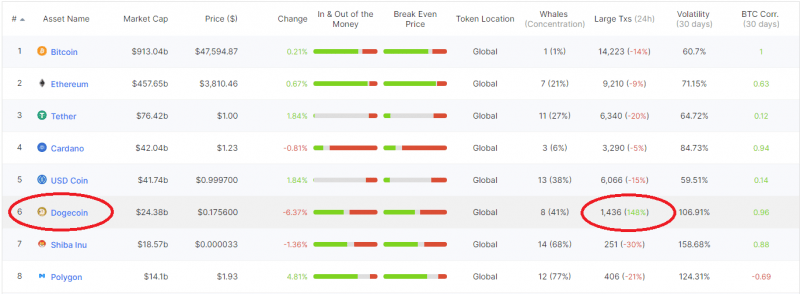

As seen from IntoTheBlock analyzes, large Dogecoin trades have risen as a result of the price drops

According to IntoTheBlock analytics, Dogecoin’s large transactions have jumped as much as 148% in the last 24 hours. The DOGE price is presently dipping after yesterday’s 48% rise.

The “large” transactions monitored by IntoTheBlock refer to on-chain transactions greater than $ 100,000.

This indicator depicts the volume of such “large” transactions per day. It is also an indication of institutional activity or whales’ buying and selling. Therefore, the 148% increase seen over the last 24 hours for Dogecoin might suggest an enormous amount of whales buying and selling.

Dogecoin surged on Tuesday after Tesla CEO Elon Musk tweeted that the electric car maker would start accepting it as payment for goods. Dogecoin immediately jumped 48% to highs of $ 0.228 before falling, according to data from TradingView. Dogecoin is trading at $ 0.176 at time of publication.

Dogecoin price dips

Dogecoin bulls could not overpower the $0.2291 barrier at once, thus leading to a price decline. Dogecoin will likely engage in sideways trading as the near-term bias remains neutral. More positive actions may be created above the $0.2291 barrier.

Dogecoin was started in 2013 as a joke by its creators Billy Markus and Jackson Palmer. It is inspired by the Japanese dog Shiba Inu which inspired the original “doge” meme.

Although down by 12.4% in the last 24 hours at the present price of $0.176, Dogecoin remains up 5374.1% this year, according to CoinGecko data. Dogecoin was also ranked 10th largest with a market capitalization of $23.36 billion.