The entire cryptocurrency market has witnessed a massive setback. In total, it has lost over 2.5% of its market capitalization, which currently stands at $ 2.52 million. Yet, institutional investors seem unfazed by the bloodbath.

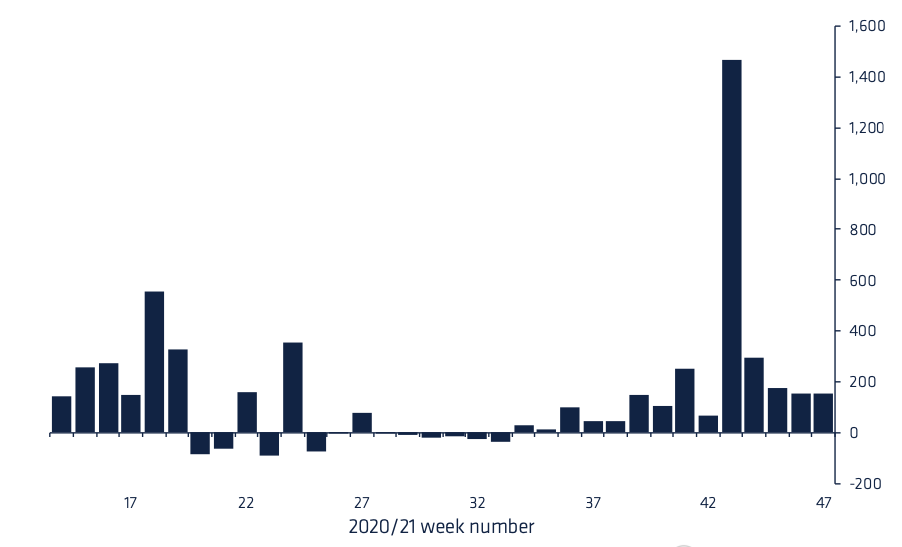

The last published report by CoinShares gives some support to this narrative. As of November 22, the weekly digital asset fund flow report stated:

“Digital asset investment products saw inflows totaling US$154m last week, with the most recent price correction, where Bitcoin prices fell by 12% over the week, seemingly not impacting the positive investor sentiment.”

As mentioned above, there has been a decent increase in entries over the previous report. At the time of going to press, the weekly crypto asset looked like this:

The largest altcoin witnessed inflows amounting to over a $100 million, whereas Bitcoin,

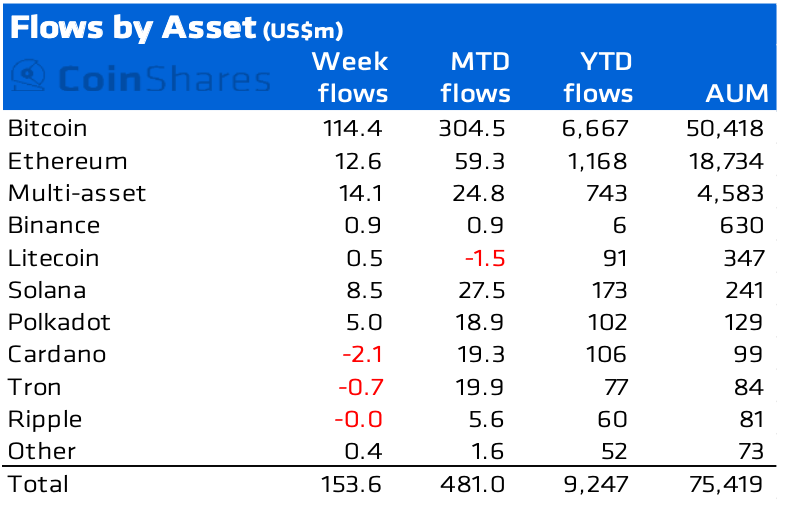

“…continues to see the majority of inflows, totaling $ 114 million last week. This allowed it to maintain a 67% share of assets under management (AuM) over the past month among investment products.“

The table below showcases a similar scenario.

Now here’s an interesting part. Institutional demand had exploded, it is undeniable. But what about the price? At press time, BTC was trading deep inside the red-zone. It saw a 3% setback in 24 hours as it dived below the $57k mark. As mentioned in the report,

“This disparity may be due to recently launched ETFs in the United States, where investment products recorded 90% of inflows.”

Nevertheless, this still marked a significant rise for BTC as compared to the previous findings, that is, more than a 17.5% surge.

Now let’s move on to altcoins. Ethereum, the largest altcoin, “registered entries totaling US $ 14 million last week, marking its fourth consecutive week of entries totaling US $ 80 million.” As covered before, Ethereum products saw inflows of $17 million, with AUM over $21 billion. Clearly, the difference was noteworthy.

Solana is going strong

On top of that, there was another interesting turn of events. Unlike last time, Solana stole the crown from her great rival, Cardano.

“Inflows into world computer assets suggest that investors favor Solana. By measure of total inflows over the last month, Solana has seen inflows totaling US$43m over the last month versus Cardano at US$23m.”

SOL, the 5th biggest token, continued its momentum, compared to other important tokens as well. Cardano’s native token ADA, was right below SOL, which, “for the first time in many months saw minor outflows.” ADA’s outflow amounted to $2.1m, as per the report.