There is huge anticipation around Ethereum’s price action. On November 10, altcoin hit a new all-time high of $ 4,878 on the charts. Alas, a correction followed thereafter. And, it gave investors a subtle hint of what to expect from future price actions.

Ethereum mimics Bitcoin

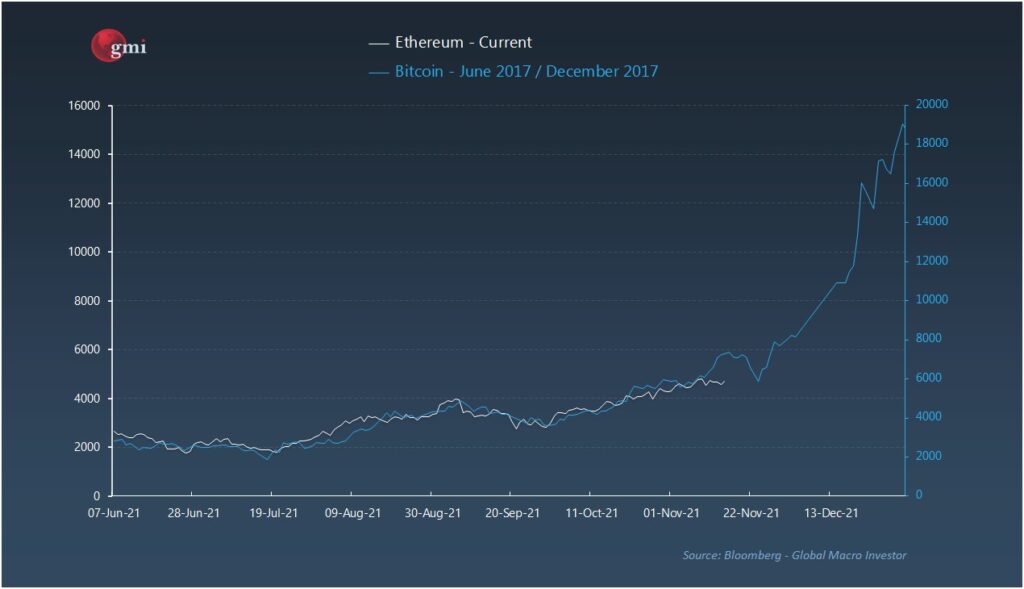

Yesterday, investment strategist Raoul Pal shared a chart that highlighted how closely Ethereum’s current price movement closely mimics Bitcoin’s price action in 2017.

Consider this – Bitcoin recorded a major rally in December 2017, one that took the King’s Coin from $ 6,000 to $ 19,000 in a month and a half. This period of appreciation saw the crypto hike by 236% on the charts.

Well, Ethereum isn’t at $ 6,000 right now. Even so, since it apparently mimics the movement of BTC, we can check back and forth to see what kind of expectations to expect from ETH.

The first way is to see what a 236% rally would look like for ETH. Second – What kind of hike is needed for ETH to touch $19k?

If the altcoin increases 236% from now on, it will end at $ 11.2,000. Those who expect ETH to go to $19k would need a 343% rally from the crypto on the charts.

Will it happen?

Well, let’s not forget that Bitcoin is one of a kind. Ethereum, on the other hand, is not the next Bitcoin. In fact, ETH’s rise hasn’t been strong enough to support a 343% rally in any way. Even a 236% rally looks doubtful at the moment.

During the strongest rally period from August to November, Ethereum only rose 174% in three months (ref. Ethereum price action image). So, it would make sense if it didn’t reach either case in just one month.

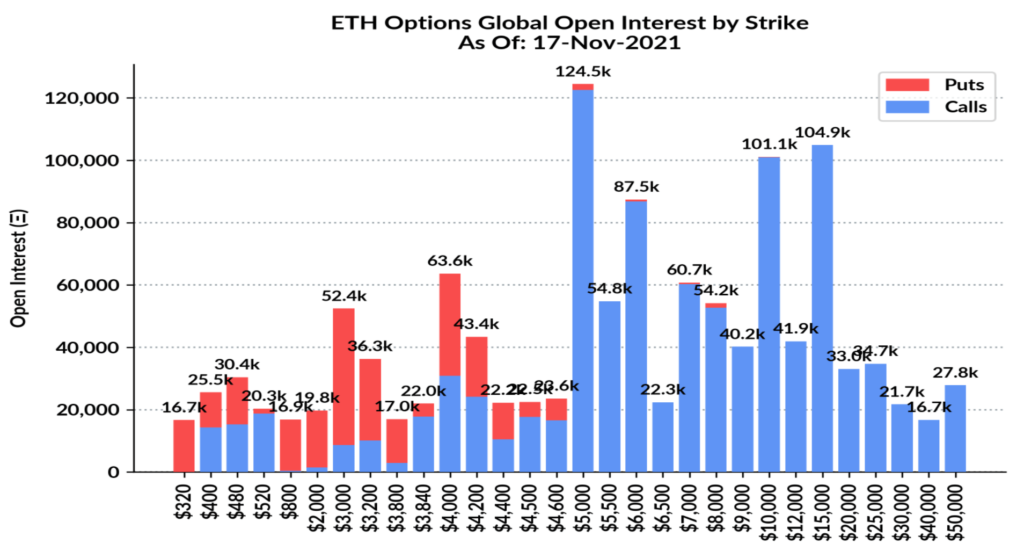

But, if it really were to go berserk, hypothetically, at best we can see $11k becoming a reality since that price level holds the highest demand from investors. Currently, nearly 142,000 contracts claim it.

Interestingly, the next big expiry is scheduled for December. If all the pieces fall together, maybe ETH could hit $11k by then.

Of course, participation plays an important role as an increasing number of investors is the key to any rally. Back in 2017, at the end of September, Bitcoin had approximately 646k active addresses on the network. This went up to 1.15 million by the beginning of 2018.

ETH, by the end of September, had about 450,000 addresses. Despite having more addresses than Bitcoin though, it still has lower active addresses. That will have to change if Ethereum plans to hit $ 11,000 by the end of 2021.