All activity in the options market generally has a direct impact on the price of the underlying asset. Major events like option expiries are usually awaited, as they end up giving the price a definitive direction.

Ethereum, at this point, is at an undecided turning point. Its price has been consolidating in and around the $ 4.2,000 to $ 4.3,000 range for over seven days now. Notably, the price upticks in the aforementioned period have largely been under 3%.

So, the question is, will the Ethereum market continue its monotonous state during the last week of November, or will the market see some lively action in the next few days?

The upcoming expiries

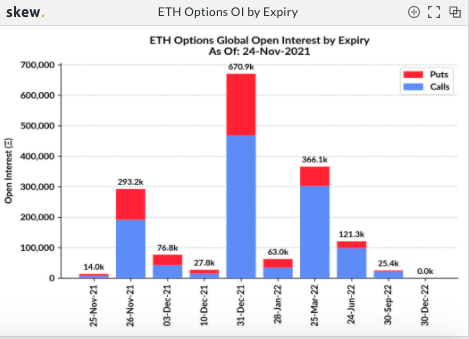

At the time of writing, from the derivatives point of view, over 307 ETH are set to expire in two batches over the next few hours. The first batch, expiring on November 25, is minor and concerns only 14,000 ETH.

However, the expiry of 26 November is the biggest that the Ethereum market would face before the 31st December one. Well, over 293.2k ETH are set to perish on 25 November.

Now, as Skew’s chart attached below shows, the number of calls currently dominates the number of put options by a large margin. This suggests that a majority of traders are confident about Ethereum’s future prospects.

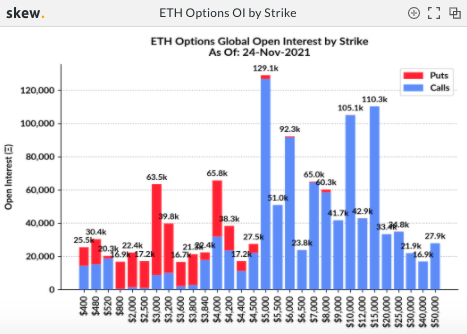

A review of the breakdown below further indicates that appeals or purchase contracts dominate proceedings in the price brackets above $ 4,000. Puts or sell contracts, on the other hand, have a say in the lower price regions.

Since the price of Ethereum has been relatively in the upper range lately, one can expect a buying spree. More so, because call owners would be triggered to exercise their option of buying their respective ETH tokens. The same would help further increase the price of the asset, and more people would eventually enter the market following the progress of ETH.

However, for the aforementioned chain-reaction to materialize, Ethereum would have to sustain its price level for at least the next 36-hours.

Other key factors

The volatility of the Ethereum market has been fairly controlled lately. As per Messari’s data, the same has been revolving below one throughout November. Now it is a known fact that a less volatile environment generally prohibits significant price variation.

Thus at this stage, it can be said that Ethereum would likely continue to revolve in the current price bracket over the next few hours.

The higher alt speed landscape was calm and composed of lag, which is a pretty good sign. Interestingly, an uptrend is usually accompanied by steady velocity while a turbulent landscape opens up the door for corrections.

Well, things were looking good on the Ethereum price chart. The weekends were less dramatic than the weekdays in November. Further, as can be seen from the chart attached below the uptrend seemed to be definitive. At the time of writing, the price of Ethereum is floating just below critical resistance.

If it manages to break above soon and give a confirmation, then, nothing much would stop its journey to $4.5k and beyond. Even though Ethereum is rejected at this level, it has two support levels that would most likely prevent it from dropping below $ 4000.

By and large, Ethereum’s near-term prospects, at this stage, fairly look good.