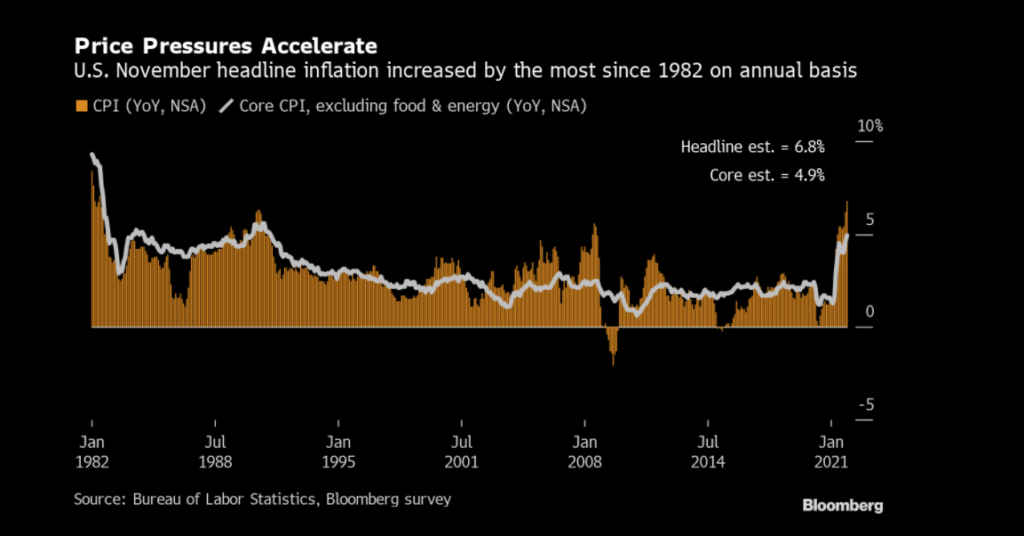

The consumer price index (CPI) data released Friday by the U.S. Bureau of Labor Statistics show prices in the United States climbed 6.8% in November compared to 12 months ago. It’s the largest rise in close to forty years, and U.S. policymakers are backing away fast from saying inflation is transitory.

Inflation accelerates in the United States

Inflation continues to rear its ugly head in America as the cost of goods and services continues to rise with 2021 approaching the end of the year. The Bureau of Labor Statistics, a unit of the US Department of Labor, released the agency’s report on the Consumer Price Index (CPI) for November on Friday, and the statistics look gruesome. Basically, the CPI is a measure of a basket of goods that urban households consume on a regular basis. The metric hit its highest level in nearly forty years, jumping 6.8% from the same period in 2020.

Of course, economists and analysts all over the world had something to say about America’s rising inflation. The journalist and “market maniac” Holger Zschäpitz discussed the latest CPI report from the Bureau of Labor Statistics:

“Ouch! US inflation jumped to 6.8% in [November], meeting the expectations of economists ”, Zschäpitz noted. “The reading shows the fastest rate of price growth since 1982, when Ronald Reagan was president. Inflation accelerated throughout the fall, as the supply crunch and heavy spending fueled the price hike. “

U.S. households paid 0.8% more for consumer goods and services since October as well, according to the latest CPI report. Sven Henrich, the founder of northmantrader.com, sarcastically told his 323,800 Twitter followers “as long as you don’t need cars, housing, food or energy inflation is only 6.8%.” In a recent blog post published by Henrich, the market analyst criticized Fed chair Jerome Powell for sticking to the transitory inflation narrative for so long.

“What a colossal and embarrassing blunder,” said Henrich. “Once again, a Fed chairman is in total denial of reality. Like Ben Bernanke in 2007 declaring subprime loans contained and not a threat to the economy, persistent inflation is suddenly a risk to the economy when it did not last all year as the data stopped. not to say it. The analyst added:

The Fed not only got inflation wrong but by extension they got policy completely wrong and I find myself very much validated here: They’ve totally overdone it on the liquidity front as they kept printing like madmen into an inflationary environment that they denied existed.

Grant Thornton’s economist: “It’s inflation that shouldn’t be insignificant anytime soon”

Diane Swonk, chief economist at Grant Thornton, recently spoke with Washington Post reporter Rachel Siegel and said inflation can come down, but this particular case could be problematic. “Yes, inflation can slow down, but what [policymakers] to care is: is it important or insignificant to people’s lives and decision-making? »Stressed Swonk. “It’s inflation that shouldn’t be insignificant anytime soon, and it’s a problem.”

A longtime critic of the Federal Reserve, Peter Schiff believes the central bank’s schemes will just add more fuel to the fire. “Maybe the reason investors think the Fed can cure the worst inflation in U.S. history by lifting interest rates slightly above zero [is] because they know even a tiny rate hike will crash the economy, which they assume will kill off inflation. But in reality, it will extend its life,” Schiff said on Friday.