Two days ago on November 30, the price of bitcoin (BTC) tapped a high that day reaching $59,250 per unit, but it has since dropped close to 5% in value to just above the $56K region. Onchain statistics indicate that whales and long-term holders (LTHs) have been spending over the last month and blockchain parsers have witnessed enormous movements in recent days.

Btcparser 3 Spots Drows of Bitcoin from Cold Wallets move to active exchanges

During the first two days of December, there were massive movements of bitcoin whales (BTC) from long-term bitcoin holders. On Thursday morning, the creator of the Btcparser.com web portal explained that “significant amounts of bitcoin have been withdrawn from cold wallets and moved to active exchanges.”

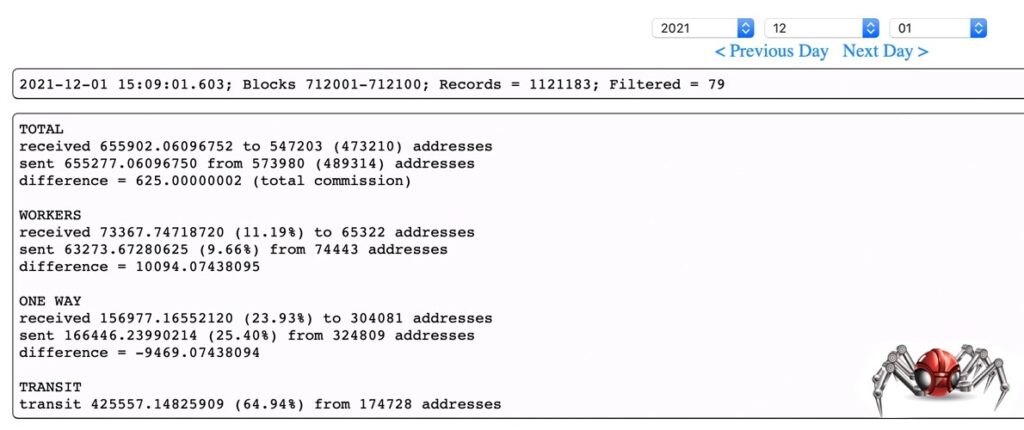

The onchain action was caught by the blockchain parsing tool Btcparser 3, a tool that analyzes each and every new bitcoin block by getting detailed information about all transactions within it. “The bot uses groups of 100 blocks and identifies all wallets that sent or received a total exceeding 1,000 bitcoins during that time,” explains the parsing tool’s website.

On December 1, Btcparser 3 caught some major onchain action, which saw the movement of thousands of bitcoins during the course of the day. For instance, on Wednesday the parser caught the movement of 15,074 BTC or $849 million, 6,970 BTC moved, and thousands more BTC spent as well.

