Options market analysis

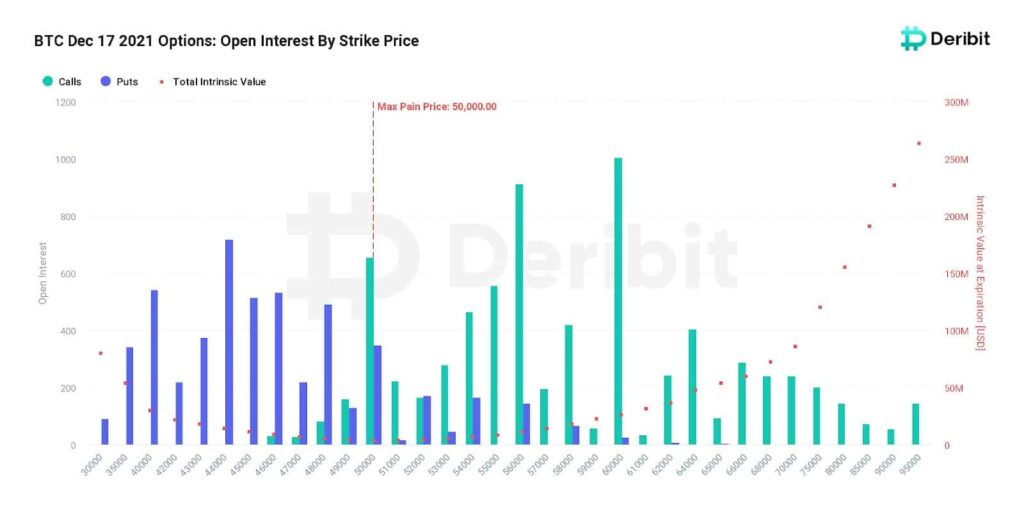

The price of bitcoin is now below $ 49,000, or about 27% below the ATH ($ 69,000). Options traders have set different hedging strategies over the past few weeks to protect against the market downturn. Next Friday, December 17, around $ 630 million worth of bitcoin options contracts will expire in Deribit. The maximum pain scenario for this expiration is if the price is $ 50,000. Calls at a strike price of 60,000 have the highest open interest rate with 1,005 contracts. Options traders have sold a lot of calls for this strike. They seem to view the 60,000 strike price as resistance at the moment.

Short-term realized volatility is still higher than implied volatility. It seems that options traders are unsure of V-shape recovery yet.

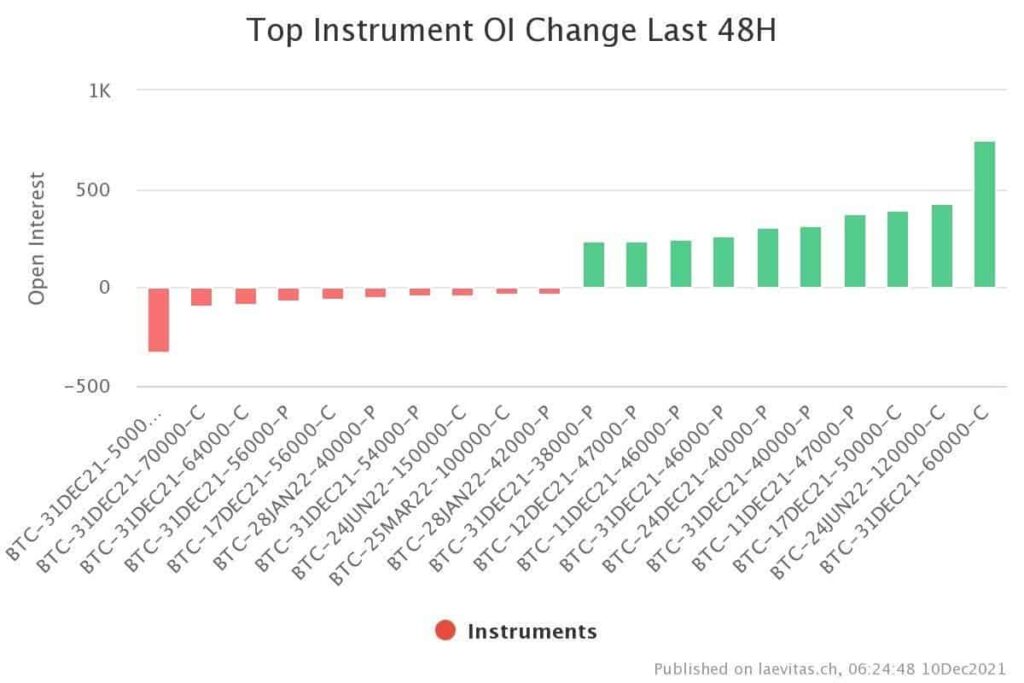

The evolution of the main instrument’s OI over the last 48 hours shows that the demand for put options due to protection has increased for December.

Technical Analysis

Long-term Analysis – Weekly

The combination of the weekly chart and RSI indicator does not show a positive and promising sign for the mid-term. This RSI index is below 50, indicating bears’ greater power in the market. According to historical data, whenever this index falls below 50, we have had a downward trend or, at best, a ranging phase in market price action. The hope is for this index to recover and get out of the area.

Short-term-daily analysis

The situation is not good on the daily chart either. The long-term bullish trend of the market, which has formed since the COVID crash, has been lost. The OBV indicator shows conditions similar to the April-May crash. Uncertainty in the financial markets, due to the announcement of the inflation rate in the United States and Europe, could introduce some volatility in the coming weeks.

On-chain Analysis

The short-term holder’s SOPR (Spend Output Profit Ratio, which estimates sell price ratio to last time a coin was moved or buy price), showing these investors are selling at a loss. This is a sign of fear for top buyers who tend to be sensitive about short-term volatilities.