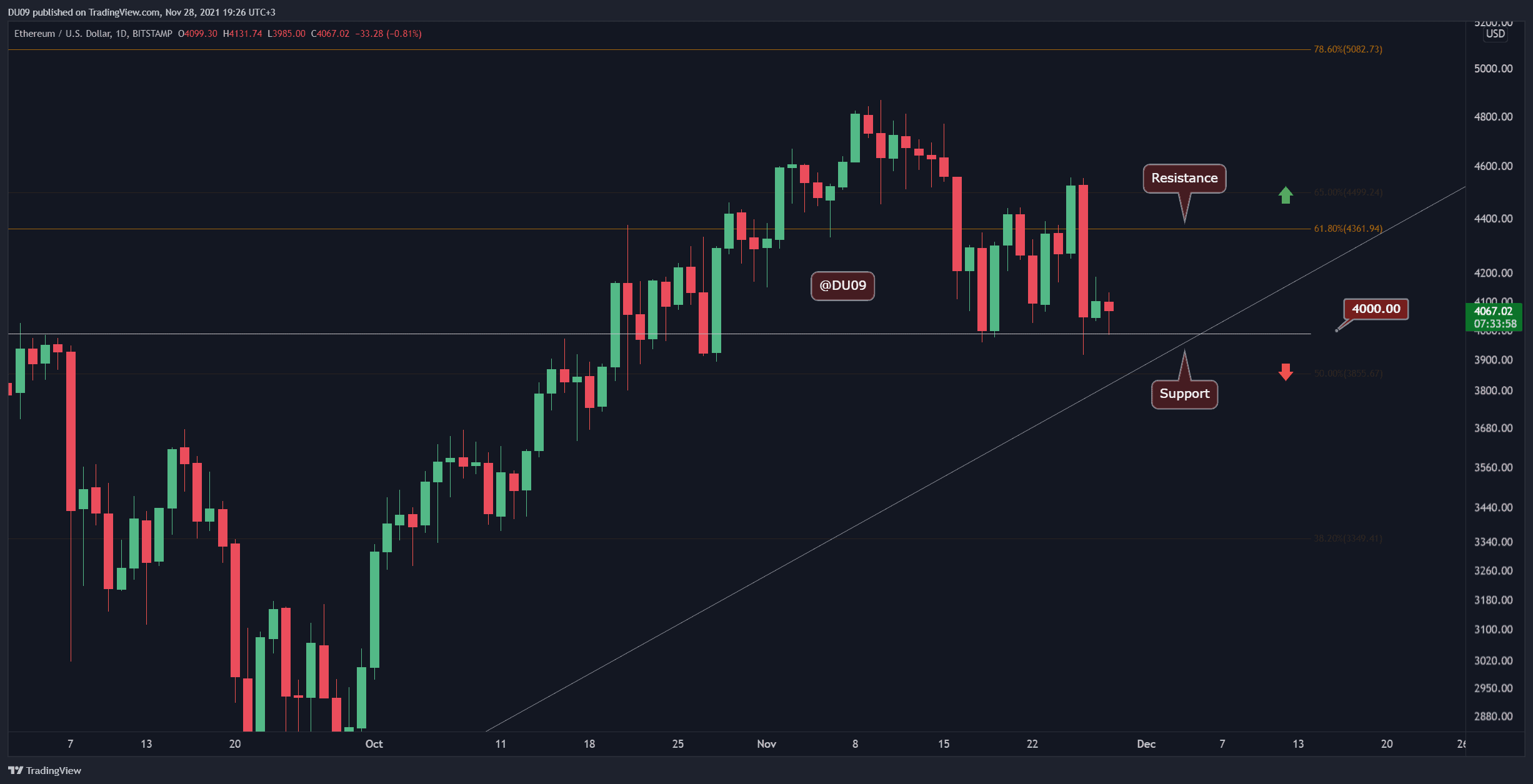

Key assistance levels: $ 4,000

Key Resistance levels: $4,350, $4868 (ATH)

ETH failed to chart any significant gains throughout the week as the bears intercepted all rally attempts and managed to pull the price back towards the $ 4,000 support on a few occasions.

This price action shows that bulls don’t appear ready to push above the $4,350 resistance, and bears are seemingly in control of the momentum, at least for the short term. Until $4,350 is flipped into support, bulls need to be very careful of potential downward movements.

Technical indicators

Trade volume: The volume is decreasing, possibly in anticipation of a major breakout. Previous attempts to break the key resistance level were at low volume, which is why the bears were also successful in rejecting such attempts.

RSI: The daily RSI is making higher lows. This is somewhat bullish, but it is too early to get excited since the price can go either way.

MACD: The MACD is bearish on the daily period, and the histogram and moving averages continue to decline. There is no reversal potential in sight yet. On lower timeframes, the MACD is flat, suggesting a period of consolidation before the next big move.

Bias

The bias for ETH is neutral. So long as the price stays above $4,000, the bulls have a good chance to regain control. If they lose this key level, then they will be at a big disadvantage.

Short-term price prediction for ETH

Ethereum consolidation may continue, which will keep the price around $ 4000. The low volume, flat trend, and inability to move price past the key resistance level show that the bulls do not yet have the strength to push ETH higher. The coming weekdays can lead to increased volatility, and it is important to remain cautious.