Ethereum didn’t have a good time in November. Down more than 9% at one point, assets continued to decline over the month.

However, the overall view might not be as bad as it seems on the surface. In fact, Ethereum has registered a 0.5% ROI for the month, which means investors would not have lost much even if they had invested towards the beginning of November.

Now, in this article, we will highlight a few factors that might suggest that patience is paying off for ETH investors in the last month of 2021. At the time of publication, Ethereum’s market cap had recovered above $ 500 billion, having appreciated 7% on the charts. .

Structural survival and setting foundation

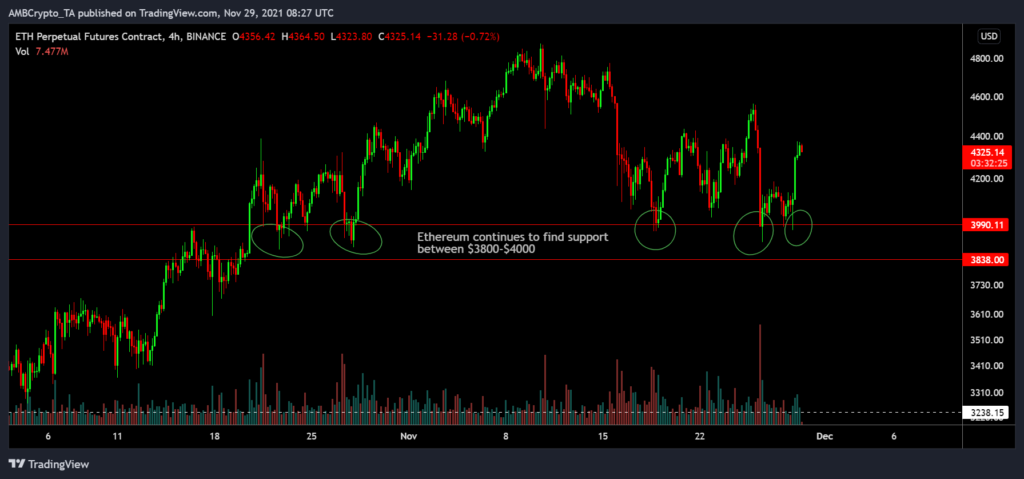

One of the primary observations seen over the past 30 days is that Ethereum continued to find support between $3800 and $4000. After hitting $4400 in late October, it tested that range again before rising higher on the charts. However, the 2nd half of November led to strong corrections and on 26 November, a significant collapse took place. This range was tested again and now, over the last 30 days, the same price zone has been tested 5 times.

Speculation suggests that Ether may experience corrections beyond this level after struggling just above $ 4,000 for the past few days. However, in the last 24 hours, ETH has returned above $ 4,300.

Now, immediate corrections concerns might have been put to bed and another positive trait can be observed.

Ethereum and its big plans for December?

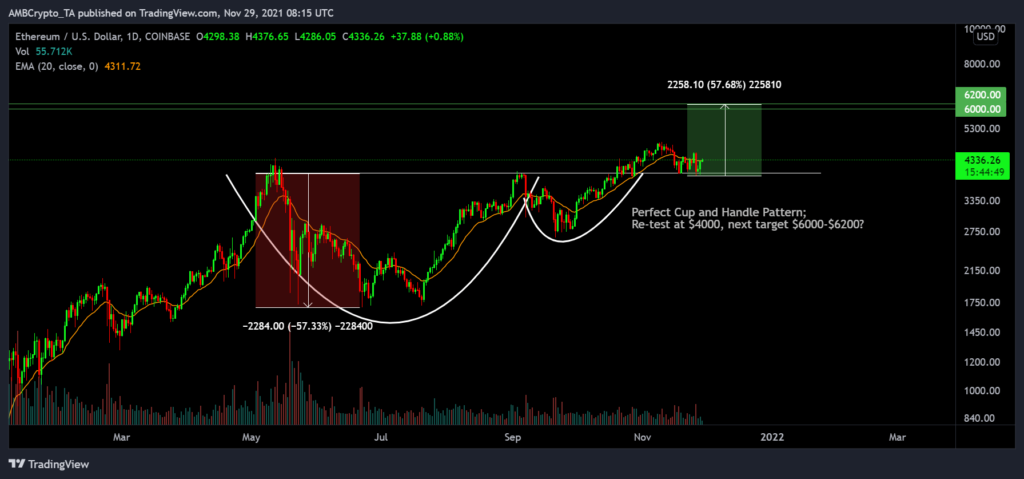

The short-term ether price chart might indicate chaos, but the long-term chart seemed to imply a dynamic uptrend. This can lead to a strong December. The movement of the asset has formed a cup and grip pattern over the past few months. Keeping a base resistance of $ 4,000, the pattern took a positive breakout in early November.

Now, in the grand scheme of things, the last few weeks of correction were a testing phase down to $4000.

Finally, Ether closed above $ 4000 yesterday on the weekly chart, highlighting the presence of long term bulls in the chart. Therefore, technically, if the cup and grip pattern experiences a positive turnaround, Ethereum should expect a 50% chance of testing a new high of $ 6,000- $ 6,200 during the month of December.

Investment greenlight

On the question of identifying on-chain proficiency, ETH’s MVRV ratio suggested a buying opportunity. With the value dropping down to zero, it was a sign that selling pressure has more or less fallen for the altcoin. Historically, this has been a good period to buy based on the MVRV, and the overall market is set up in that direction as well.