Unstable price action and indecision – this is how we can sum up the last two days in the cryptocurrency market.

In our last BTC price analysis, we examined if whether or not $69K was the cycle’s top following the vicious corrections, and now, we take a closer look into how the market is developing from a technical and on-chain perspective.

Options market analysis

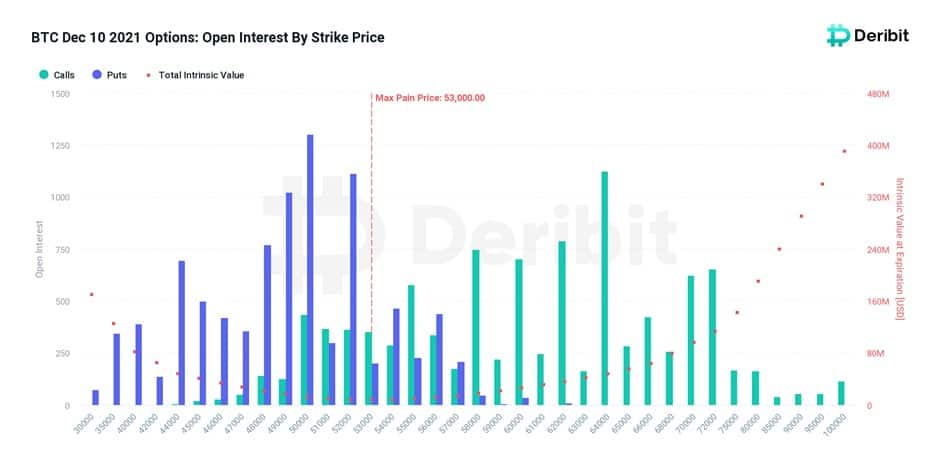

This Friday, December 10, approximately $ 946 million of bitcoin options contracts will expire in Deribit. The maximum pain price for this expiration is 53k. Put options with the strike price of $ 50,000 have the highest open interest rate with 1,305 contracts.

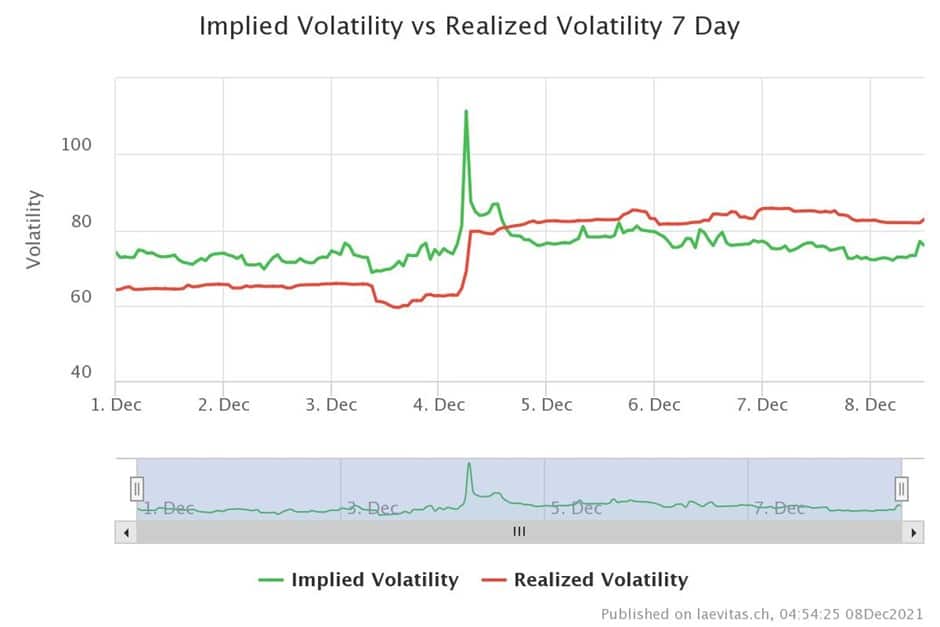

Realized volatility is still higher than implied volatility (IV). All in all, it seems that options traders are not sure about an imminent V-shape recovery yet.

