Ethereum loses support for fundamental trend after falling more than $ 250 overnight, but institutions are still in

Following the global cryptocurrency market correction, Ethereum drops below the trendline that has been forming since the end of October while institutional inflows rise in the previous week, with assets under management hitting a new record of $21 billion.

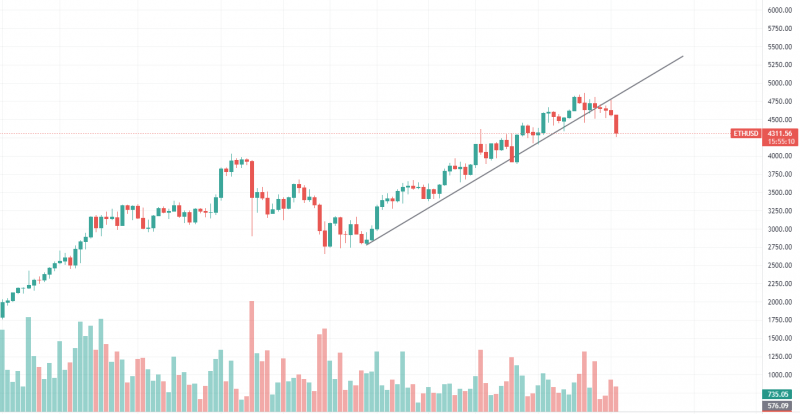

50 day trend line

Ethereum’s run that began in October lasted 46 days, ending after the massive sell-off in the global cryptocurrency market that started with Bitcoin falling 4.3% in the past 24 hours.

The trendline was formed after Oct. 23 and has been tested multiple times during this run. The most recent test took place on November 10 right after Ethereum hit the new ATH.

Ethereum has immediately followed the largest cryptocurrency and lost almost 6% of its value, which returns it to the beginning of November when it was trading around $4,300. Ethereum’s previous ATH was hit on Nov. 19 and reached $4,867.

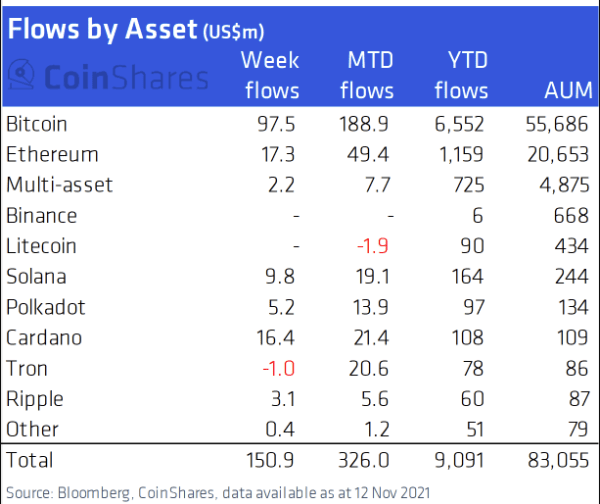

Institutional flows of the previous week

Although last week was not the most successful week for the cryptocurrency market, institutions were still interested in the Bitcoin and altcoin markets by investing a total of $ 150 million. Ethereum’s share the week before was $ 17.3 million.

The total volume of Ethereum assets under management has exceeded $21 billion in total, which is a record for the second-largest cryptocurrency on the market.

At the time of going to press, Ethereum is trading at $ 4,313 with a negative market performance of 5.5%.