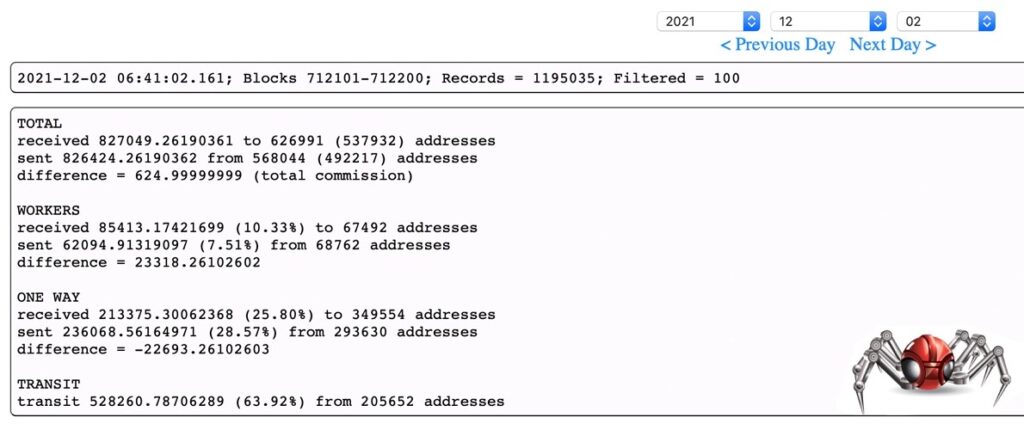

Then the next day, December 2, monster-sized bitcoin transactions were captured by Btcparser 3. This transaction on Thursday saw a huge deposit of 36,645 BTC and 10,547 BTC left the wallet. That’s over $ 2 billion worth of bitcoin in USD value, and the address has spent over $ 28.2 billion on bitcoin (BTC) over its lifetime. At 1:59 a.m. EST on Thursday, Btcparser 3 captured 15,074 BTC or $ 849 million.

Glassnode Report Shows Long-Term Holders Are Spending Bitcoin Holdings — ‘Key Active Whale Addresses Are Content’

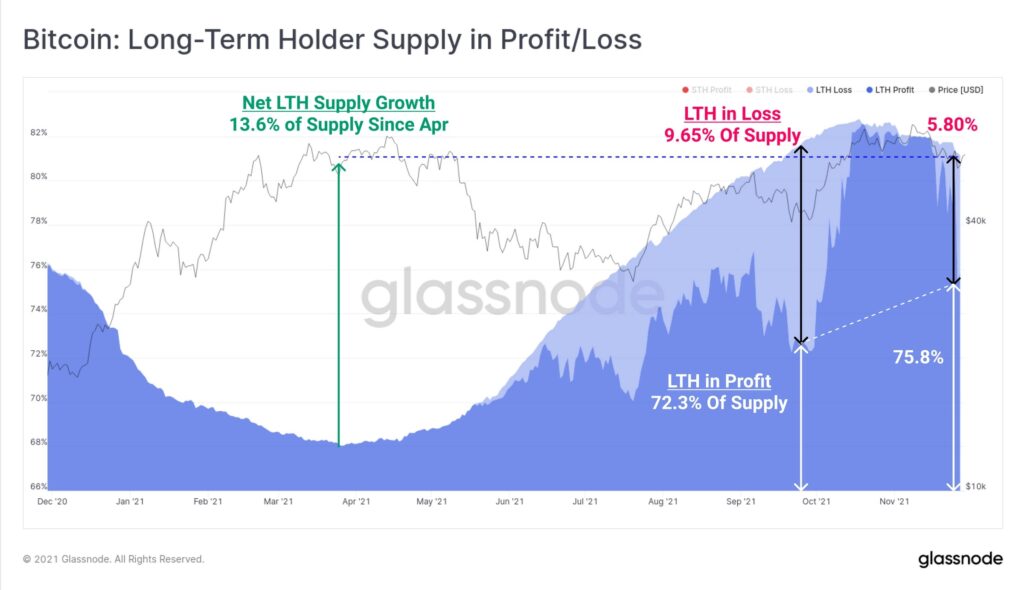

In addition to Btcparser 3 catching two days worth of major whale movements, Glassnode’s most recent insights report, “Week Onchain 48,” establishes that long-term holders (LTHs) are “spending some of their holdings.” Glassnode’s report notes that this action has been prominent during the last 30 days.

“Shift our attention to [LTHs]», Details Glassnode’s report. “We can see that there has been a reasonably continuous rate of spending over the past month. Since peaking at 13.5 million BTC in holdings, LTHs have spent (supposedly distributed) 150,000 BTC, or about 5.8% of the volume accumulated since March 2021. “

Crypto advocates have been discussing major whale movements on forums and bitcoin whale commentary is littered all over social media. The crypto analytics firm Santiment also tweeted about this past month’s whale action on November 23.

“Top addresses of active Bitcoin whales that hold between 100 and 10,000 BTC are satisfied after accumulating a total of around 40,000 additional BTC during last week’s drop,” Santiment noted. The company also shared its weekly report, which discusses whale action and “growing bearish sentiment (and why that’s a good thing)”.