The best altcoin, Ethereum, has rallied and reached new highs in the past two days. The broader sentiment for the coin remains bullish. In a sense, greed dominated the minds of market participants. However, it should be noted that the altcoin has gradually started to lose value on its price chart.

Not all roses and sunshine

After losing 1.4% of its value in the past 24-hours, Ethereum was seen trading at $4.72k, at the time of writing. Now this downtrend comes at a critical time. Since Ethereum has successive option expirations over the next three days.

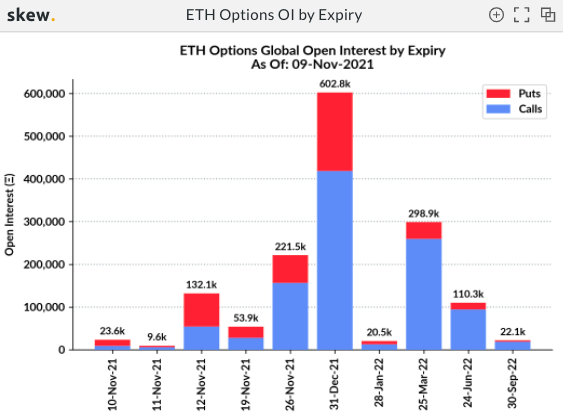

As per data from Skew, over 165.3k ETH are set to expire in three batches this week, starting today – 10 November.

Well, Skew’s OI chart by strike price instinctively suggested that the number of call contracts dominated the proceedings. Nevertheless, a closer look at the same would reveal that puts largely have an upper hand in the strike-price band around $4.5k.

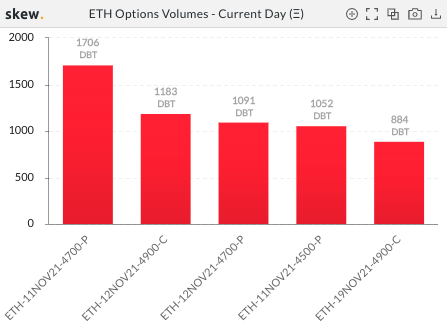

In fact, in terms of current volumes, over 3,849 DBT sales contracts, expiring November 11 and 12, were purchased at strike prices of $ 4,500 and $ 4,700 compared to just 1,183 contracts from DBT purchase, Nov. 12 at the strike price of $ 4,900.

In fact, as far as the current day volumes are concerned, over 3849 DBT put contracts, expiring on 11 and 12 November, have been bought at the $4500 and $4700 strike prices when compared to the mere 1183 DBT, 12 November call contracts at the strike price of $4900.

Overall, the aforementioned data paints a bearish picture and underscores that a majority of options traders oppose the price rise narrative at this point. So, if Ethereum tumbles below its current price, it might end up consolidating for some time before proceeding with its rally again.

Establish the odds of a dive

Since Ethereum is in its price discovery phase, there aren’t many strong resistance or support levels. As can be seen from the chart attached below, during the uptrend phase that began on 6 November, levels that once resisted the alt from inching further had ended up flipping into support levels. Correspondingly, since the downtrend phase that started on November 9, the reverse reversal has occurred.

At press time, however, the downtrend on the 4-hour chart looked decisive. Nevertheless, there were three levels around Ethereum’s trading price. And, $ 4.5,000 touted as reliable support levels.

On the other hand, the space up north was filled with obstacles and Ethereum will have to overcome them in order to break above the psychological level of $5k.

Rays of hope

Ethereum’s metrics, on the other hand, paint a pretty bullish picture. The velocity reading, for instance, has been more towards the quieter side of late, providing a sigh of relief. As in previous ones, an uptrend on Ethereum’s price charts has most often been accompanied by constant speed. However, turbulent landscapes paved the way for corrections.

Thus, the current state of this metric has managed to stir in slight optimism amidst the ongoing downtrend on the price chart.

Alt volatility was hovering around the 40% mark at the time of writing. This essentially ensures that the price of Ethereum would not subject to any dramatic increases or decreases. The price movement in either direction would be gradual and steady. Thus, Ethereum could remain in its current range of $ 4.7,000 for the next few trading sessions.

If that’s indeed the case, the options expiry wouldn’t necessarily set in a selling spree.

Therefore, ETH would likely be able to hit the $ 5,000 trading target within a week. However, a failure to hold above the current level would trigger put holders in a position to exercise their option of selling their respective ETH. This, in turn, would make the narrative of falling prices more dynamic.