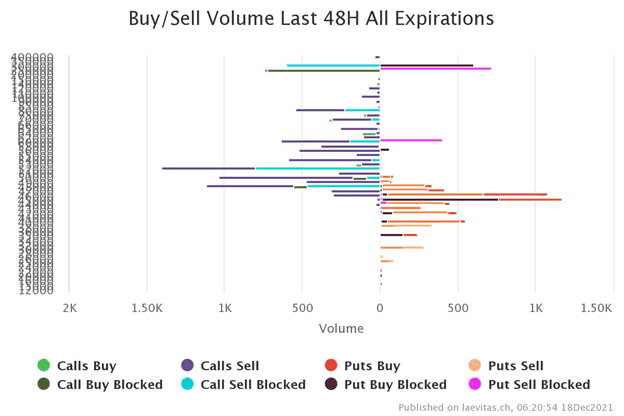

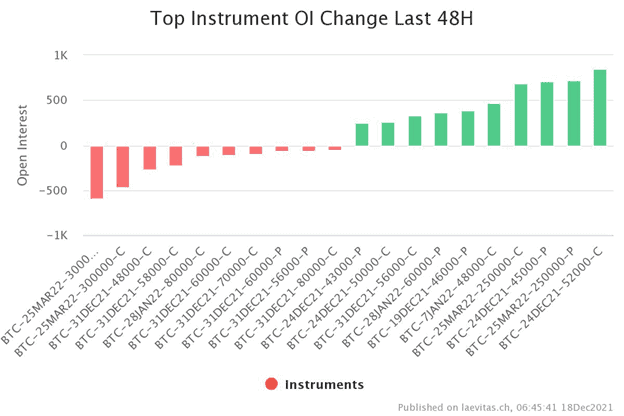

According to Reuters, the Russian central bank wants to ban investments in cryptocurrencies in the country. Following the bearish news, the price of Bitcoin fell to nearly $ 48.5,000 in the spot market. In the options market over the past 48 hours, many options traders have written calls and bought put options to cover short-term maturities.

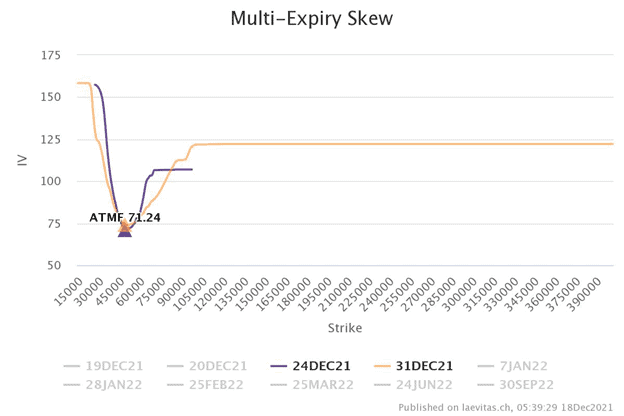

Multi expiry skew shows that traders seek downside protection. It seems that they are not optimistic about the rally in 2021:

Technical analysis

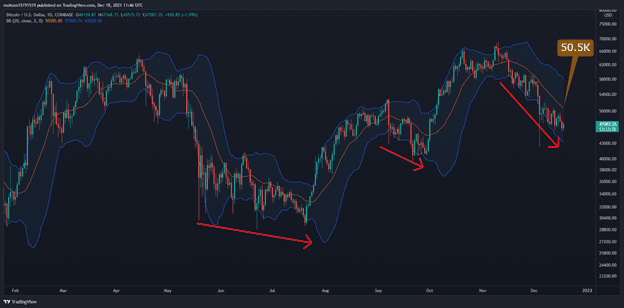

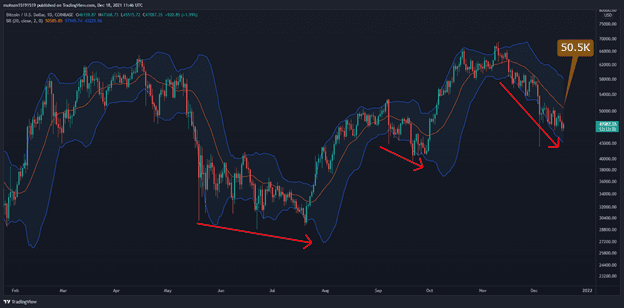

On a daily period, according to the Bollinger Bands indicator, the short term trend still appears to be downward, the slope of the lower band is greater than the previous corrections and the baseline has built resistance at 50.5 $ 000. Price appears to be entering a long term erosive correction phase and, most likely, this will make retail investors disappointed and frustrated.

On the 1-hour timeframe, the price is going down and forming a falling wedge (a technical pattern that is usually bullish), creating a lower low and lower high. One can expect the price to rise to this wedge, but if it passes, the resistance of $50K on the way of Bitcoin to form a higher high.

Chain analysis

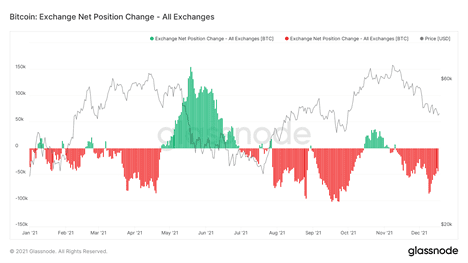

The most bullish point is probably from the perspective of onchian analysts. Right now there is a divergence between the price action and the trend of all trading reserves.

Unlike the market crash in May, the monthly net position change shows a significant volume of BTC being taken off the market the recent drop from $69K to $42K. The Conclusion is that the supply shock is evident but the supply/demand puzzle would be completed when the new capital flows into the market by new investors.