There is usually something going on in the Ethereum ecosystem. Whether it is a new NFT collection or the exorbitant gasoline costs, there are still eyes on the second largest crypto by market cap. In the frenzy of activity, however, it’s easy to miss out on Ethereum’s layer 2 solutions – The smart contract rollup chains.

Rolling into the future

Rollups are a Layer 2 solution to reduce congestion on the Ethereum mainnet by handling transactions externally. A recent report by Arcane Research analyzed how much of a difference this has made to the blockchain’s ecosystem.

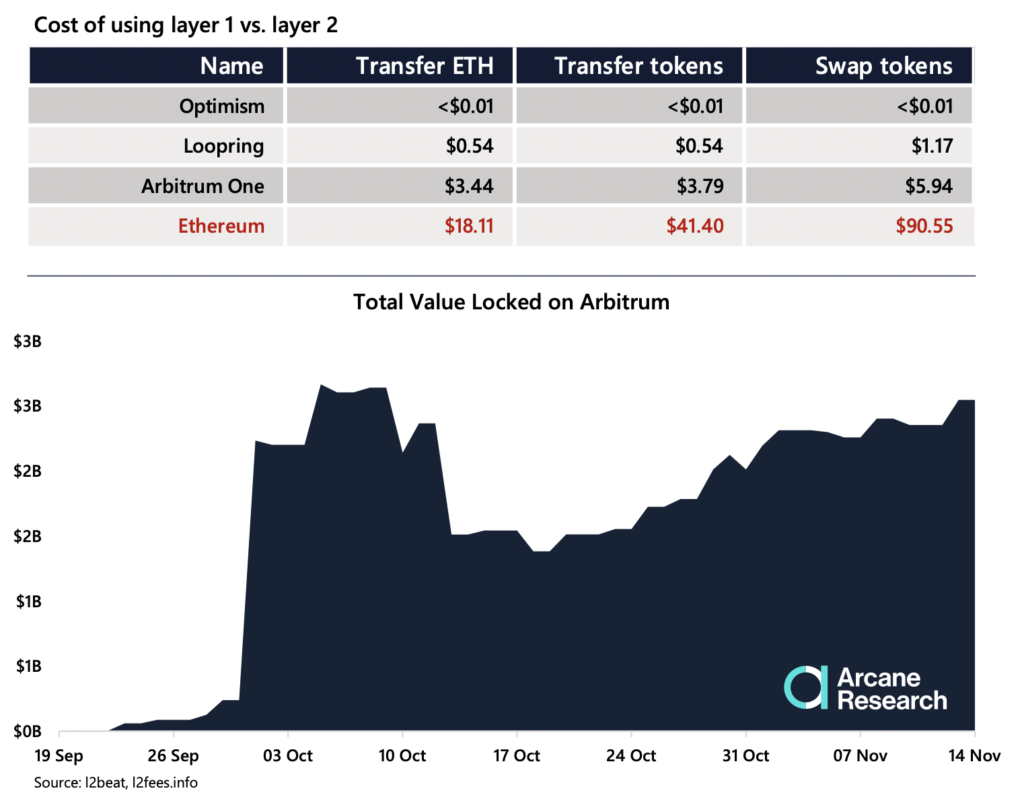

The report found that stacks like Arbitrum One and Optimism reduced fees by 90% or more. For example, if transferring ETH costs $18.11 and swapping tokens costs $90.55, Optimism cost less than $0.01 for both these activities.

And yet the trade-off is speed. The observed report,

“However, both StarkNet and zKsync plan on launching EVM-compatible zK- rollups soon. Compared to optimistic rollups where native withdrawals of any asset take more than a week, zK rollups reach Ethereum’s finality in about 10 minutes.

At the Wanxiang Blockchain Summit, Vitalik Buterin spoke about how participants could deposit and withdraw money from the launched rollup networks. In addition, he claimed that a stack would allow 10x expansion.

Not quite rock and roll

Despite these stats, a closer look at Arbitrum is a must. The layer 2 solution’s total value locked [TVL] shot past $2 billion, but this isn’t the only indicator that matters. As previously stated, Arbitrum was unable to maintain its growth momentum. While it saw growth rates of 192,578% in September, this was 134% in October and in the single-digit range during the first week of November.

Simply put, the challenge of scaling Ethereum is not yet resolutely resolved.

Arcane Research’s report added,

“Many rollup projects are still in their early stage, and do not yet have a token.”

In the loop

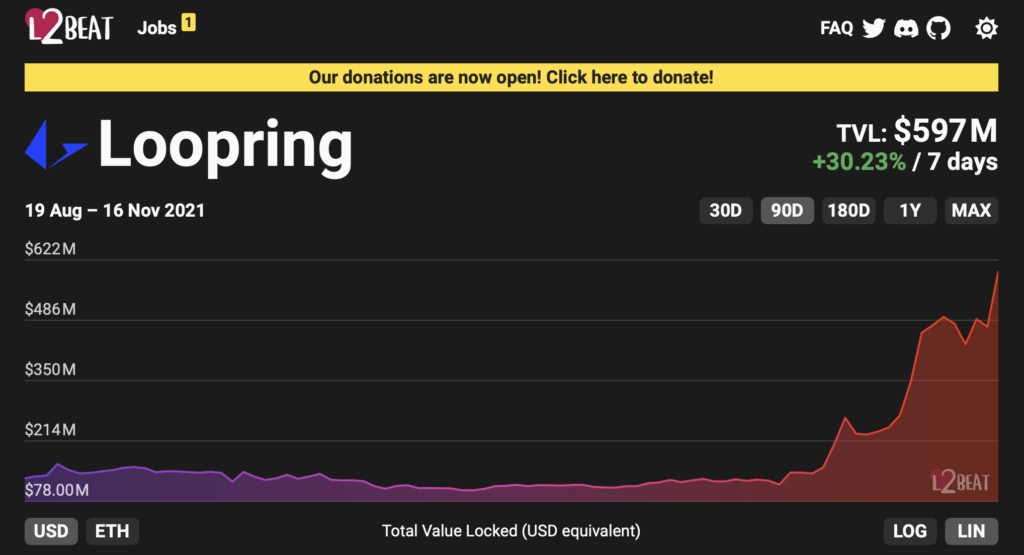

Loopring has been in the headlines in recent days. A major reason for this was the rumor that the protocol could be teaming up with GameStop for an NFT marketplace.

On its own, however, Loopring, which uses zk-rollups, has seen an increase in TVL and is approaching the $ 600 million mark.

Just a week ago, the protocol’s TVL hit an ATH of $459 million.