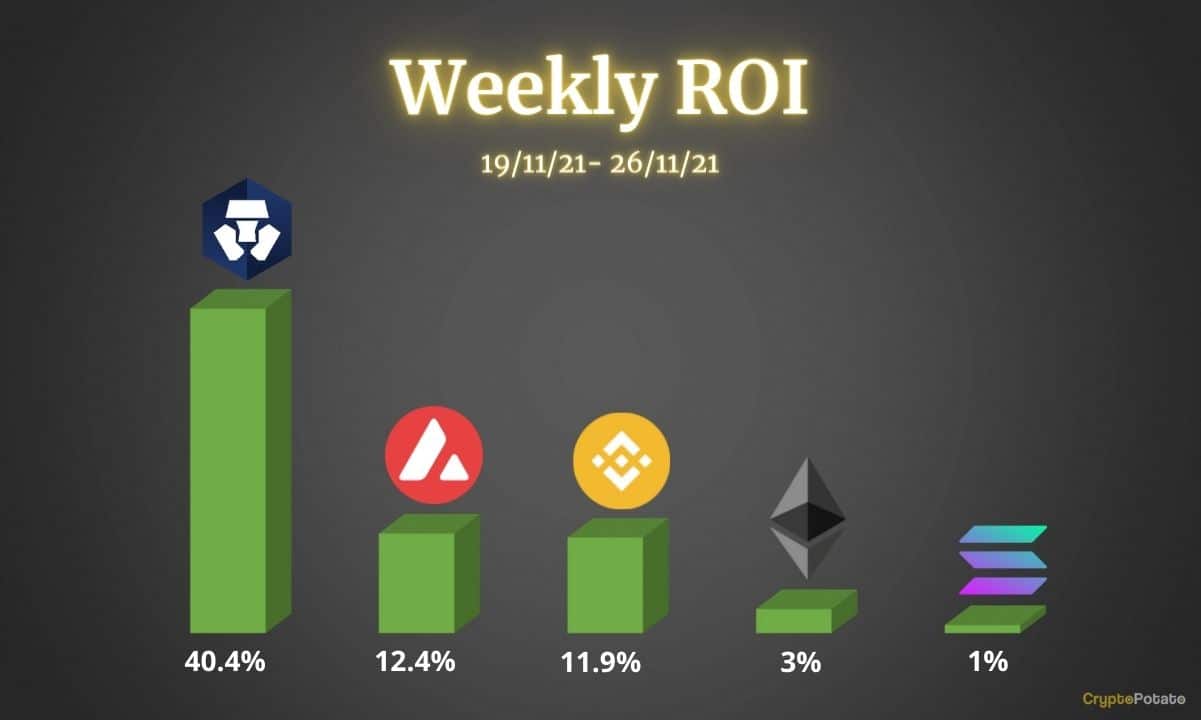

This week, the market correction continued, with most cryptocurrencies taking significant losses, especially today when Bitcoin fell 10% in 12 hours and altcoins registered double-digit losses. In what follows, we take a look at Ethereum, Binance Coin, Solana, Avalanche, and CryptoCom’s CRO.

Ethereum (ETH)

Ethereum has had a great rally in recent days and has given hope for a major breakthrough. However, today’s price action has re-set ETH back to $4,000 ending the past seven days in green at only 3%.

The $ 4000 level is also a key support, and it would be surprising to see ETH fall below. Bulls are likely to defend it well and may not allow ETH to drop further outside of a wick.

Resistance is at $ 4,500, and the bulls may take some time to pull the price down as today’s crash was significant above 10%. Looking ahead, ETH seems likely to consolidate around the key support level before bulls gather strength for another push higher. Until then, watch out for bears as they may attempt to break the $ 4,000 support again.

Binance Coin (BNB)

Binance Coin broke above $600 yesterday and was giving a strong bullish signal. But the positivity was short-lived as bears took control of the price today and dragged it below this key psychological level. Still, BNB remains about 12% up on the weekly, despite today’s bloodbath.

BNB has strong support, just above $ 500, and despite the current decline, it has hit a higher low. It is very important to see how BNB closes today’s candle because if the higher low is maintained, then this correction might have been one more dip before higher prices are reached.

Looking ahead, BNB indicators are trying to move up on the daily period, and today’s correction has delayed a possible bullish cross. The bias remains somewhat bullish for BNB as long as it holds above the key support at $516.

Solana (SOL)

Solana had a strong rally last week but was rejected by resistance at $ 236. Due to today’s market dropdown, SOL was pushed back on the key support level at $190.

SOL was already giving a bearish signal due to the indicators, with a daily MACD that ended a bearish cross on November 11th. Whenever this happens, it is always best to be cautious and not FOMO in. SOL has continued to make lower highs and lower lows. Today’s daily candle dipped to $ 182, which is the lowest level since late October.

Looking ahead, Solana appears to be in a longer correction that might take longer to play out, and today’s price action only reinforces this bias. While the support at $ 190 held firm today, that does not guarantee that it can contain another attempt to break it. Indicators such as MACD and RSI remain bearish, and you better stay cautious.

Avalanche (AVAX)

Avalanche surprised everyone this past week with a significant rally that topped at a new all-time high at $147. However, since then AVAX has corrected and today’s candle has brought the price down to $ 100.

Moreover, AVAX, much like Solana, also completed a bearish cross on the daily MACD today. If the day ends like this, this is a major warning signal that lower price levels could be reached in the future. In the best-case scenario, AVAX’s price should contain the correction just above $100. Then bulls can then recover from this assault and attempt a recovery.

In general, it is important to remain very cautious as the market is currently in a state of instability, and a lot of volatility could come into play. Vigilance is therefore of the utmost importance.

CryptoCom (CRO)

CryptoCom Coin had a fantastic rally in October and the first half of November. Now the price appears to have finally hit major resistance, which unsurprisingly sits at just under $ 1. Such key psychological levels will always represent turning points in price action, and the CRO is no different. Despite the ongoing correction, CRO’s performance this week was stellar, with a 40% price increase.

Current support lies at $ 0.63. However, given the rally past, the CRO might not only correct the Fibonacci retracement to 38%, it might go down even further.

Looking ahead, CRO’s indicators on the daily timeframe have curved back down after the major rally in the past couple of weeks. This is a clear warning sign, and if the CRO goes below $ 0.63 support, then things could get even uglier.