Bitcoin and Ethereum are never compared when functionality is taken into consideration. The sole difference comes down to Ethereum’s smart contracts feature. However, all other projects that have smart contracts, at one point or another, have been considered an Ethereum killer.

The trend began back in 2018 during the ICO boom when EOS was considered competition to Ethereum’s smart contracts proficiency. Now, there is a reasonable chance that a minority of readers will not be familiar with EOS at all. And, that says a lot.

2021 has been different though. The DeFi ecosystem classified protocols in a different light and the importance of smart contracts has been realized further. The term ‘Ethereum killer’ has received more attention than usual, but might it no longer be relevant in the future?

Ethereum and its killers – To co-exist happily ever after?

Over the years, the term has risen from the prospect that new protocols would eventually take over Ethereum‘s market share. In 2021, the adoption of new Layer 1 solutions was exceptional with Solana and Avalanche. But here’s the crux: their ecosystem thrives on an individual level.

These protocols have established parallel applications and deployment on all chains, which is evident on ETH’s blockchain as well. Now one way to measure DeFi demand is basically through TVL or Total Value Locked. Ethereum boasted a $21 billion TVL in January, with the same at around $86 billion now. However, its market share across the ecosystem increased from 97% to 73.2% when Polygon and BSC entered the fray.

However, does it change things in the long term? Possibly not.

Increases and decreases in TVL don’t take much into account in the long run because it is a variable metric. In the short term, it may signify activity for new projects, but Ethereum has an established and thriving Network Effect.

Coexistence doesn’t mean survival now

When it comes to Ethereum, it will always have the edge in terms of market credibility during a bear market. It has survived such market cycles in the past, unlike these protocols that have emerged only in the last few months.

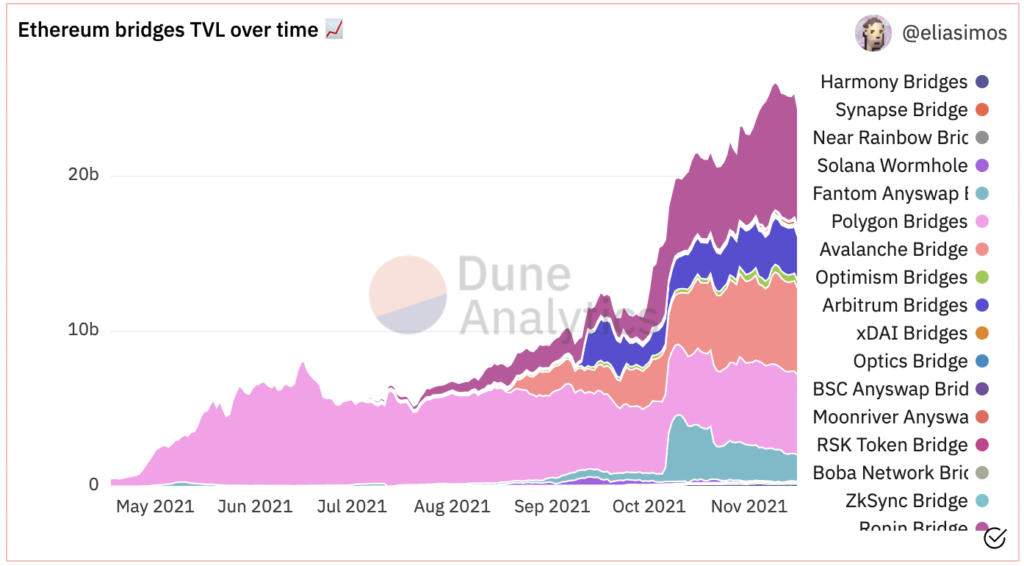

On the other hand, Ethereum bridges TVL has continued to grow in recent months. What this indicates is that its TVL share cannot be estimated based on only parent chain lockout. Over time, some of the contenders, rather than the killers, could be knocked out due to incentive programs drying up the charts or non-innovative protocols becoming less relevant.

Another recipe for disaster would be centralization shortcomings and regulations and hardware costs getting accelerated. Therefore, in the long run, Ethereum will never be “killed”. Even so, it is essential for small protocols to function in order to onboard users that continue to be priced out of Ethereum’s base layer of activity.