Ethereum has settled comfortably above the $ 4,500 mark, while Bitcoin continues to trade north of $ 65,000. Now, even though the top two assets have more or less similar quarterly ROIs, BTC charted 49% three-monthly ROI v. USD while ETH reaped 55% ROI over the same timeframe.

Here, it cannot be denied that Bitcoin has largely been the driving force behind the crypto market’s gains.

BTC v. ETH

The ‘Ethereum flipping Bitcoin’ narrative has been around for quite some time now. However, the direct northward movement of ETH since October 1 has further fueled the narrative that Ethereum could decouple from Bitcoin and also reverse the main asset.

Nonetheless, the fact remains that “Bitcoin is digital gold” is a much clearer and well-established narrative than “Ether is oil for Dapps.”

That being said, Bitcoin’s market dominance and first-mover advantage have always fueled rallies triggered by higher BTC prices, followed by Ethereum, and then other altcoins.

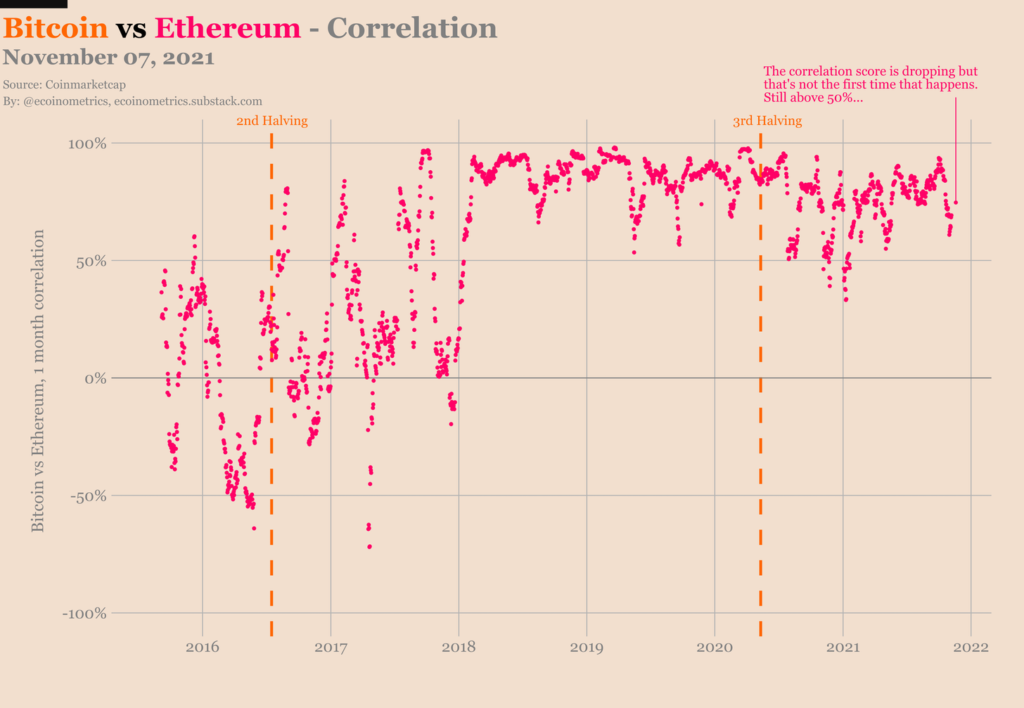

In fact, most cryptos, especially Etherum, still have a high correlation with BTC.

Notably, while the BTC vs. ETH correlation score appeared to be dropping, it still stood above 50%.