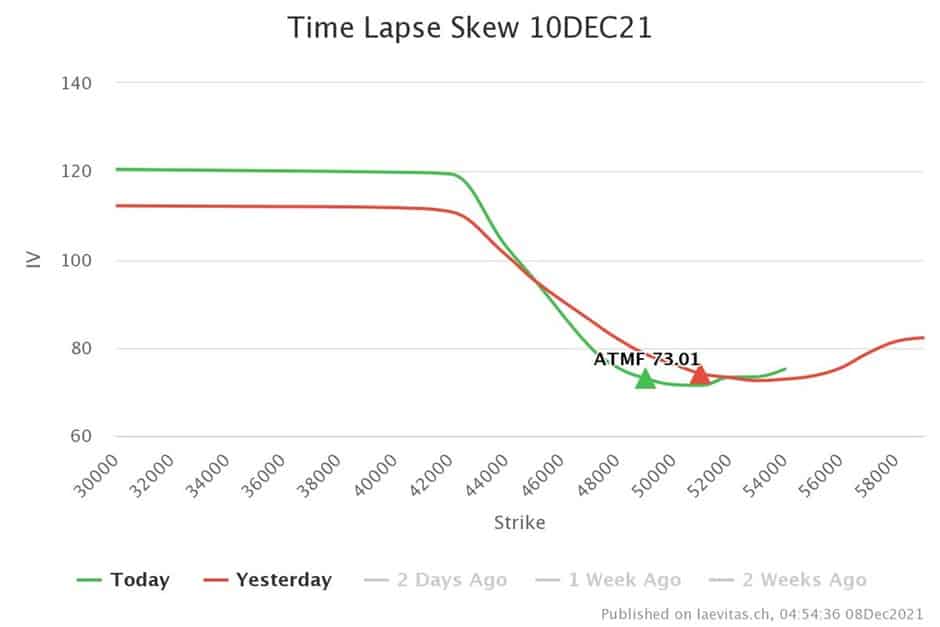

The jet lag shows a higher IV for strikes below $ 45,000. The simple interpretation would be that options traders want to hedge against the downside of the market.

Futures Market Sentiment and Supply/Demand Analysis

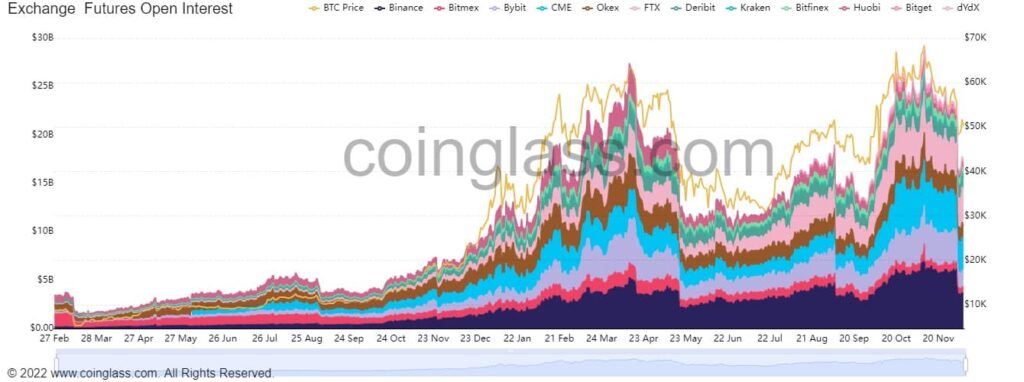

Like the market crash in May, last week’s market has experienced a massive drop in Futures Market open interest due to cascades of long liquidations. The open interest has dropped from its all-time high ($28.8B) to $17.2 B.

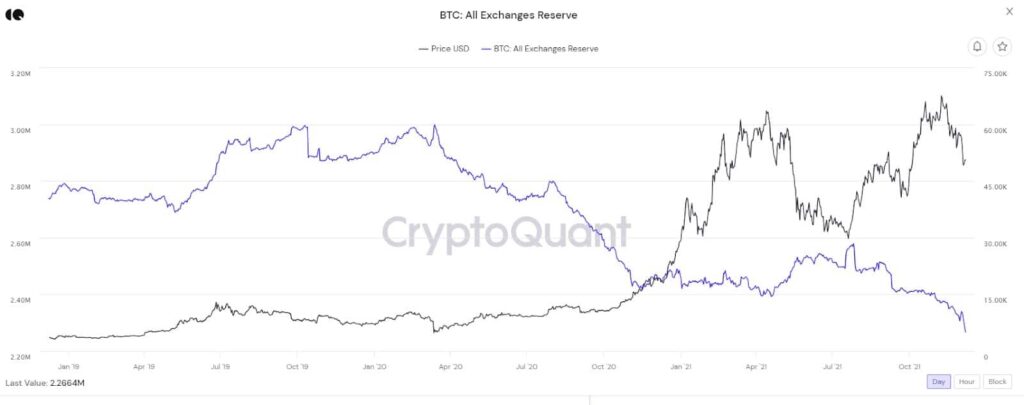

Interestingly, as the futures market absorbed the shock of a massive drop in open interest, reserves across all exchanges showed large exits from the stock exchanges. It’s quite different from the last major stock market crash in May, where we have substantial inflows to the stock markets.

Technical Analysis

Current Market Conditions Choppy

Yesterday, the price moved up on the 4H time frame following a sharp fall on December 6th and is currently struggling with its failed support. The RSI indicator is below 50 and follows a downtrend line since the price was 69K (new ATH).

The transition from this downtrend to bullish momentum in the RSI depends on the recovery of the mentioned failing support line. The BMAX DT indicator, which maps opportunities for momentum change, is still declining and has not shown a positive signal.

We will have to wait for the required confirmations to ensure that the trend is reversed. Most of the technical analysis believe that going back to the 53K and stabilizing above that level would be a good signal.

Where is the key level of a possible reversal trend?

Buy orders on major support levels pushed the price up yesterday. However, the greater selling pressure from short-term traders looking for an opportunity to exit the market brought it down to lower levels.

Due to the divergences that have formed in MACD and the awesome oscillator(AO), it’s important to remain vigilant of potentially lower prices on the daily timeframe. At the moment, the critical support level is $42k-$40k. Don’t forget that the market is fearful about the new COVID variant and possible lockdowns.