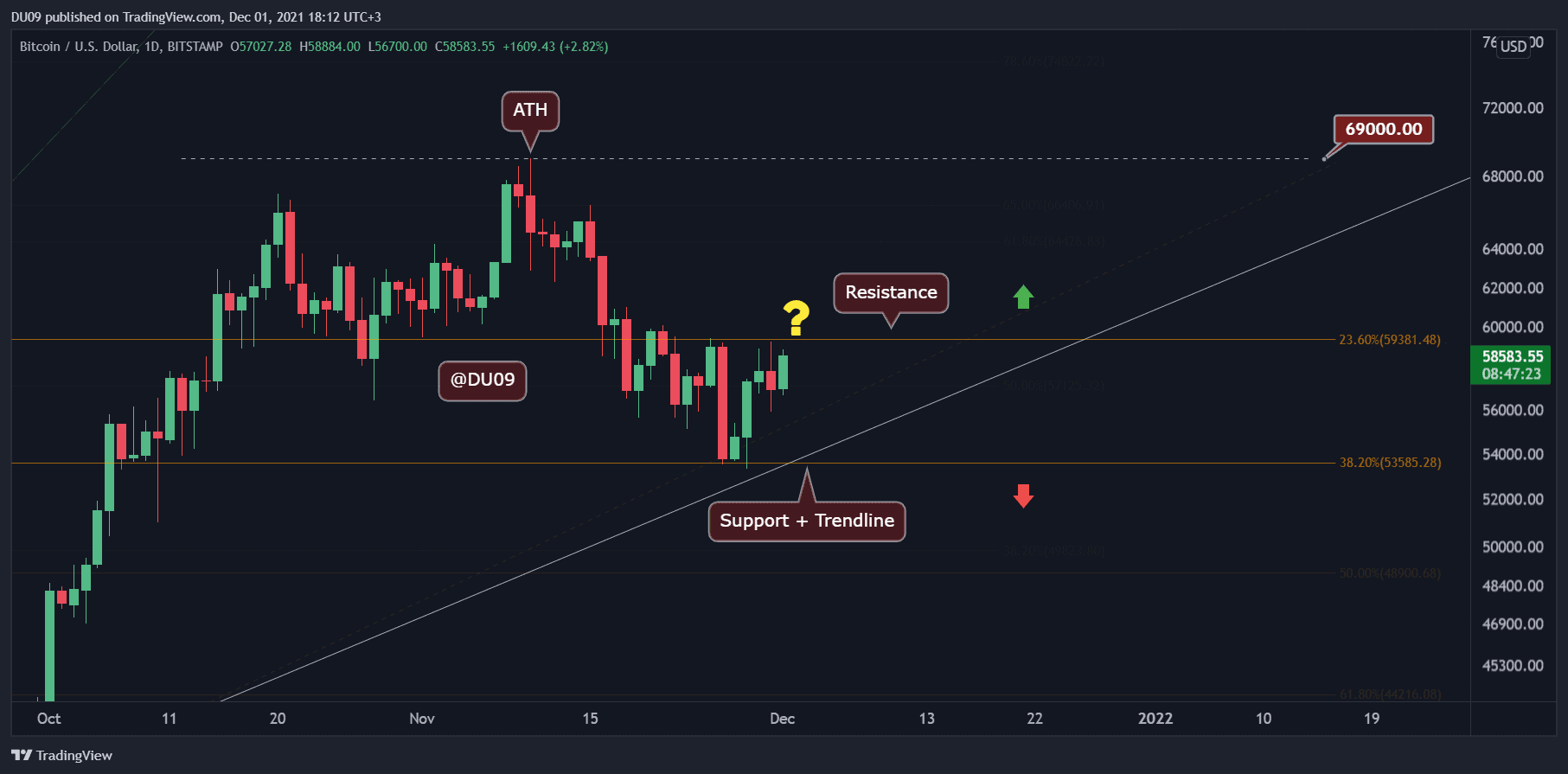

The price of Bitcoin over the past few days has been particularly volatile. As recently as yesterday, BTC jumped towards $ 59,000 but failed to break through that significant resistance level.

Subsequently, it dropped towards the significant $56K mark, but bulls were quick to defend it and are pushing towards $59K once again.

The techniques

Bitcoin is rapidly approaching key resistance at $ 59-60,000, as of this writing. A breakout above may lead to a further rally towards the $ 60,000 territory. Bitcoin was able to trade above the latter for an entire month between mid-October and mid-November.

In between, on Nov-10 the current ATH was set – at $69K. As a reminder, Bitcoin was able to make a 2-day spike between $60K and $68K on Nov-6, just days before nailing the current ATH. Hence, the range of $59-60K is crucial for the bulls.

Technical indicators are slowly turning bullish, meaning that the possibility of a retest of significant support at $ 53,000 is diminishing. The global market is heating up and December has historically been a very good month for crypto bulls in general.

The volume is still low. However, as mentioned, a break above the key resistance range at $59-60K can change that very fast (matter of the volume levels of the breakout). The daily RSI is curving up and has made a higher low, which supports the idea of a breakout of the key resistance.

The MACD is a day or two away from achieving a bullish cross on the daily period. If that happens, a new rally would be more likely to start.

The On-Chain

In terms of on-chain, Bitcoin’s fundamentals remain strong as there’s no sign of aggressive distribution from long-term holders and miners.

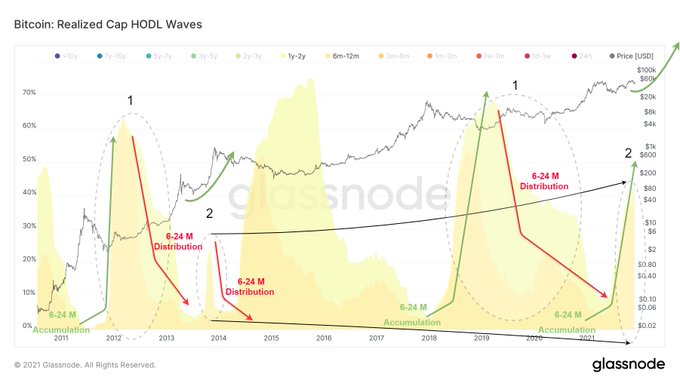

However, it is also worth considering where the main possible selling pressure may come from. To do this, the Crypto chain analyst VizArt take a closer look the cyclical behavior of investors who bought their coins 6 to 24 months ago.

The cyclical behavior (Accumulation – Distribution) of 6-12M and 1-2Y old coins is one of the most fascinating aspects of the current market macro-cycle. Looking at 2013-2014, these players had two Accu-Dist phases during market double tops.

The analyst notes that in the current cycle, “we are seeing a similar Acc-Dist phase” and that, at the moment, the 2nd wave is in accumulation mode.

He also outlines that it’s important to monitor the behavior of the players that are holding approximately 40% of the floating supply could be an indicator to map the next major top of the market.