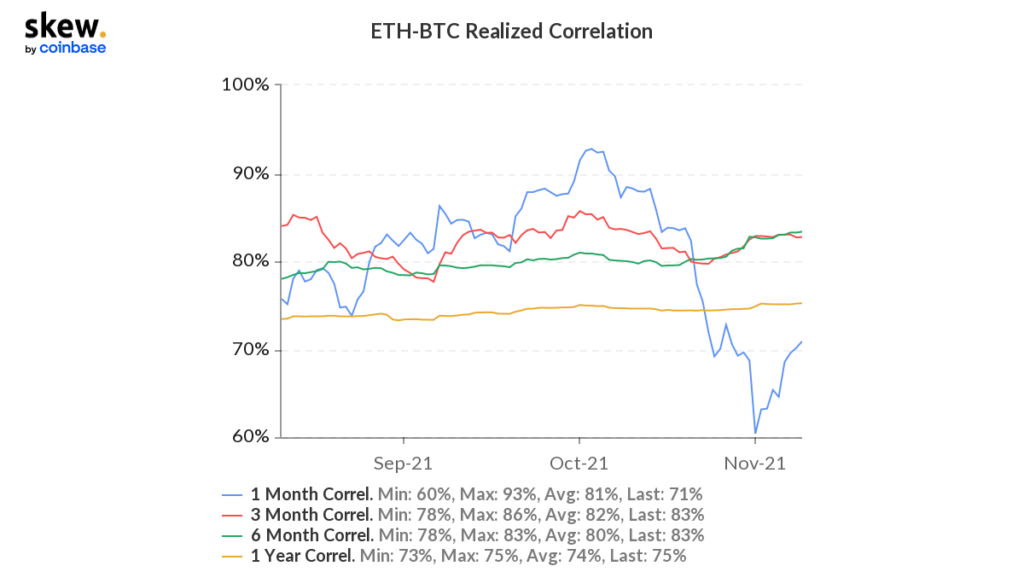

Now, towards the beginning of November, the ETH-BTC one-month realized correlation went down to as low as 60%. However, he quickly picked up. At the same time, while the one-month correlation is still quite low in relative terms, it has high values, having climbed to 93% over the past month.

Decoupling might have to wait?

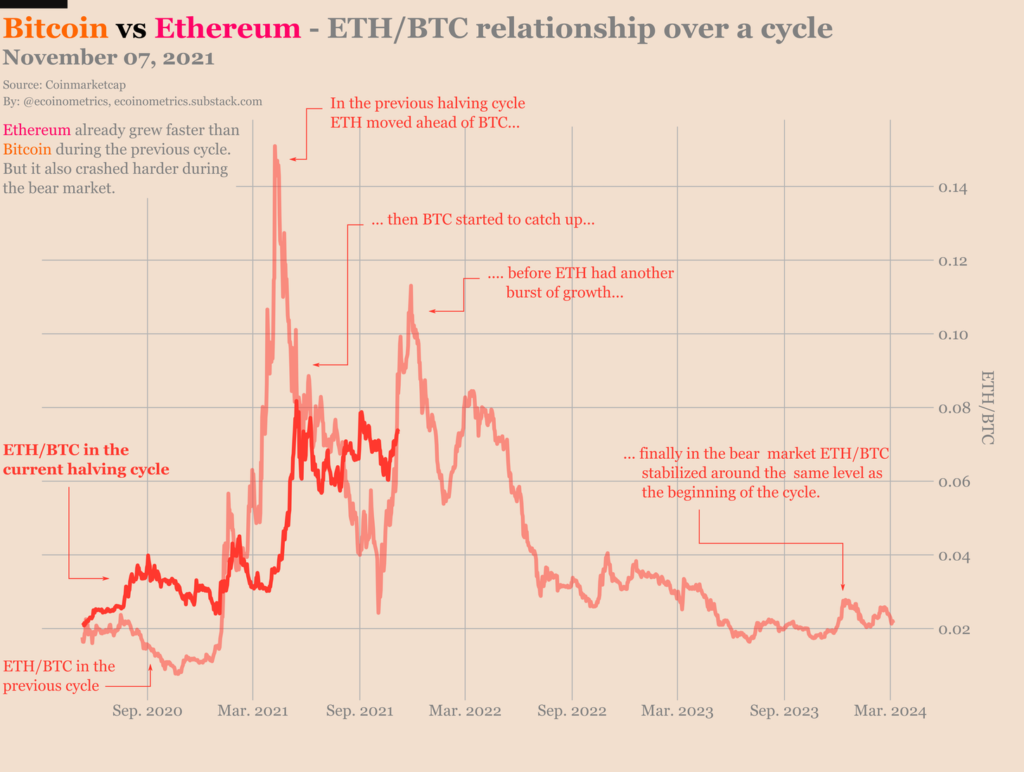

Looking at the price action of the top two assets, in terms of recovery, ETH has performed better than BTC. Bitcoin is up by 7.2x this cycle, which is still much below the peak of 29.5x in the previous cycle. Even so, the same was much higher than the previous bear market’s lower multiplier at 4.9x.

On the contrary, Ethereum is up by 24.3x, also below its peak of 120x in the previous cycle, but above the bottom multiplier of 7.2x in the previous bear market.

This, however, puts Ethereum ahead of Bitcoin in terms of recovery.

While BTC is digital gold, can the narrative of ‘Ethereum: Powering the Metaverse’ change the game for ETH? Well, seems like the network might not be ready for the same.

As a recent Ecoinometrics report points out, the current state of Ethereum’s network “is not ready to power any kind of large-scale metaverse.” Why? Well, mostly because very few people are going to use NFTs for gaming purposes if interacting with them costs $100 to $200 in gas on average.

This means that Ethereum will need mature L2 ecosystems to operate at scale, which will not happen in the near future.

That being said, looking at their relative price, ETH/BTC is still 50% below the all-time high it set in 2017.

Notably, while ETH recovered and recovered better than BTC, it also fell harder during the bearish cycle. Additionally, BTC gains have been key to triggering market-wide rallies and even Ethereum recovery.

So it seems like decoupling Ethereum from BTC still looks like a distant dream. However, the two main assets could have a more parallel trajectory.