:

- The largest stablecoins by market cap promise to be redeemable at any time at a stable U.S. dollar value, but not every token is necessarily guaranteed 1: 1 with a fiat equivalent. Instead, some stablecoins are backed by commercial bonds, which may lose value or become illiquid. If these assets lose value, stablecoin issuers may not be able to meet redemption requests.

- Stablecoins have structural weaknesses similar to certain money market funds, that make them susceptible to liquidation runs by investors who could drain their accounts all at once.

- The report says these shortcomings could be amplified by a lack of transparency and governance standards regarding some of the assets backed by stablecoins.

- Lastly, the potential use of stablecoins in payments and their capacity to grow can also pose risks to payment and financial systems.

Reasons why the Fed publishes this report

The total report is over 80 pages long and covers many other topics beyond cryptos and stablecoins. The Fed says at the beginning of the document that the purpose of the report is to provide its perspective on the resilience of the U.S. financial system, while striving to “…promote public understanding and increase transparency and accountability for the Federal Reserve’s views on this topic.”

Whether the threats specific to stablecoin were real or exaggerated FUD, they were real enough for Fed members to include them in this report. However, it could be argued convincingly that all four bullet points cited as stablecoin vulnerabilities could also apply to most fiat currencies, including the U.S. dollar. This is especially true when viewed in the context of the government’s fiscal and monetary policies in recent years.